Answered step by step

Verified Expert Solution

Question

1 Approved Answer

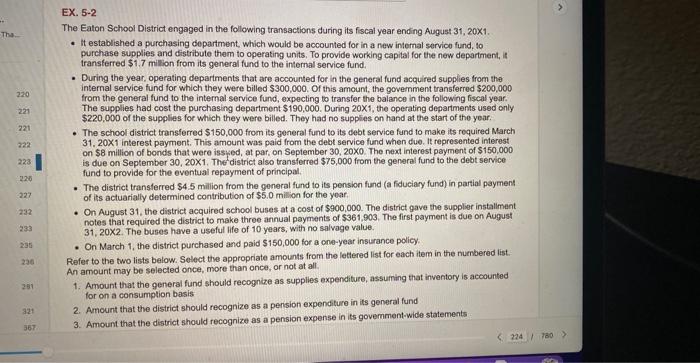

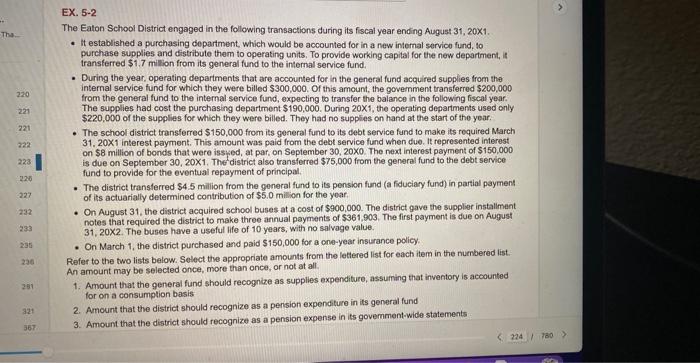

What is the amount that the district should recognize as nonspendable fund balance in its governmental fund statements and why? please explain. EX. 5-2 The

What is the amount that the district should recognize as nonspendable fund balance in its governmental fund statements and why? please explain.

EX. 5-2 The Eaton School District engaged in the following transactions during its fiscal year ending August 31, 20X1. - It established a purchasing department, which would be accounted for in a new internal servico fund, to purchase supplies and distribute them to operating units. To provide working capilal for the new department, it transferred $1.7 milison from its general fund to the internal service fund. - During the year, operating depariments that are accounted for in the general fund acquired supplies from the internal service fund for which they were billed $300,000. Of this amount, the govemment transferred $200,000 from the general fund to the internal service fund, expecting to transfer the balance in the following fiscal year. The supplies had cost the purchasing department $190,000. During 201, the operating departments used only $220,000 of the supplies for which they were billed. They had no supplies on hand at the start of the year. - The school district transferred $150,000 from its general fund to its debt service fund to make its required March 31. 201 interest payment. This amount was paid from the debt service fund when due. It represented interest on $8 million of bonds that were issyed, at par, on September 30,200. The next interest payment of $150,000 is due on September 30, 20X1. The district also transferred $75,000 from the general fund to the debt service fund to provide for the eventual repayment of principal. - The district transferred $4.5 million from the goneral fund to its pension fund (a fiduciary fund) in partial payment of its actuarially determined contribution of $5.0mili on for the yoar. - On August 31, the district acquired school buses at a cost of $900,000. The district gave the supplier instaliment notes that required the district to make three annual payments of $361,903. The first payment is due on August 31,202. The buses have a useful life of 10 years, with no salvage value. - On March 1, the district purchased and paid $150,000 for a cne-year insurance policy. Refer to the two lists below. Select the appropriate amounts from the letiered list for each item in the numbered list. An amount may be selected once, more than once, or not at all. 1. Amount that the general fund should recognize as supplies expenditure, assuming that inventory is accounted for on a consumption basis 2. Amount that the district should recognize as a perision expenditure in its general fund 3. Amount that the district should recognize as a pension expense in its govemment-wide statements

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started