Answered step by step

Verified Expert Solution

Question

1 Approved Answer

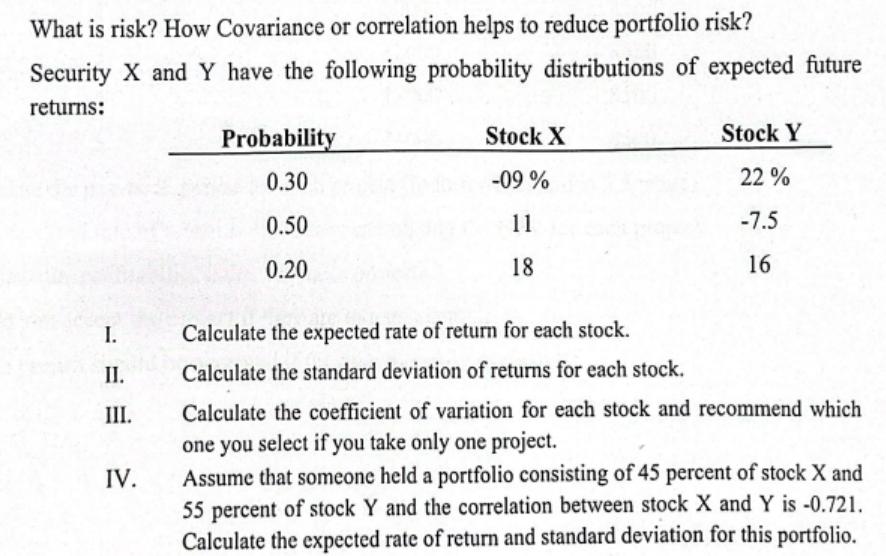

What is risk? How Covariance or correlation helps to reduce portfolio risk? Security X and Y have the following probability distributions of expected future

What is risk? How Covariance or correlation helps to reduce portfolio risk? Security X and Y have the following probability distributions of expected future returns: I. II. III. IV. Probability 0.30 0.50 0.20 Stock X -09 % 11 18 Calculate the expected rate of return for each stock. Calculate the standard deviation of returns for each stock. Stock Y 22% -7.5 16 Calculate the coefficient of variation for each stock and recommend which one you select if you take only one project. Assume that someone held a portfolio consisting of 45 percent of stock X and 55 percent of stock Y and the correlation between stock X and Y is -0.721. Calculate the expected rate of return and standard deviation for this portfolio.

Step by Step Solution

★★★★★

3.38 Rating (151 Votes )

There are 3 Steps involved in it

Step: 1

Risk refers to the potential for loss or uncertainty in achieving desired outcomes In the context of investments risk refers to the possibility of losing money or not achieving expected returns Covari...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started