Answered step by step

Verified Expert Solution

Question

1 Approved Answer

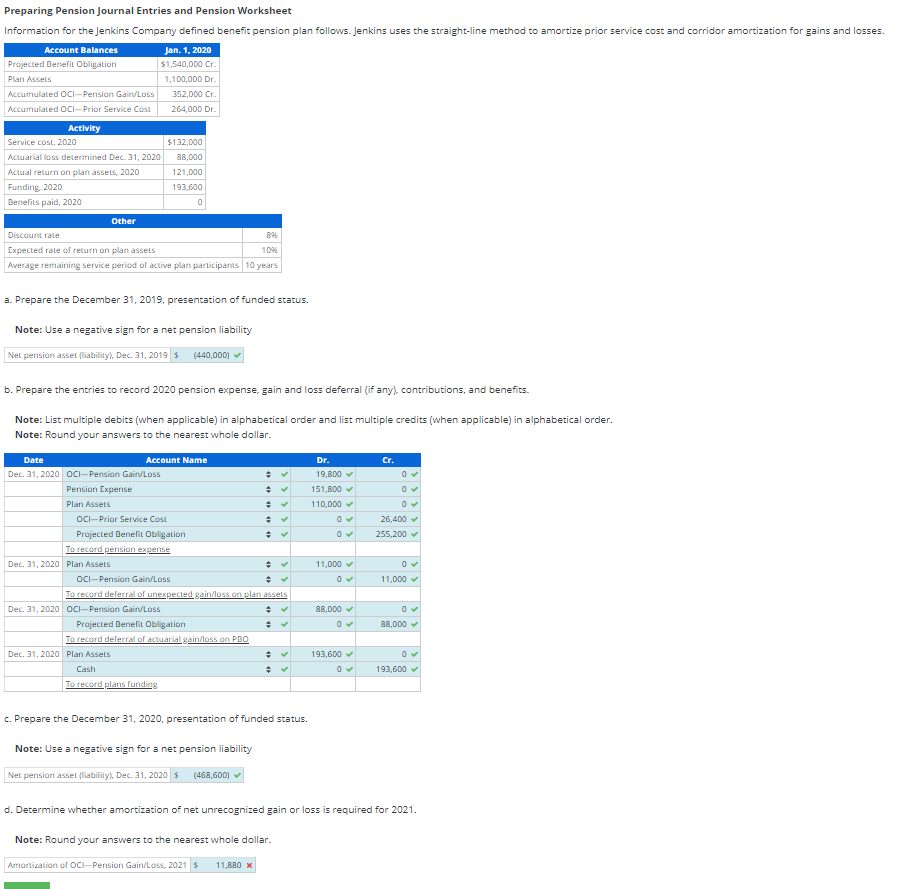

What is the answer for amortization of net unrecognized gain or loss? Preparing Pension Journal Entries and Pension Worksheet Information for the Jenkins Company defined

What is the answer for amortization of net unrecognized gain or loss?

Preparing Pension Journal Entries and Pension Worksheet Information for the Jenkins Company defined benefit pension plan follows. Jenkins uses the straight-line method to amortize prior service cost and corridor amortization for gains and losses. Account Balances Jan. 1.2020 Projected Benefit Obligation $1,540,000 Cr. Plan Assels 1,100,000 Dr. Accumulated OCI-Pension Gain/Loss 352,000 Cr Accumulated OCI-Prior Service Cost 264,000 Dr. Activity Service COSI, 2020 $132.000 Actuarial loss determined Dec 31, 2020 88,000 Actual return on plan assets, 2020 121,000 Funding 2020 193,600 Benefits paid, 2020 0 Other Discount rate 89 Expected rate of return on plan assets 109 Average remaining service period of active plan participants 10 years a. Prepare the December 31, 2019, presentation of funded status. Note: Use a negative sign for a net pension liability Net pension asset liability)Dec. 31, 2019 $ (440,000) b. Prepare the entries to record 2020 pension expense, gain and loss deferral (if any) contributions, and benefits. Note: List multiple debits (when applicable) in alphabetical order and list multiple credits (when applicable) in alphabetical order. Note: Round your answers to the nearest whole dollar. Cr. Dr. 19,800 0 151,800 110,000 26,400 255,200 11,000 Date Account Name Dec 31, 2020 OCI-Pension Gain Loss Pension Expense Plan Assets OCI-Prior Service Cost Projected Benefit Obligation To record pension expanse Dec 31, 2020 Plan Assets OCI-Pension Gair Loss To record deferral or unexpected gain/loss on plan assets Dec 31, 2020 OCI-Pension Gair Loss Projected Benefit Obligation To record deferral of actuarial gain/loss on PBO Dec 31, 2020 Plan Assets Cash To record plans tunding 11,000 88,000 O 88,000 193,600 0 193,600 c. Prepare the December 31, 2020, presentation of funded status. Note: Use a negative sign for a net pension liability Net pension asset liability), Dec 31, 2020 $ (468,600) d. Determine whether amortization of net unrecognized gain or loss is required for 2021. Note: Round your answers to the nearest whole dollar. Amortization of OCI-Pension Gain/Loss, 2021 S 11,880 XStep by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started