Answered step by step

Verified Expert Solution

Question

1 Approved Answer

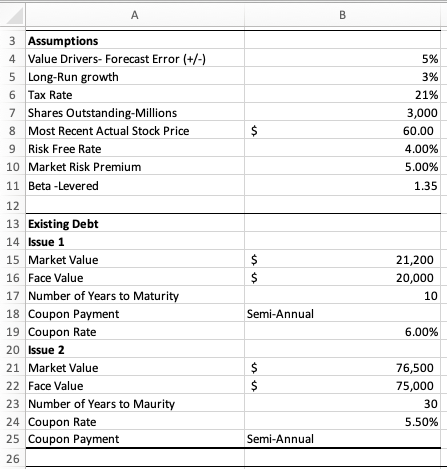

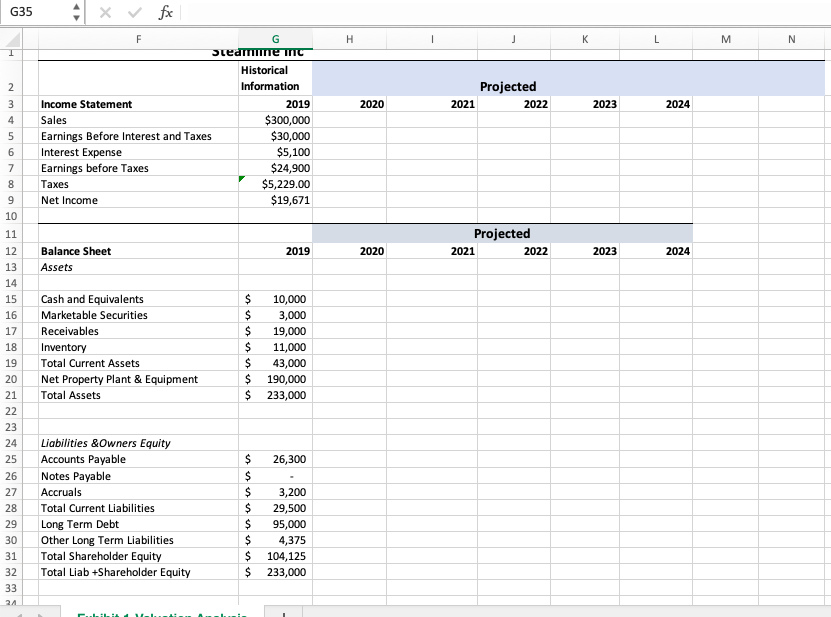

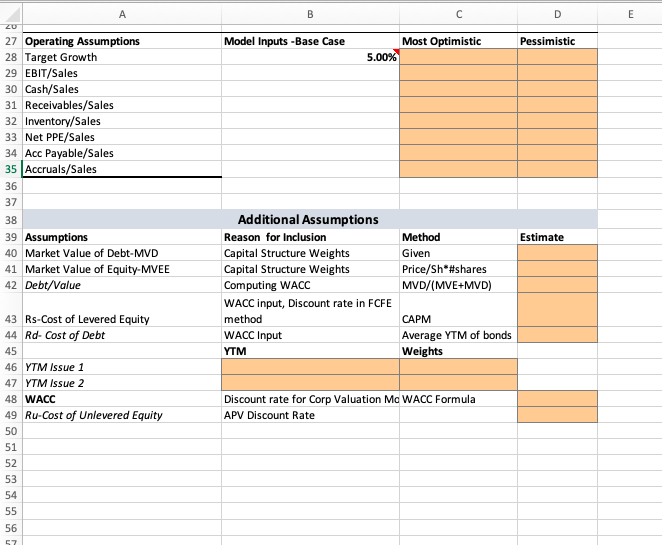

What is MVD, MVEE, Debt/value, Rs, Rd, YTM, Weights, WACC, Ru? Cells D39, D40, D41,D42, D43, D44, B46, C46, B47, C48, D48, D49. B 5%

What is MVD, MVEE, Debt/value, Rs, Rd, YTM, Weights, WACC, Ru? Cells D39, D40, D41,D42, D43, D44, B46, C46, B47, C48, D48, D49.

