Answered step by step

Verified Expert Solution

Question

1 Approved Answer

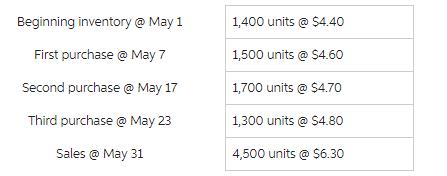

What is the amount of cost of goods sold assuming the LIFO cost flow method? Multiple choice $20,700 $21,130 $19,800 $21,600 Super Shop had revenue

What is the amount of cost of goods sold assuming the LIFO cost flow method?

Multiple choice

Multiple choice$20,700

$21,130

$19,800

$21,600

Super Shop had revenue of $209,500 cost of goods sold totaling $102,410 during 2020. The company started the year with $17,000 in inventory and finished the year with $29,000 in inventory. On average, how many days does it take Super Shop to sell through their inventory?

Multiple Choice

82 days

4 days

61 days

- 40 days

Beginning inventory @ May 1 1,400 units @ $4.40 First purchase @ May 7 1,500 units @ S4.60 Second purchase @ May 17 1,700 units @ $4.70 Third purchase @ May 23 1,300 units @ $4.80 Sales @ May 31 4,500 units @ $6.30

Step by Step Solution

★★★★★

3.31 Rating (142 Votes )

There are 3 Steps involved in it

Step: 1

Answers 1 21130 2 82 Days LIFO Method Cost of Goods Sold is allocated from the L...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started