Answered step by step

Verified Expert Solution

Question

1 Approved Answer

What is the amount of Goodwill or Gain on Bargain Purchase arising from the business combination? Please enter a positive number to indicate Goodwill or

What is the amount of Goodwill or Gain on Bargain Purchase arising from the business combination? Please enter a positive number to indicate Goodwill or a negative number to indicate Gain on Bargain Purchase.

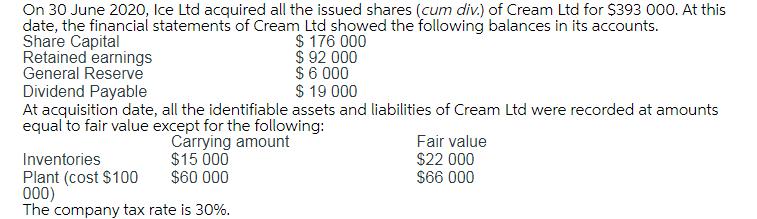

On 30 June 2020, Ice Ltd acquired all the issued shares (cum div.) of Cream Ltd for $393 000. At this date, the financial statements of Cream Ltd showed the following balances in its accounts. Share Capital $ 176 000 $ 92 000 $6.000 $ 19 000 At acquisition date, all the identifiable assets and liabilities of Cream Ltd were recorded at amounts equal to fair value except for the following: Carrying amount Retained earnings General Reserve Dividend Payable Inventories Plant (cost $100 000) The company tax rate is 30%. $15 000 $60 000 Fair value $22 000 $66 000

Step by Step Solution

There are 3 Steps involved in it

Step: 1

SOLUTION To calculate the amount of Goodwill or Gain on Bargain Purchase arising from the business c...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started