Question

Question 2 (20 Marks) Raymond is an employee of the X2Y Accounting firm; He is provided with 10 gift vouchers worth $50 each for

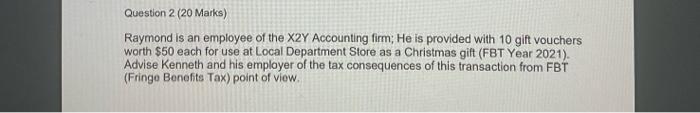

Question 2 (20 Marks) Raymond is an employee of the X2Y Accounting firm; He is provided with 10 gift vouchers worth $50 each for use at Local Department Store as a Christmas gift (FBT Year 2021). Advise Kenneth and his employer of the tax consequences of this transaction from FBT (Fringe Benefits Tax) point of view.

Step by Step Solution

3.45 Rating (155 Votes )

There are 3 Steps involved in it

Step: 1

Solution Provide 10 gift vouchers Wor...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get StartedRecommended Textbook for

Fundamental Financial Accounting Concepts

Authors: Thomas Edmonds, Christopher Edmonds

9th edition

9781259296802, 9781259296758, 78025907, 1259296806, 9781259296765, 978-0078025907

Students also viewed these Accounting questions

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

View Answer in SolutionInn App