Question

What is the 2020 cost recovery deduction for Philosophical Consulting, Inc? John Rawls owns and operates Philosophical Consulting, Inc. During 2019 and 2020 he made

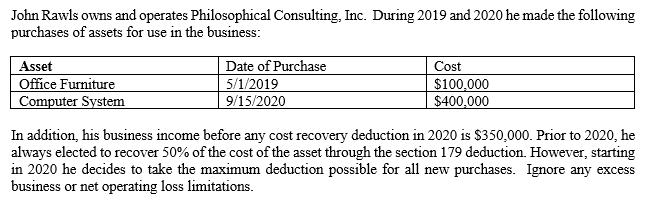

John Rawls owns and operates Philosophical Consulting, Inc. During 2019 and 2020 he made the following purchases of assets for use in the business: Asset Cost Office Furniture Date of Purchase 5/1/2019 9/15/2020 $100,000 $400,000 Computer System In addition, his business income before any cost recovery deduction in 2020 is $350,000. Prior to 2020, he always elected to recover 50% of the cost of the asset through the section 179 deduction. However, starting in 2020 he decides to take the maximum deduction possible for all new purchases. Ignore any excess business or net operating loss limitations.

Step by Step Solution

There are 3 Steps involved in it

Step: 1

The modified accelerated cost recovery system MACRS ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get StartedRecommended Textbook for

Accounting

Authors: Carl warren, James Reeve, Jonathen Duchac, Sheila Elworthy,

Volume 1, 2nd canadian Edition

176509739, 978-0176509736, 978-0176509743

Students also viewed these Accounting questions

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

View Answer in SolutionInn App