Answered step by step

Verified Expert Solution

Question

1 Approved Answer

What is the annual interest paid on note resulting from the purchase of the Louisiana plant and the annual floating interest paid to counterparty on

What is the annual interest paid on note resulting from the purchase of the Louisiana plant and the annual floating interest paid to counterparty on the note resulting from the sale of the European plant?

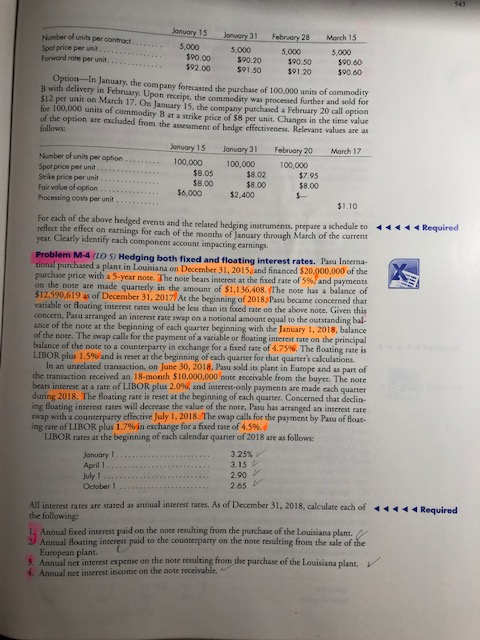

January 15 January 31 February 28 March 15 b ol units per contact ....... 5.000 5.000 5.000 5.000 Spotprice per unit... $90.00 $90 20 $90.50 $90.60 Forward rate per unit, $92.00 $91.50 301.20 390.60 Option in January, the company forecasted the purchase of 100,000 units of commodity B with delivery in February. Upon rescis she commodity was processed further and sold for $12 per unit on March 17. On Tangay 15 the y purchased a February 20 call option for 100,000 units of commodity Bar a strike price of 58 per unit. Changes in the time value of the option are excluded from the assessment of hede effectiveness. Relevant values are as follows: January 15 January 31 February 20 March 17 Number of units per option ......... 100.000 100.000 100.000 Spotprice per unit........... $8.05 $8.02 $7.95 Srika price per unit $8.00 $8.00 $8.00 Foir volue of option $6,000 $2,400 Processing cost per unit. $1.10 4 4 Required For each of the above hedged events and the related hedging instruments, prepare a schedule to 4 reflect the effect on earnings for each of the months of lanuary through March of the current year. Clearly identify each component account impacting earnings. Problem M-4 (LOS) Hedging both fixed and floating interest rates. Pasu Interna- tional purchased a plant in Louisiana on December 31, 2015, and financed $20.000.000 of the purchase price with a 5-year note. The note bears interest at the fixed rate of 5% and payments on the note are made quarterly in the amount of $1,136,408. The note has a balance of $12.590.619 as of December 31, 2017 At the beginning of 2018. Pasu became concerned that variable or floating interest rates would be less than its fixed rate on the above noce. Given this concern. Pasu arranged an interest rate swap on a notional amount equal to the outstanding bal ance of the note at the beginning of each quarter beginning with the January 1, 2018, balance of the note. The swap calls for the payment of a variable or floating interest rate on the principal balance of the note to a counterparty in exchange for a fixed rate of 4.75%. The floating rate is LIBOR plus 1.5% and is reset at the beginning of each quarter for that quarter's calculations In an unrelated transaction, on June 30, 2018. Pasu sold its plant in Europe and as part of the transaction received an 18-month $10,000,000 note receivable from the buyer. The note bears interest at a rate of LIBOR plus 2.096, and interest-only payments are made each quarter during 2018. The Boating rate is reset at the beginning of each quarter. Concerned that declin- ing Boating interest rates will decrease the value of the note, Pasu has arranged an interest rate swap with a counterparty effective July 1, 2018. The swap calls for the payment by Pasy of four- ing rate of LIBOR plus 1.796 in exchange for a fixed rate of 4.5% LIBOR rates at the beginning of each calendar quarter of 2018 are as follows 3.25% January 1 . ...................... April 1.. July 1 October 1... 3.15 2.90 2.65 Required All interest rates are stated as annual interest rates. As of December 31, 2018, calculate cach of 444 the following 1 Annual fixed interest paid on the note resulting from the purchase of the Louisiana plant Annual floating interest paid to the counterparty on the note resulting from the sale of the European plant. 3. Annual net interest expense on the note resulting from the purchase of the Louisiana plan. 4. Annual net interest income on the note receivableStep by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started