Answered step by step

Verified Expert Solution

Question

1 Approved Answer

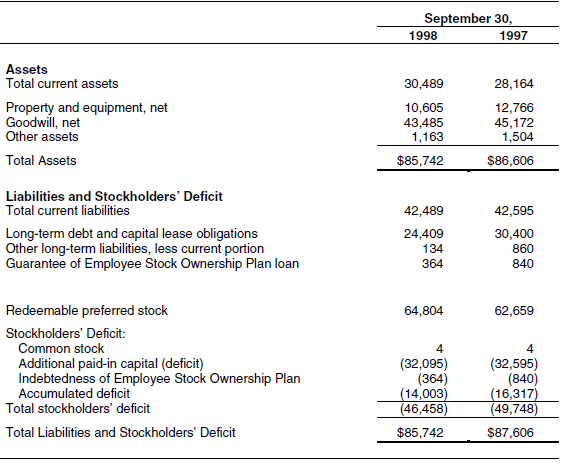

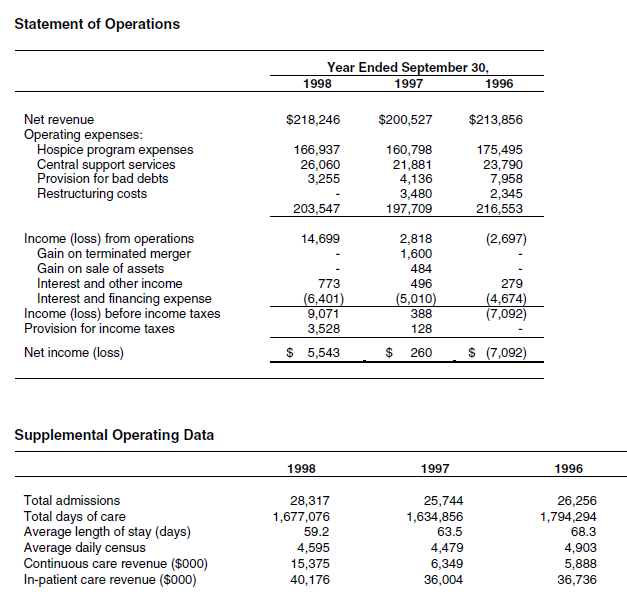

What is the: 1) Profit margin (show work) 2) Current ratio (show work) 3) Debt ratio (show work) 4) Equity ratio (show work) 5) What

What is the:

1) Profit margin (show work)

2) Current ratio (show work)

3) Debt ratio (show work)

4) Equity ratio (show work)

5) What do these financials tell you about this firm? Is it in good standing? Bad? Why? Elaborate.

September 30 1998 1997 Assets Total current assets 30.489 28,164 Property and equipment, net Goodwill, net Other assets 10,605 43,485 1,163 12,766 45,172 1,504 Total Assets $85,742 $86,606 Liabilities and Stockholders' Deficit Total current liabilities 42,595 30.400 860 840 42,489 Long-term debt and capital lease obligations Other long-term liabilities, less current portion Guarantee of Employee Stock Ownership Plan loan 24,409 134 364 Redeemable preferred stock Stockholders' Deficit: 64,804 62,659 Common stock Additional paid-in capital (deficit) Indebtedness of Employee Stock Ownership Plan Accumulated deficit 4 (32,095) (364) 14,003 46,458 4 (32,595) (840) 16,317 49.748 Total stockholders' deficit Total Liabilities and Stockholders' Deficit $85,742 $87,606Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started