Answered step by step

Verified Expert Solution

Question

1 Approved Answer

What is the author concerned about and why? Who is he trying to convince? This article was written in 1983. Based upon what youve learned

- What is the author concerned about and why? Who is he trying to convince?

- This article was written in 1983. Based upon what youve learned this week about the DCF method, do you think the author was correct way back then, or have his concerns been addressed?

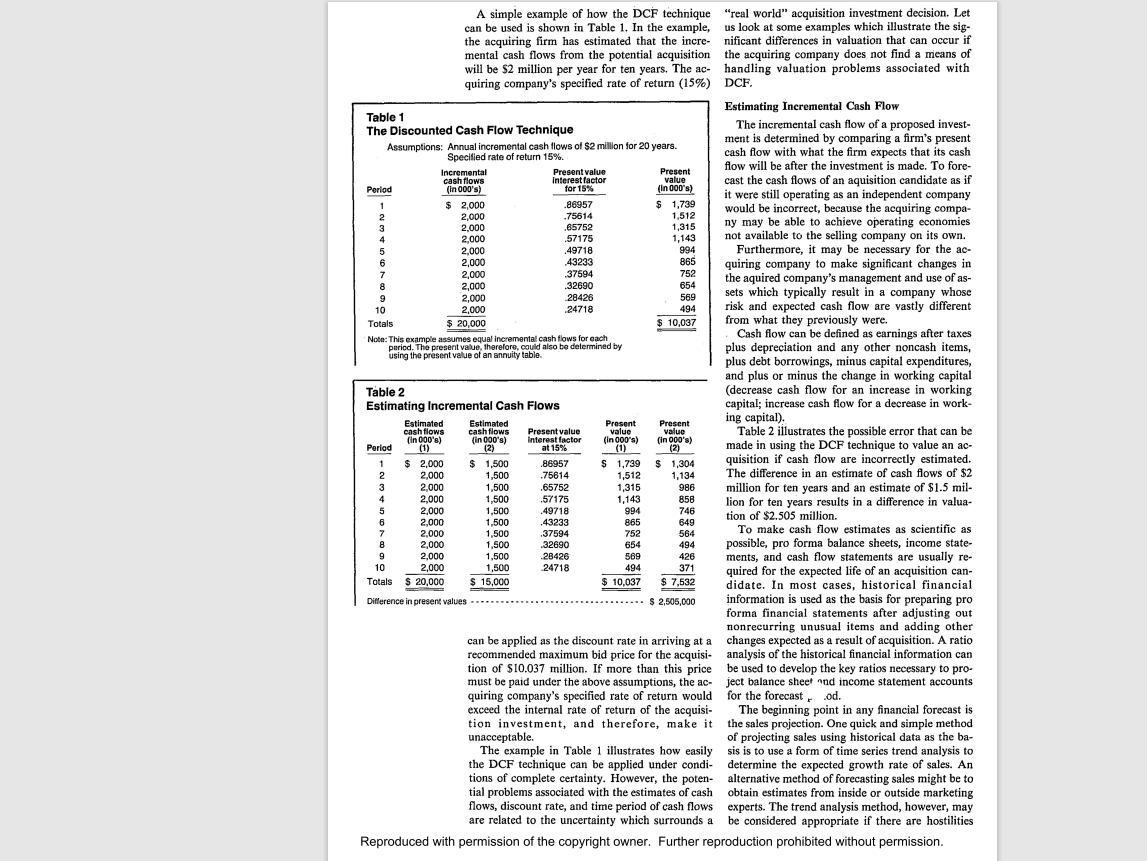

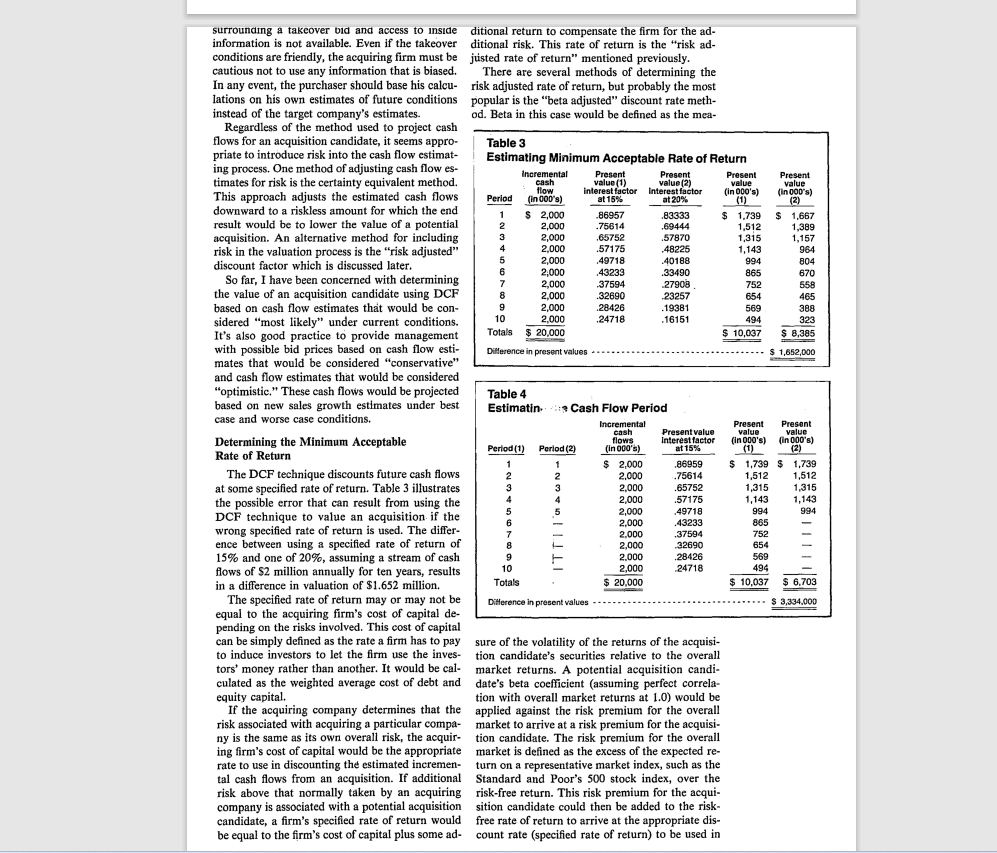

By James S. Ritchey Where are the high premium takeover bids coming from? When Mobil announced its offer, Marathon stock jumped from $67 a share to $90; the day after U.S. Steel's bid of $125 a share, Marathon shares climbed to $106.75. How can a $60 a share offer be made by Fluor Corporation for the stock of St. Joe Minerals Corporation which previously had been selling on the market at $27 a share? American Medical International made an offer of $52 a share for Brookwood Hospital's stock which had been selling on the market for $15 a share. All of this activity suggests that the stock market is undervaluing stock of some companies and helps explain the increase in acquisitions and mergers versus internal growth strategies. When making an investment decision, financial management generally aims to maximize the present worth of the company. Why then do some investments fail to meet this objective? One reason is a lack of understanding of fundamental valuation theory. How then can the risk of acquisition failure be reduced? This risk can be reduced through the use of valuation techniques and procedures that are well defined and used in a consistent and systematic manner. There are many factors that an acquiring company can consider in establishing the value of an enterprise. By reviewing a financial evaluation tool called the discounted cash flow (DCF) technique and the potential dangers associated with using it, I will provide some insight into some of the problems encountered in arriving at the purchase price of an acquisition. Although the DCF method has been increasing in popularity, some people feel that the use of DCF represents guesswork and that others recognize the importance of the information gathering and estimating process as it relates to the DCF method. The potential problems which surround this process involve the following three areas: 1. Determining the time period for estimating cash flows (i.e. how long the acquisition is expected to generate cash flows), 2. Estimating the incremental cash flows expected to be generated through acquisition, and 3. Determining the minimum acceptable rate of return to be used in discounting cash flows to arrive at a value. The Discounted Cash Flow Technique The DCF technique used in the valuation of an acquisition by the acquiring company is basically the same DCF technique that companies are using to make internal growth decisions. However, the analysis of a potential acquisition appears to be Reproduced with permission of the copyright owner. Further reproduction prohibited without permission. 1. ine rasks assocuated witn a typican investment are usually similar to those already in the company's portfolio of investments, while the risks associated with a potential acquisition may be completely different. 2. A company's typical investments are under the control of familiar managers, while the abilities of managers associated with a potential acquisition are relatively unknown. 