Answered step by step

Verified Expert Solution

Question

1 Approved Answer

What is the amount Cynthia can take as a student loan interest deduction on her Form 1040, Schedule 1? $__________________ . Cynthia is an electrician,

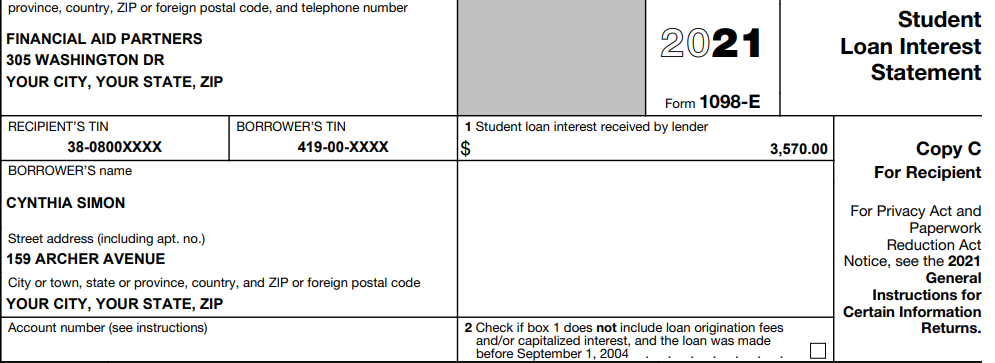

What is the amount Cynthia can take as a student loan interest deduction on her Form 1040, Schedule 1? $__________________

. Cynthia is an electrician, age 29, and single. Cynthia has investment income and has a consolidated broker's statement. Cynthia began a cleaning service business in 2020. She was paid on Form 1099- NEC for 2021. She also received additional cash receipts of $400 not reported on the Form 1099-NEC. . Cynthia uses the cash method of accounting. She uses business code 561720. Cynthia has receipts for the following expenses: . $350 for cleaning supplies $225 for business cards $450 for a mop, broom, and vacuum cleaner $150 for work gloves $125 for lunches $175 for work clothes suitable for everyday use Cynthia has a detailed mileage log reporting for 2021: Mileage from her home to her first client's home and mileage from her last client's home to her home 750 miles In addition, on the days Cynthia worked for multiple clients, she kept track of the mileage from the first client's home to the second client's home in case that mileage was also deductible. She logged 450 miles (not included in the 750 miles). . The total mileage on her car for tax year 2021 was 11,200 miles. Of that, 10,000 were personal miles. She placed her only vehicle, a pick-up truck, in service on 3/15/2020. Cynthia will take the standard mileage rate. Cynthia took an early distribution from her IRA in April to pay off her educational expenses. Cynthia is paying off her student loan from 2018. Cynthia is working towards her Master of Business Administration (MBA) degree. She took a few college courses this year at an accredited college. . . province, country, ZIP or foreign postal code, and telephone number 2021 FINANCIAL AID PARTNERS 305 WASHINGTON DR YOUR CITY, YOUR STATE, ZIP Student Loan Interest Statement RECIPIENT'S TIN 38-0800XXXX BORROWER'S TIN 419-00-XXXX Form 1098-E 1 Student loan interest received by lender $ 3,570.00 BORROWER'S name Copy C For Recipient CYNTHIA SIMON Street address (including apt. no.) 159 ARCHER AVENUE City or town, state or province, country, and ZIP or foreign postal code YOUR CITY, YOUR STATE, ZIP Account number (see instructions) For Privacy Act and Paperwork Reduction Act Notice, see the 2021 General Instructions for Certain Information Returns. 2 Check if box does not include loan origination fees and/or capitalized interest, and the loan was made before September 1, 2004 . Cynthia is an electrician, age 29, and single. Cynthia has investment income and has a consolidated broker's statement. Cynthia began a cleaning service business in 2020. She was paid on Form 1099- NEC for 2021. She also received additional cash receipts of $400 not reported on the Form 1099-NEC. . Cynthia uses the cash method of accounting. She uses business code 561720. Cynthia has receipts for the following expenses: . $350 for cleaning supplies $225 for business cards $450 for a mop, broom, and vacuum cleaner $150 for work gloves $125 for lunches $175 for work clothes suitable for everyday use Cynthia has a detailed mileage log reporting for 2021: Mileage from her home to her first client's home and mileage from her last client's home to her home 750 miles In addition, on the days Cynthia worked for multiple clients, she kept track of the mileage from the first client's home to the second client's home in case that mileage was also deductible. She logged 450 miles (not included in the 750 miles). . The total mileage on her car for tax year 2021 was 11,200 miles. Of that, 10,000 were personal miles. She placed her only vehicle, a pick-up truck, in service on 3/15/2020. Cynthia will take the standard mileage rate. Cynthia took an early distribution from her IRA in April to pay off her educational expenses. Cynthia is paying off her student loan from 2018. Cynthia is working towards her Master of Business Administration (MBA) degree. She took a few college courses this year at an accredited college. . . province, country, ZIP or foreign postal code, and telephone number 2021 FINANCIAL AID PARTNERS 305 WASHINGTON DR YOUR CITY, YOUR STATE, ZIP Student Loan Interest Statement RECIPIENT'S TIN 38-0800XXXX BORROWER'S TIN 419-00-XXXX Form 1098-E 1 Student loan interest received by lender $ 3,570.00 BORROWER'S name Copy C For Recipient CYNTHIA SIMON Street address (including apt. no.) 159 ARCHER AVENUE City or town, state or province, country, and ZIP or foreign postal code YOUR CITY, YOUR STATE, ZIP Account number (see instructions) For Privacy Act and Paperwork Reduction Act Notice, see the 2021 General Instructions for Certain Information Returns. 2 Check if box does not include loan origination fees and/or capitalized interest, and the loan was made before September 1, 2004Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started