Answered step by step

Verified Expert Solution

Question

1 Approved Answer

what is net present value (npv) for the SA project assuming the WACC equals 16% how do you get these numbers? Business Finance 381 -

what is net present value (npv) for the SA project assuming the WACC equals 16%

how do you get these numbers?

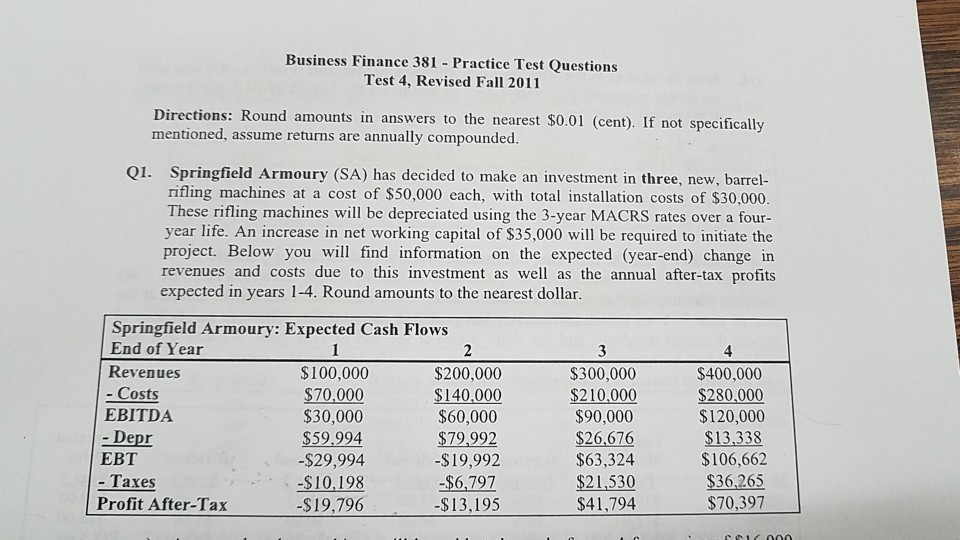

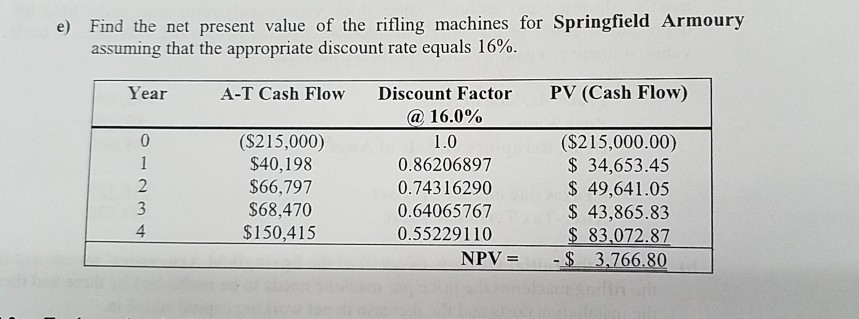

Business Finance 381 - Practice Test Questions Test 4, Revised Fall 2011 Directions: Round amounts in answers to the nearest $0.01 (cent). If not specifically mentioned, assume returns are annually compounded. Q1. Springfield Armoury (SA) has decided to make an investment in three, new, barrel- rifling machines at a cost of $50,000 each, with total installation costs of $30,000. These rifling machines will be depreciated using the 3-year MACRS rates over a four- year life. An increase in net working capital of $35,000 will be required to initiate the project. Below you will find information on the expected (year-end) change in revenues and costs due to this investment as well as the annual after-tax profits expected in years 1-4. Round amounts to the nearest dollar Springfield Armoury: Expected Cash Flows End of Year Revenues $100,000 $70.000 $30,000 $59.994 -$29,994 -$10.198 -$19,796 $200,000 40,000 $60,000 79,992 -$19,992 $6,797 -$13,195 $300,000 $210.,000 $90,000 $26,676 $63,324 $21,530 $41,794 4 $400,000 $280,000 $120,000 $13,338 $106,662 $36,265 $70,397 EBITDA EBT - Taxes Profit After-Tax e) Find the net present value of the rifling machines for Springfield Armoury assuming that the appropriate discount rate equals 16% Year A-T Cash Flow PV (Cash Flow) (S215,000) $40,198 $66,797 $68,470 $150,415 Discount Factor @ 16.0% 1.0 0.86206897 0.74316290 0.64065767 0.55229110 (S215,000.00) 34,653.45 49,641.05 S 43,865.83 $ 83,072.87 4 NPV --$ 3,766.80

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started