3. The valuation in the capital marketplace is likely to be different for a typical investment and an acquisition investment. The capital market acts as a pricing mechanism to equate the value of a company with its risk-return characteristics. Because of these reasons, it is unreasonable to expect that the DCF technique would be used as the only means of determining an acquisition price. In most cases, such a determination will require the study of many additional factors that are not normally considered in the typical investment decision. One of the main features of the DCF technique is that a dollar of cash received today is worth more than a dollar received a year from now, because today's dollars can be invested to earn a return during the intervening time. An acquiring company would not want to pay more than the present value of an acquisition candidate. The acquiring company also would more than likely have in mind a specified rate of return which would be used to discount the expected cash flows of an acquisition candidate to the present. Under the DCF technique, the amount of cash that will accumulate over the expected life of an acquisition investment is estimated and this cash is discounted to the present using the acquiring company's specified rate of return. The result will be the maximum price the acquiring company would pay for an acquisition. As mentioned previously, however, the resulting price from the use of the DCF technique may or may not be the final offer price because of the many other factors that might need to be considered in the corporate acquisition decision. The actual formula for DCF can be considered to be a spin-off of the net present value formula. It can be written as follows: DV=(1+k)2a2+(1+k)2a2+(1+k)2as+(1+k)nan DV is the discounted present value of the potential acquisition and is the result we are looking for. The incremental cash flows (cash receipts less cash payments) of the potential acquisition are represented by a1,a2,a3,, an at the end of the years 1,2,3,..n. The specified rate of return of the acquiring company as it relates to the proposed acquisition is represented by k. The cash flows for each year (a1,a2,a3,.an) are discounted back to the present when using the formula. A simple example of how the DCF technique can be used is shown in Table 1 . In the example, the acquiring firm has estimated that the incremental cash flows from the potential acquisition will be $2 million per year for ten years. The acquiring company's specified rate of return (15\%) Table 1 The Discounted Cash Flow Technique Assumptions: Annual incremental cash flows of $2 million for 20 years. Enanitiad rata of rathurn 1 reo. using the present value of an annuity table. can be applied as the discount rate in arriving at a recommended maximum bid price for the acquisition of $10.037 million. If more than this price must be paid under the above assumptions, the acquiring company's specified rate of return would exceed the internal rate of return of the acquisition investment, and therefore, make it unacceptable. The example in Table 1 illustrates how easily the DCF technique can be applied under conditions of complete certainty. However, the potential problems associated with the estimates of cash flows, discount rate, and time period of cash flows are related to the uncertainty which surrounds a "real world" acquisition investment decision. Let us look at some examples which illustrate the significant differences in valuation that can occur if the acquiring company does not find a means of handling valuation problems associated with DCF. Estimating Incremental Cash Flow The incremental cash flow of a proposed investment is determined by comparing a firm's present cash flow with what the firm expects that its cash flow will be after the investment is made. To forecast the cash flows of an aquisition candidate as if it were still operating as an independent company would be incorrect, because the acquiring company may be able to achieve operating economies not available to the selling company on its own. Furthermore, it may be necessary for the acquiring company to make