Answered step by step

Verified Expert Solution

Question

1 Approved Answer

What is the answers to the questions below? Question 16 1 pts Katie Ledecky has been offered a 20-year bond issued by Barone, Inc. at

What is the answers to the questions below?

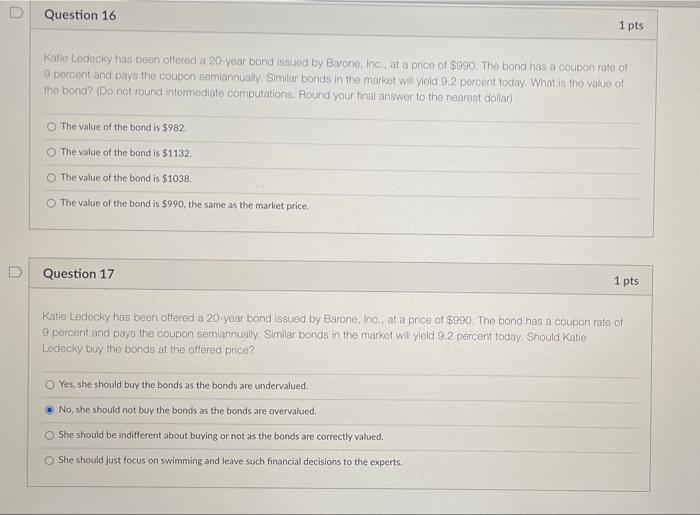

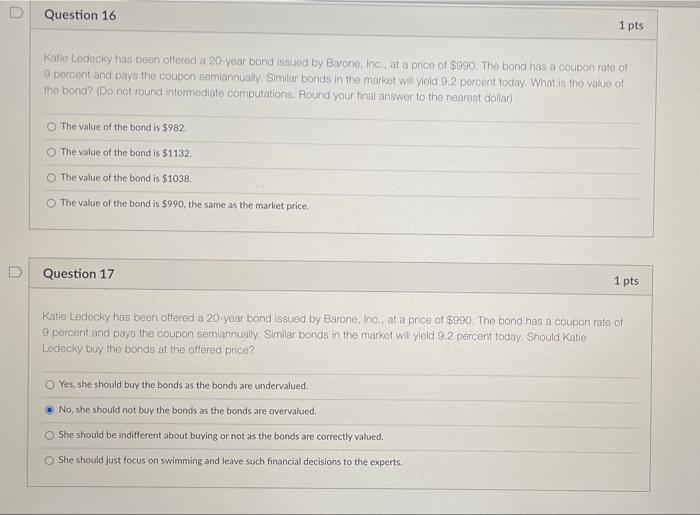

Question 16 1 pts Katie Ledecky has been offered a 20-year bond issued by Barone, Inc. at a price of $990. The bond has a coupon rate of percent and pays the coupon semiannually Similar bonds in the market will yield 9.2 percent today. What is the value of the bond? (Do not found intermediate computations. Round your final answer to the nearest dollar) The value of the bond is 5982 The value of the bond is $1132 The value of the bond is $1038 The value of the bond is $990, the same as the market price. Question 17 1 pts Katie Ledecky has bean offered a 20 year bond issued by Barone, Inc., at a price of $990. The band has a coupon rate of 9 percent and pays the coupon semiannually. Similar bonds in the market will yield 9.2 percent today Should Katie Ledecky buy the bonds at the offered price? Yes, she should buy the bonds as the bonds are undervalued No, she should not buy the bonds as the bonds are overvalued, She should be indifferent about buying or not as the bonds are correctly valued. She should just focus on swimming and leave such financial decisions to the experts

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started