Answered step by step

Verified Expert Solution

Question

1 Approved Answer

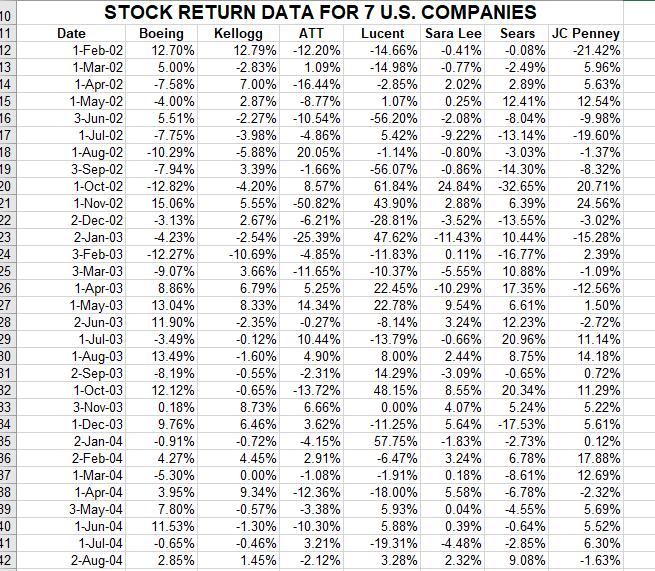

What is the average return of Kellogg when Sara Lee had a negative return? Use Advanced Filter to reduce the database so that you highlight

What is the average return of Kellogg when Sara Lee had a negative return? Use Advanced Filter to reduce the database so that you highlight (or extract) only returns when Sara Lee had

a negative return (Hint: May be best to do an Output range rather than sort in place)

| Criteria Range | |||||||

| Date | Boeing | Kellogg | ATT | Lucent | Sara Lee | Sears | JC Penney |

10 STOCK RETURN DATA FOR 7 U.S. COMPANIES 11 Date Boeing Kellogg ATT 12 1-Feb-02 12.70% 12.79% 13 1-Mar-02 5.00% Lucent -12.20% -14.66% -2.83% 1.09% -14.98% Sara Lee Sears JC Penney -0.41% -0.08% -21.42% -0.77% -2.49% 5.96% 14 1-Apr-02 -7.58% 7.00% -16.44% 15 1-May-02 -4.00% 2.87% -8.77% 16 3-Jun-02 5.51% -2.27% -10.54% -2.85% 1.07% 0.25% 12.41% -56.20% 2.02% 2.89% 5.63% 12.54% -2.08% -8.04% -9.98% 17 1-Jul-02 -7.75% -3.98% -4.86% 5.42% -9.22% -13.14% -19.60% 18 1-Aug-02 -10.29% -5.88% 20.05% -1.14% -0.80% -3.03% -1.37% 19 3-Sep-02 -7.94% 3.39% -1.66% -56.07% -0.86% -14.30% -8.32% 20 1-Oct-02 -12.82% -4.20% 8.57% 61.84% 24.84% -32.65% 20.71% 21 1-Nov-02 15.06% 5.55% -50.82% 43.90% 2.88% 6.39% 24.56% 22 2-Dec-02 -3.13% 2.67% -6.21% -28.81% -3.52% -13.55% -3.02% 23 2-Jan-03 -4.23% -2.54% -25.39% 47.62% -11.43% 10.44% -15.28% 24 3-Feb-03 -12.27% -10.69% -4.85% -11.83% 0.11% -16.77% 2.39% 25 3-Mar-03 -9.07% 3.66% -11.65% -10.37% -5.55% 10.88% -1.09% 26 1-Apr-03 8.86% 6.79% 27 1-May-03 13.04% 8.33% 5.25% 14.34% 22.45% -10.29% 17.35% -12.56% 22.78% 9.54% 6.61% 1.50% 28 2-Jun-03 11.90% -2.35% -0.27% -8.14% 3.24% 12.23% -2.72% 29 1-Jul-03 -3.49% -0.12% 10.44% -13.79% -0.66% 20.96% 11.14% 30 1-Aug-03 13.49% -1.60% 4.90% 8.00% 2.44% 8.75% 14.18% 31 2-Sep-03 -8.19% -0.55% -2.31% 14.29% -3.09% -0.65% 0.72% 32 1-Oct-03 12.12% -0.65% -13.72% 48.15% 8.55% 20.34% 11.29% 83 3-Nov-03 0.18% 8.73% 6.66% 0.00% 4.07% 5.24% 5.22% 34 1-Dec-03 9.76% 6.46% 3.62% -11.25% 5.64% -17.53% 5.61% 35 2-Jan-04 -0.91% -0.72% -4.15% 57.75% -1.83% -2.73% 0.12% 36 2-Feb-04 4.27% 4.45% 2.91% -6.47% 3.24% 6.78% 17.88% 37 1-Mar-04 -5.30% 0.00% -1.08% -1.91% 0.18% -8.61% 12.69% 38 1-Apr-04 3.95% 9.34% -12.36% -18.00% 5.58% -6.78% -2.32% 39 3-May-04 7.80% -0.57% -3.38% 5.93% 0.04% -4.55% 5.69% 40 1-Jun-04 11.53% -1.30% -10.30% 5.88% 0.39% -0.64% 5.52% 41 1-Jul-04 -0.65% -0.46% 3.21% -19.31% -4.48% -2.85% 6.30% 12 2-Aug-04 2.85% 1.45% -2.12% 3.28% 2.32% 9.08% -1.63%

Step by Step Solution

There are 3 Steps involved in it

Step: 1

SOLUTION To extract the returns for Sara Lee when it had a negative return we can use ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started