significant changes in the aquired company's management and use of assets which typically result in a company whose risk and expected cash flow are vastly different from what they previously were. Cash flow can be defined as earnings after taxes plus depreciation and any other noncash items, plus debt borrowings, minus capital expenditures, and plus or minus the change in working capital (decrease cash flow for an increase in working capital; increase cash flow for a decrease in working capital). Table 2 illustrates the possible error that can be made in using the DCF technique to value an acquisition if cash flow are incorrectly estimated. The difference in an estimate of cash flows of $2 million for ten years and an estimate of $1.5 million for ten years results in a difference in valuation of $2.505 million. To make cash flow estimates as scientific as possible, pro forma balance sheets, income statements, and cash flow statements are usually required for the expected life of an acquisition candidate. In most cases, historical financial information is used as the basis for preparing pro forma financial statements after adjusting out nonrecurring unusual items and adding other changes expected as a result of acquisition. A ratio analysis of the historical financial information can be used to develop the key ratios necessary to project balance sheet nnd income statement accounts for the forecast t. od. The beginning point in any financial forecast is the sales projection. One quick and simple method of projecting sales using historical data as the basis is to use a form of time series trend analysis to determine the expected growth rate of sales. An alternative method of forecasting sales might be to obtain estimates from inside or outside marketing experts. The trend analysis method, however, may be considered appropriate if there are hostilities surrounding a takeover bid and access to inside information is not available. Even if the takeover conditions are friendly, the acquiring firm must be cautious not to use any information that is biased. In any event, the purchaser should base his calculations on his own estimates of future conditions instead of the target company's estimates. Regardless of the method used to project cash flows for an acquisition candidate, it seems appropriate to introduce risk into the cash flow estimating process. One method of adjusting cash flow estimates for risk is the certainty equivalent method. This approach adjusts the estimated cash flows downward to a riskless amount for which the end result would be to lower the value of a potential acquisition. An alternative method for including risk in the valuation process is the "risk adjusted" discount factor which is discussed later. So far, I have been concerned with determining the value of an acquisition candidate using DCF based on cash flow estimates that would be considered "most likely" under current conditions. It's also good practice to provide management with possible bid prices based on cash flow estimates that would be considered "conservative" and cash flow estimates that would be considered "optimistic." These cash flows would be projected based on new sales growth estimates under best case and worse case conditions. Determining the Minimum Acceptable Rate of Return The DCF technique discounts future cash flows at some specified rate of return. Table 3 illustrates the possible error that can result from using the DCF technique to value an acquisition if the wrong specified rate of return is used. The difference between using a specified rate of return of 15% and one of 20%, assuming a stream of cash flows of $2 million annually for ten years, results in a difference in valuation of $1.652 million. The specified rate of return may or may not be equal to the acquiring firm's cost of capital