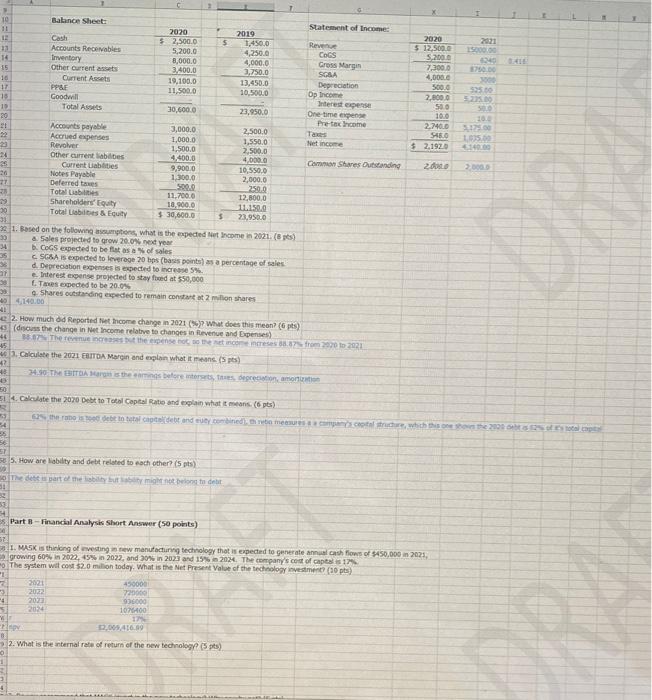

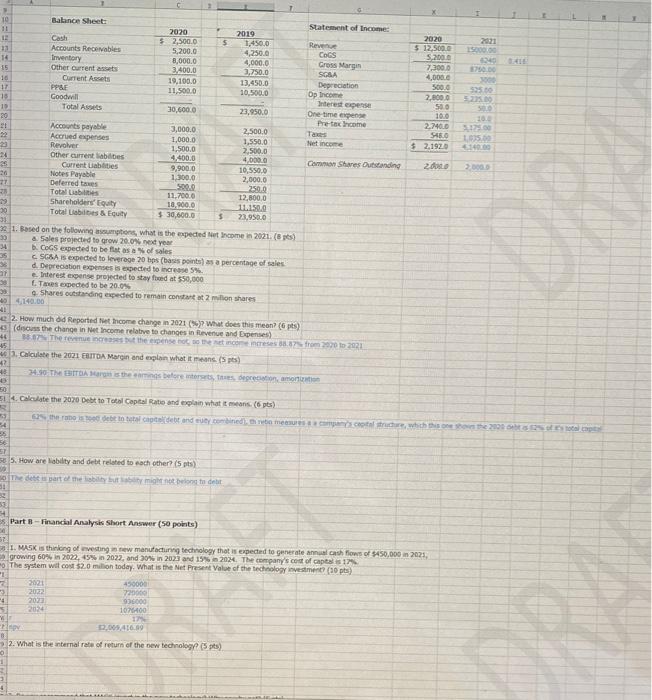

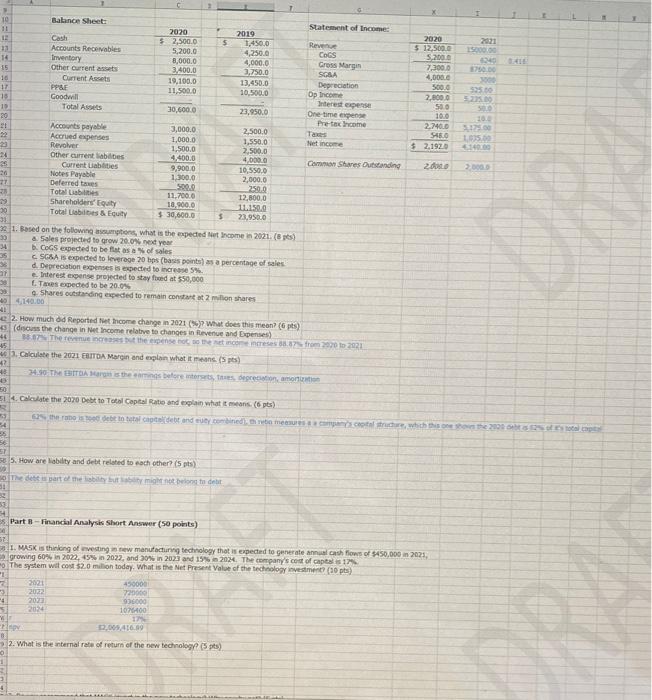

what is the answers for part B question 2?

C TO Balance Sheet: Statement of Income: 2020 2019 13 Cash 2020 $ 2,500.0 5 1.450.0 Revenue $ 12,50 11 Accounts Receivables 5,200.0 4,250.0 COGS 14 Triventory 5.2006 8,000.0 4,000.0 Cross Margin 15 Other Current 3,400.0 7,300.0 2,750.0 SGSA 10 Current Assets 4,000.0 19,100.0 17 PPDF 13,450.0 Depreciation 560.0 535.00 11,500.0 10,500.0 Op Income 15 Goodwill 2.8000 525 Interest expense 500 19 Total Assets 30.600.0 23.950.0 One-time egen 20 10.0 10. Preta come 2t Accounts payable 2.7400 3,000.0 2,500.0 Accrued expenses Taxes 22 S160 LE 1,000.0 1,550.0 Revolver income $ 2.1920 5140 1,500.0 2.500.0 24 Other current labelbes 4,400.0 4,00020 Cam Shares Outstanding Current Liabilities 2 foto 9,900.0 20 Notes Payable 10,550.0 1.300.0 77 Deferred taxes 2,000.0 5000 Total Liabile 2500 11.700.0 12,800,0 09 Shareholders Equity 18,900.0 11.150.0 20 Total Liabiles & Equity $ 30,000.0 23.950.0 31 30 1. Based on the following assumptions, what is the expected at Income in 2021 (6) 30 a. soles projected to grow 20.0% next year 34 COGS expected to be flat as of sales 35 CSGSA is expected to leverage 20 bps (bass points) as a percentage of sales d. Depreciation expenses is expected to increase 5% an e. Interest expense projected to stayed at $50,000 Les expected to be 20.0% 9. Shares outstanding expected to remain constant at 2 million shares 40 4140.00 11 2. How much od Reported that come change in 2021 (%) What does this mean? (6 pts) -3 (discuss the change in Net Income relative to changes in Revenue and Expenses) 46 307 The event the expense et congress 3.87 from 2000 to 2021 45 63. Calculate the 2021 EBITDA Margin and explain what it means. (p) 40 34 30 TM EBITDA Burns the songs before interes, e deprecionamo 50 51 4. Calculate the 2070 Debt to Total Capital Ratio and explain what it means (6 pts) 6 there is a debt total cap debt and combined in mesurselor which the 2000 54 DR 56 50 5. How are liability and debt related to each other? (5 pts) The dessert the ability but might belong to det 31 53 54 s Part 3 - Financial Analysis Short Answer (50 points) 52 I. MASKI thinking of vestingsw manufacturing technology that is expected to generate annual cash flows of $450,000 in 2021 growing 60% in 2022.5% in 2022, and 20% in 2023 and 15% 2024. The company's cost of caps 11 The system wit cost $2.0 million today. What is the Net Present Value of the technology investment (10 pts 2021 450000 2022 720000 4 2031 936000 2024 107600 17 2.009410.19 8 2. What is the internal rate of return of the new technology (5) ORA