Answered step by step

Verified Expert Solution

Question

1 Approved Answer

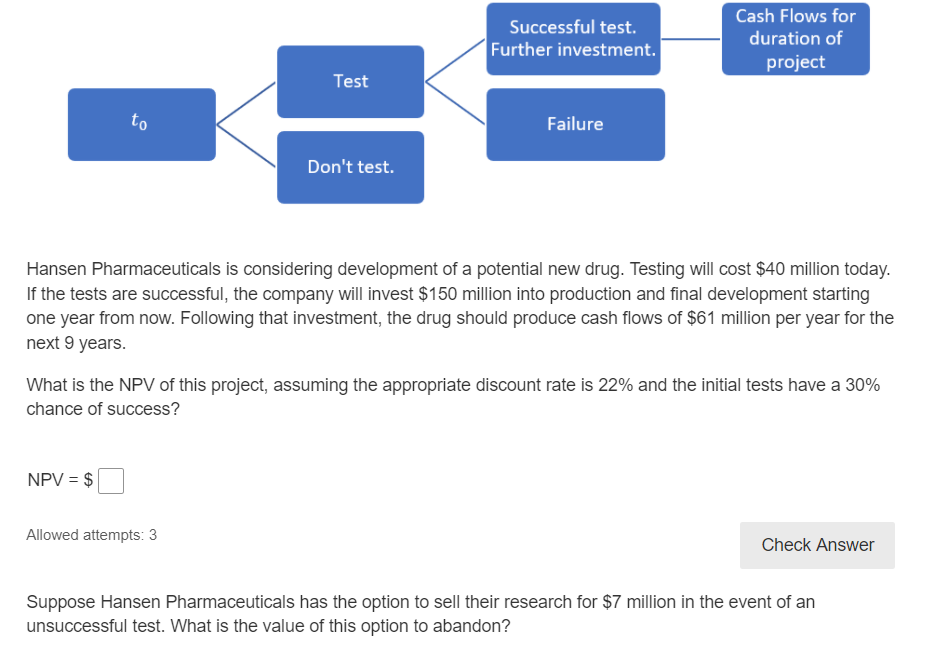

What is NPV and resulting value of option to abandon? Successful test. Further investment. Cash Flows for duration of project Test to Failure Don't test.

What is NPV and resulting value of option to abandon?

Successful test. Further investment. Cash Flows for duration of project Test to Failure Don't test. Hansen Pharmaceuticals is considering development of a potential new drug. Testing will cost $40 million today. If the tests are successful, the company will invest $150 million into production and final development starting one year from now. Following that investment, the drug should produce cash flows of $61 million per year for the next 9 years. What is the NPV of this project, assuming the appropriate discount rate is 22% and the initial tests have a 30% chance of success? NPV = $ Allowed attempts: 3 Check Answer Suppose Hansen Pharmaceuticals has the option to sell their research for $7 million in the event of an unsuccessful test. What is the value of this option to abandonStep by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started