What is the answer for 1 d)

What is the answer for 1 d)

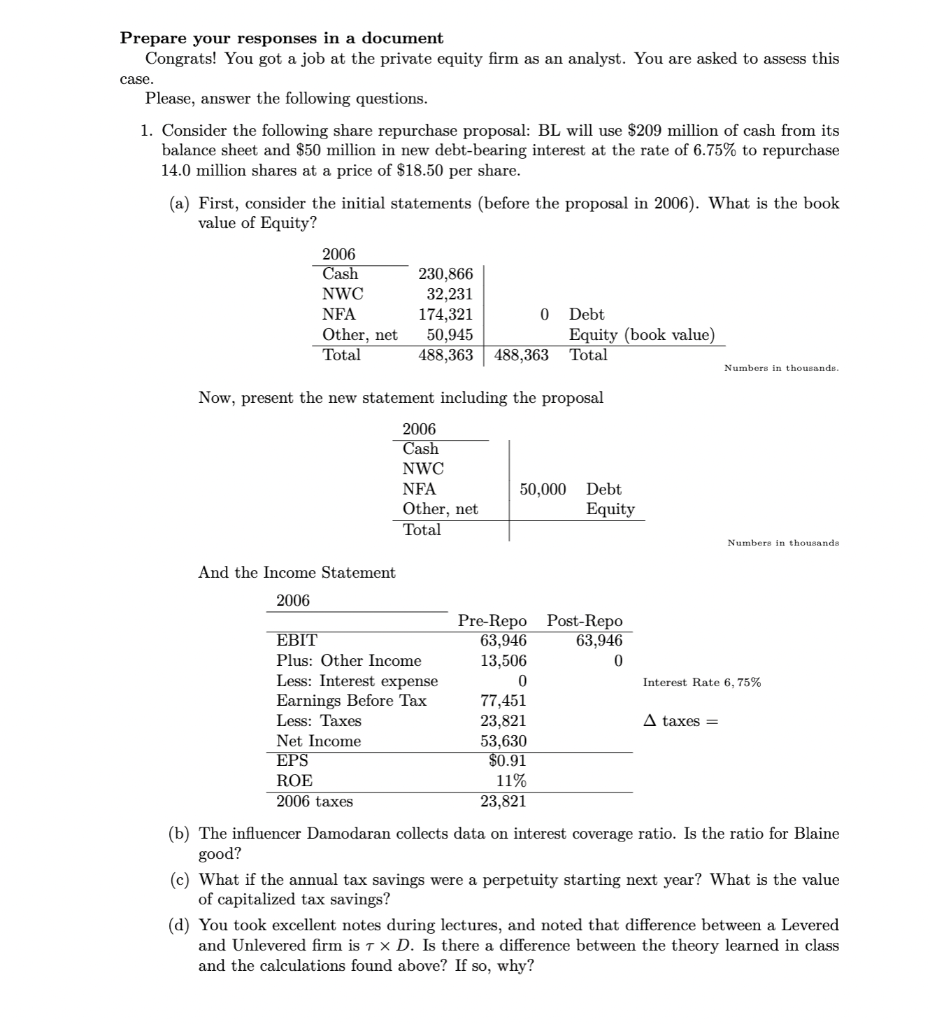

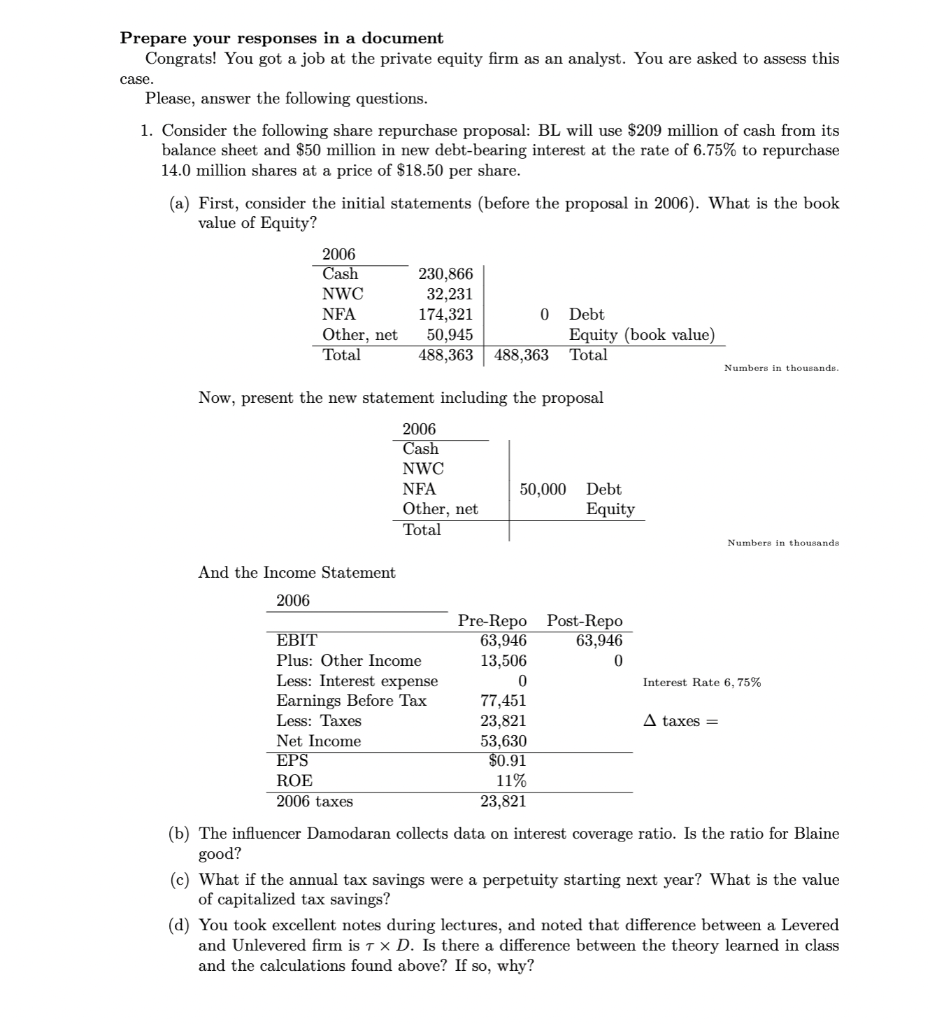

Prepare your responses in a document Congrats! You got a job at the private equity firm as an analyst. You are asked to assess this case. Please, answer the following questions. 1. Consider the following share repurchase proposal: BL will use $209 million of cash from its balance sheet and $50 million in new debt-bearing interest at the rate of 6.75% to repurchase 14.0 million shares at a price of $18.50 per share. (a) First, consider the initial statements (before the proposal in 2006). What is the book value of Equity? mbers in thousande. Now, present the new statement including the proposal Numbers in thousands And the Income Statement (b) The influencer Damodaran collects data on interest coverage ratio. Is the ratio for Blaine good? (c) What if the annual tax savings were a perpetuity starting next year? What is the value of capitalized tax savings? (d) You took excellent notes during lectures, and noted that difference between a Levered and Unlevered firm is D. Is there a difference between the theory learned in class and the calculations found above? If so, why? Prepare your responses in a document Congrats! You got a job at the private equity firm as an analyst. You are asked to assess this case. Please, answer the following questions. 1. Consider the following share repurchase proposal: BL will use $209 million of cash from its balance sheet and $50 million in new debt-bearing interest at the rate of 6.75% to repurchase 14.0 million shares at a price of $18.50 per share. (a) First, consider the initial statements (before the proposal in 2006). What is the book value of Equity? mbers in thousande. Now, present the new statement including the proposal Numbers in thousands And the Income Statement (b) The influencer Damodaran collects data on interest coverage ratio. Is the ratio for Blaine good? (c) What if the annual tax savings were a perpetuity starting next year? What is the value of capitalized tax savings? (d) You took excellent notes during lectures, and noted that difference between a Levered and Unlevered firm is D. Is there a difference between the theory learned in class and the calculations found above? If so, why

What is the answer for 1 d)

What is the answer for 1 d)