depending on the risks involved. This cost of capital can be simply defined as the rate a firm has to pay to induce investors to let the firm use the investors' moncy rather than another. It would be calculated as the weighted average cost of debt and equity capital. If the acquiring company determines that the risk associated with acquiring a particular company is the same as its own overall risk, the acquiring firm's cost of capital would be the appropriate rate to use in discounting the estimated incremental cash flows from an acquisition. If additional risk above that normally taken by an acquiring company is associated with a potential acquisition candidate, a firm's specified rate of return would be equal to the firm's cost of capital plus some ad- ditional return to compensate the firm for the additional risk. This rate of return is the "risk adjuisted rate of return" mentioned previously. There are several methods of determining the risk adjusted rate of return, but probably the most popular is the "beta adjusted" discount rate method. Beta in this case would be defined as the mea- sure of the volatility of the returns of the acquisition candidate's securities relative to the overall market returns. A potential acquisition candidate's beta coefficient (assuming perfect correlation with overall market returns at 1.0 ) would be applied against the risk premium for the overall market to arrive at a risk premium for the acquisition candidate. The risk premium for the overall market is defined as the excess of the expected return on a representative market index, such as the Standard and Poor's 500 stock index, over the risk-free return. This risk premium for the acquisition candidate could then be added to the riskfree rate of return to arrive at the appropriate discount rate (specified rate of return) to be used in discounting cash flows. It also may be desirable to provide management with bid prices under the "conservative," "most likely," and "optimistic" cash flow projections for a range of different discount rates. This breakdown would supply some quick answers on rates of return for alternative bid prices, if needed. Estimating the Cash Flow Period Table 4 indicates the difference in valuation DCF can be applied easily in a model situation, but the 'real world' requires greater analysis. flows beyond a five-year period is not practical. A perhaps more sophisticated approach calls for continuing to forecast cash flows as long as the expected rate of return exceeds the cost of capital rate of the acquiring firm. This method suggests that beyond the year in which the expected rate of return exceeds the cost of capital, the market is indifferent between receiving cash dividends or having management invest in new products (i.e. the value of the company would be unaffected by growth.) Warning: DCF Pitfalls Obviously, the main danger an acquiring firm would have with any available method of valuation, including DCF, is that of overvaluing the potential acquisition candidate. The recent increased use of the DCF technique in valuing an acquisition requires those who employ it to examine the possible pitfalls associated with using the method to establish a price for an acquisition candidate. The increased use of DCF itself supports the fact that many companies are relying on the results of the DCF technique. So the results of the DCF technique must be meaningful to management when making acquisition decisions. Cash flows, the time frame of the cash flows, and an appropriate discount rate must be accurately forecasted or adjusted through the use of risk factors so that possible deficiencies in the estimates can be considered. Reproduced with permission of the copyright owner. Further reproduction prohibited without permission

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started