B 5% 3% 21% 3,000 60.00 4.00% 5.00% 1.35 $ 3 Assumptions 4 Value Drivers- Forecast Error (+/-) 5 Long-Run growth 6 Tax Rate 7 Shares Outstanding-Millions 8 Most Recent Actual Stock Price 9 Risk Free Rate 10 Market Risk Premium 11 Beta - Levered 12 13 Existing Debt 14 Issue 1 15 Market Value 16 Face Value 17 Number of years to Maturity 18 Coupon Payment 19 Coupon Rate 20 Issue 2 21 Market Value 22 Face Value 23 Number of years to Maurity 24 Coupon Rate 25 Coupon Payment 26 $ $ 21,200 20,000 10 Semi-Annual 6.00% $ $ 76,500 75,000 30 5.50% Semi-Annual G35 H L M N 1 A x fx F G sredine mc Historical Information Income Statement 2019 Sales $300,000 Earnings Before Interest and Taxes $30,000 Interest Expense $5,100 Earnings before Taxes $24,900 Taxes $5,229.00 Net Income $19,671 Projected 2021 2022 2020 2023 2 3 4 5 6 7 8 9 10 2024 Projected 2021 2022 2019 2020 2023 2024 Balance Sheet Assets 11 12 13 14 15 16 17 18 19 20 21 22 23 24 25 Cash and Equivalents Marketable Securities Receivables Inventory Total Current Assets Net Property Plant & Equipment Total Assets $ 10,000 $ 3,000 $ 19,000 $ 11,000 $ 43,000 $ 190,000 $ 233,000 26,300 26 27 28 29 30 31 32 33 Liabilities & Owners Equity Accounts Payable Notes Payable Accruals Total Current Liabilities Long Term Debt Other Long Term Liabilities Total Shareholder Equity Total Liab +Shareholder Equity $ $ $ $ $ $ $ $ 3,200 29,500 95,000 4,375 104,125 233,000 24 Pulili A B D E ZU Model Inputs -Base Case Pessimistic Most Optimistic 5.00% 27 Operating Assumptions 28 Target Growth 29 EBIT/Sales 30 Cash/Sales 31 Receivables/Sales 32 Inventory/Sales 33 Net PPE/Sales 34 Acc Payable/Sales 35 Accruals/Sales 36 37 38 39 Assumptions 40 Market Value of Debt-MVD 41 Market Value of Equity-MVEE 42 Debt/Value Estimate Additional Assumptions Reason for inclusion Capital Structure Weights Capital Structure Weights Computing WACC WACC input, Discount rate in FCFE method WACC Input YTM Method Given Price/Sh*#shares MVD/(MVE+MVD) CAPM Average YTM of bonds Weights Discount rate for Corp Valuation Mo WACC Formula APV Discount Rate 43 Rs-Cost of Levered Equity 44 Rd-Cost of Debt 45 46 YTM Issue 1 47 YTM Issue 2 48 WACC 49 Ru-Cost of Unlevered Equity 50 51 52 53 54 55 56 57 B 5% 3% 21% 3,000 60.00 4.00% 5.00% 1.35 $ 3 Assumptions 4 Value Drivers- Forecast Error (+/-) 5 Long-Run growth 6 Tax Rate 7 Shares Outstanding-Millions 8 Most Recent Actual Stock Price 9 Risk Free Rate 10 Market Risk Premium 11 Beta - Levered 12 13 Existing Debt 14 Issue 1 15 Market Value 16 Face Value 17 Number of years to Maturity 18 Coupon Payment 19 Coupon Rate 20 Issue 2 21 Market Value 22 Face Value 23 Number of years to Maurity 24 Coupon Rate 25 Coupon Payment 26 $ $ 21,200 20,000 10 Semi-Annual 6.00% $ $ 76,500 75,000 30 5.50% Semi-Annual G35 H L M N 1 A x fx F G sredine mc Historical Information Income Statement 2019 Sales $300,000 Earnings Before Interest and Taxes $30,000 Interest Expense $5,100 Earnings before Taxes $24,900 Taxes $5,229.00 Net Income $19,671 Projected 2021 2022 2020 2023 2 3 4 5 6 7 8 9 10 2024 Projected 2021 2022 2019 2020 2023 2024 Balance Sheet Assets 11 12 13 14 15 16 17 18 19 20 21 22 23 24 25 Cash and Equivalents Marketable Securities Receivables Inventory Total Current Assets Net Property Plant & Equipment Total Assets $ 10,000 $ 3,000 $ 19,000 $ 11,000 $ 43,000 $ 190,000 $ 233,000 26,300 26 27 28 29 30 31 32 33 Liabilities & Owners Equity Accounts Payable Notes Payable Accruals Total Current Liabilities Long Term Debt Other Long Term Liabilities Total Shareholder Equity Total Liab +Shareholder Equity $ $ $ $ $ $ $ $ 3,200 29,500 95,000 4,375 104,125 233,000 24 Pulili A B D E ZU Model Inputs -Base Case Pessimistic Most Optimistic 5.00% 27 Operating Assumptions 28 Target Growth 29 EBIT/Sales 30 Cash/Sales 31 Receivables/Sales 32 Inventory/Sales 33 Net PPE/Sales 34 Acc Payable/Sales 35 Accruals/Sales 36 37 38 39 Assumptions 40 Market Value of Debt-MVD 41 Market Value of Equity-MVEE 42 Debt/Value Estimate Additional Assumptions Reason for inclusion Capital Structure Weights Capital Structure Weights Computing WACC WACC input, Discount rate in FCFE method WACC Input YTM Method Given Price/Sh*#shares MVD/(MVE+MVD) CAPM Average YTM of bonds Weights Discount rate for Corp Valuation Mo WACC Formula APV Discount Rate 43 Rs-Cost of Levered Equity 44 Rd-Cost of Debt 45 46 YTM Issue 1 47 YTM Issue 2 48 WACC 49 Ru-Cost of Unlevered Equity 50 51 52 53 54 55 56 57Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started