Answered step by step

Verified Expert Solution

Question

1 Approved Answer

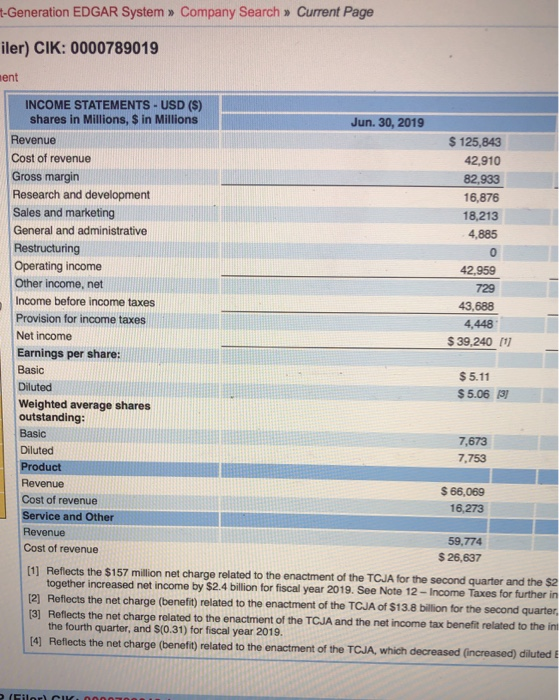

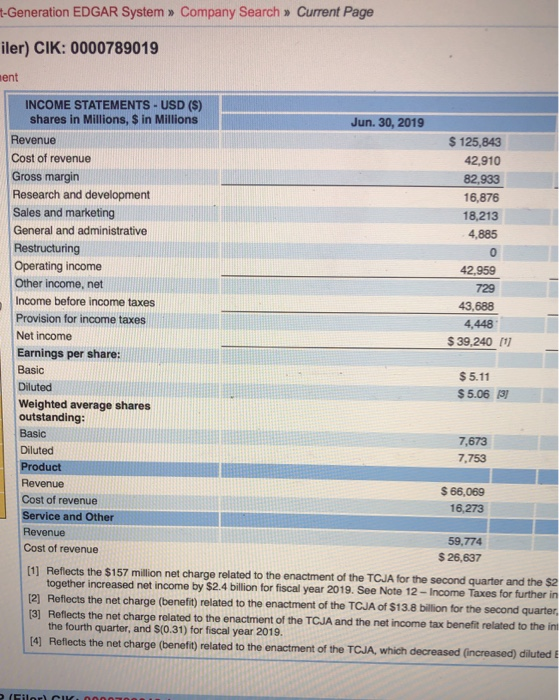

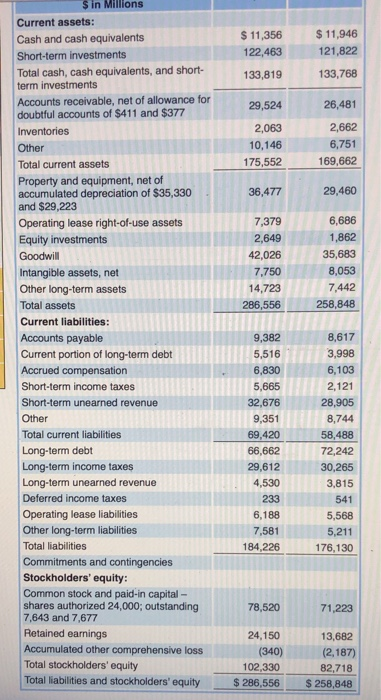

what is the accounts receivable turnover ratio, inventory turnover, and return on assets? for balance sheet info use left column numbers t-Generation EDGAR System Company

what is the accounts receivable turnover ratio, inventory turnover, and return on assets?

for balance sheet info use left column numbers

t-Generation EDGAR System Company Search Current Page iler) CIK: 0000789019 ent INCOME STATEMENTS-USD (S) shares in Millions, $ in Millions Jun. 30, 2019 Revenue $125,843 Cost of revenue 42,910 Gross margin Research and development Sales and marketing 82,933 16,876 18,213 General and administrative 4,885 Restructuring Operating income Other income, net Income before income taxes 42,959 729 43,688 Provision for income taxes 4,448 Net income $39,240 Earnings per share: Basic $5.11 Diluted $5.06 Weighted average shares outstanding: Basic 7,673 Diluted 7,753 Product Revenue $66,069 Cost of revenue 16,273 Service and Other Revenue 59,774 Cost of revenue $26,637 [1] Reflects the $157 million net charge related to the enactment of the TCJA for the second quarter and the $2 together increased net income by $2.4 billion for fiscal year 2019. See Note 12-Income Taxes for further in [2] Reflects the net charge (benefit) related to the enactment of the TCJA of $13.8 billion for the second quarter [3] Reflects the net charge related to the enactment of the TCJA and the net income tax benefit related to the in the fourth quarter, and $(0.31) for fiscal year 2019. [4] Reflects the net charge (benefit) related to the enactment of the TCJA, which decreased (increased) diluted E o (Filor) CK 00003008IR $ in Millions Current assets: $11,946 $11,356 Cash and cash equivalents 121,822 122,463 Short-term investments Total cash, cash equivalents, and short- term investments 133,819 133,768 Accounts receivable, net of allowance for doubtful accounts of $411 and $377 29,524 26,481 2,662 2,063 Inventories 6,751 10,146 Other 169,662 175,552 Total current assets Property and equipment, net of accumulated depreciation of $35,330 and $29,223 29,460 36,477 6,686 Operating lease right-of-use assets Equity investments 7,379 1,862 2,649 42,026 35,683 Goodwill 8,053 7,750 Intangible assets, net Other long-term assets 7,442 14,723 258,848 Total assets 286,556 Current liabilities: 9,382 8,617 Accounts payable Current portion of long-term debt 3,998 5,516 Accrued compensation 6,830 6,103 Short-term income taxes 5,665 2,121 Short-term unearned revenue 28,905 32,676 Other 9,351 8,744 Total current liabilities 58,488 69,420 Long-term debt Long-term income taxes 66,662 72,242 30,265 29,612 Long-term unearned revenue 4,530 3,815 Deferred income taxes 233 541 Operating lease liabilities 6,188 5,568 Other long-term liabilities Total liabilities Commitments and contingencies Stockholders' equity: Common stock and paid-in capital- shares authorized 24,000; outstanding 7,581 5,211 184,226 176,130 78,520 71,223 7,643 and 7,677 Retained earnings 24,150 13,682 Accumulated other comprehensive loss (340) (2,187) Total stockholders' equity 102,330 82,718 Total liabilities and stockholders' equity $286,556 $258,848 Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started