Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Melville Inc. purchased 2,000 common shares (20%) of Raymore Ltd. on January 1, Year 5 for $42,000. Additional information on Raymore for the two

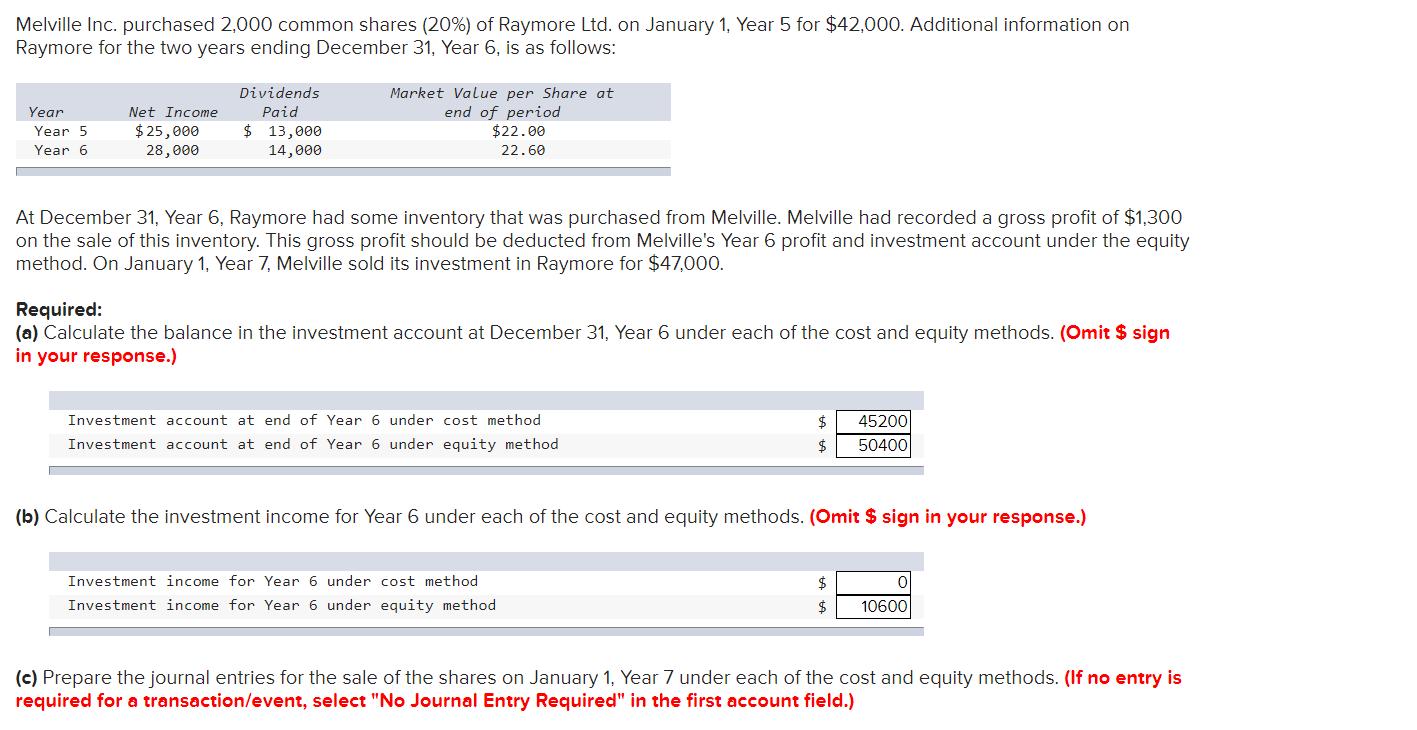

Melville Inc. purchased 2,000 common shares (20%) of Raymore Ltd. on January 1, Year 5 for $42,000. Additional information on Raymore for the two years ending December 31, Year 6, is as follows: Year Year 5 Year 6 Net Income $ 25,000 28,000 Dividends Paid $ 13,000 14,000 Market Value per Share at end of period $22.00 22.60 At December 31, Year 6, Raymore had some inventory that was purchased from Melville. Melville had recorded a gross profit of $1,300 on the sale of this inventory. This gross profit should be deducted from Melville's Year 6 profit and investment account under the equity method. On January 1, Year 7, Melville sold its investment in Raymore for $47,000. Required: (a) Calculate the balance in the investment account at December 31, Year 6 under each of the cost and equity methods. (Omit $ sign in your response.) Investment account at end of Year 6 under cost method Investment account at end of Year 6 under equity method $ $ Investment income for Year 6 under cost method Investment income for Year 6 under equity method (b) Calculate the investment income for Year 6 under each of the cost and equity methods. (Omit $ sign in your response.) 45200 50400 $ $ 0 10600 (c) Prepare the journal entries for the sale of the shares on January 1, Year 7 under each of the cost and equity methods. (If no entry is required for a transaction/event, select "No Journal Entry Required" in the first account field.)

Step by Step Solution

★★★★★

3.30 Rating (147 Votes )

There are 3 Steps involved in it

Step: 1

Solution a Investment Account at the end of ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started