Question

What is the associated 5 year annual return on the equally weighted portfolio of a) your 2 sector stocks, and b) a portfolio of your

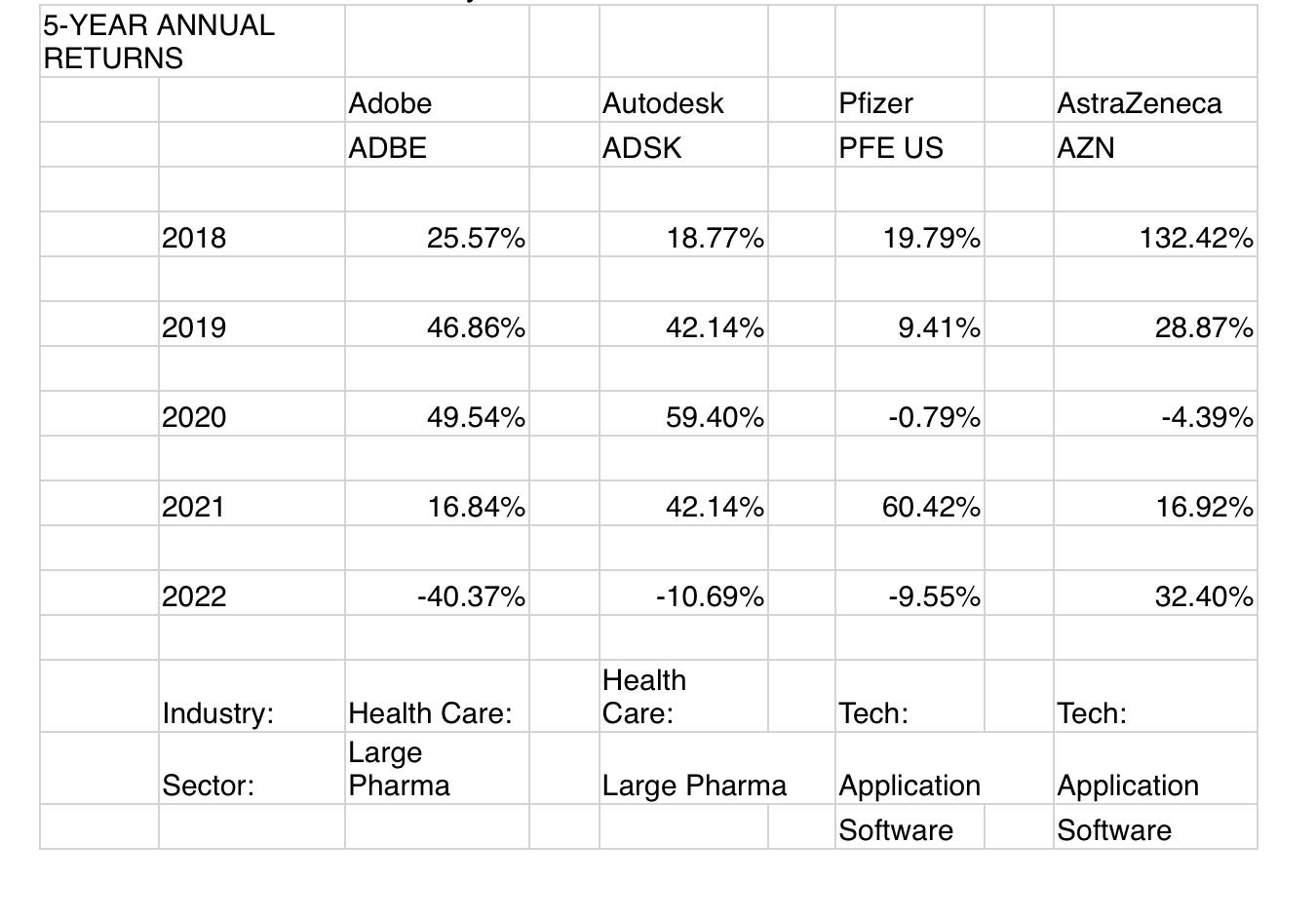

What is the associated 5 year annual return on the equally weighted portfolio of a) your 2 sector stocks, and b) a portfolio of your 2 stocks and one stock from the healthcare sector, and c) a portfolio of your 2 stocks and the other stock from the healthcare sector?

What are the standard deviations of each of the 2 sector stocks, a 2 stock equally weighted portfolio of your sector stocks, an equally weighted portfolio of all 4 stocks. Provide commentary in 2-3 sentences.

Repeat the correlations tab for all stocks. Provide commentary in 2-3 sentences.

Adding which 1 stock to your 2 stock portfolio (equal weights) provides the greatest diversification benefit? What is the resulting average return and portfolio standard deviation? Which stock would provide the least diversification benefit? Provide 3-4 sentences of commentary.

5-YEAR ANNUAL RETURNS 2018 2019 2020 2021 2022 Industry: Sector: Adobe ADBE 25.57% 46.86% 49.54% 16.84% -40.37% Health Care: Large Pharma Autodesk ADSK 18.77% 42.14% 59.40% 42.14% -10.69% Health Care: Large Pharma Pfizer PFE US 19.79% 9.41% -0.79% 60.42% -9.55% Tech: Application Software AstraZeneca AZN Tech: 132.42% 28.87% -4.39% 16.92% 32.40% Application Software

Step by Step Solution

3.43 Rating (153 Votes )

There are 3 Steps involved in it

Step: 1

Answer To calculate the associated 5year annual return on the portfolios and the standard deviations we first need to organize the provided data 1 5Year Annual Returns Adobe ADBE 2018 2557 2019 4686 2...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started