Answered step by step

Verified Expert Solution

Question

1 Approved Answer

What is the basis of the new property in each of the following situations? What is the recognized gain or loss? Required: a. Rental

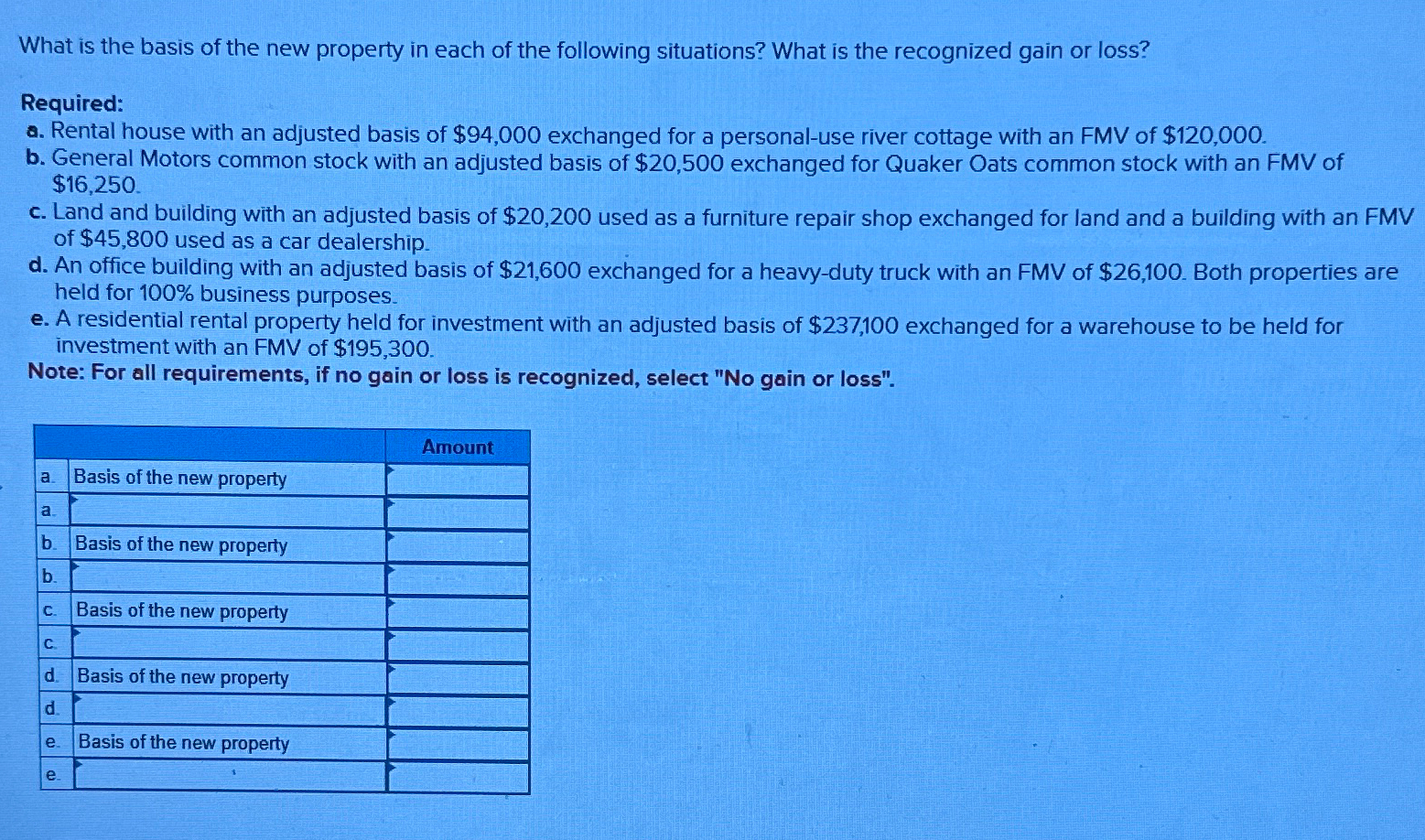

What is the basis of the new property in each of the following situations? What is the recognized gain or loss? Required: a. Rental house with an adjusted basis of $94,000 exchanged for a personal-use river cottage with an FMV of $120,000. b. General Motors common stock with an adjusted basis of $20,500 exchanged for Quaker Oats common stock with an FMV of $16,250. c. Land and building with an adjusted basis of $20,200 used as a furniture repair shop exchanged for land and a building with an FMV of $45,800 used as a car dealership. d. An office building with an adjusted basis of $21,600 exchanged for a heavy-duty truck with an FMV of $26,100. Both properties are held for 100% business purposes. e. A residential rental property held for investment with an adjusted basis of $237,100 exchanged for a warehouse to be held for investment with an FMV of $195,300. Note: For all requirements, if no gain or loss is recognized, select "No gain or loss". a Basis of the new property a. b. Basis of the new property b. C. Basis of the new property C d Basis of the new property d. e. Basis of the new property e. Amount

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Basis of the New Property and Recognized GainLoss a Rental house for personaluse river cottage Basis ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Document Format ( 2 attachments)

663d6fc5df646_967022.pdf

180 KBs PDF File

663d6fc5df646_967022.docx

120 KBs Word File

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started