Question

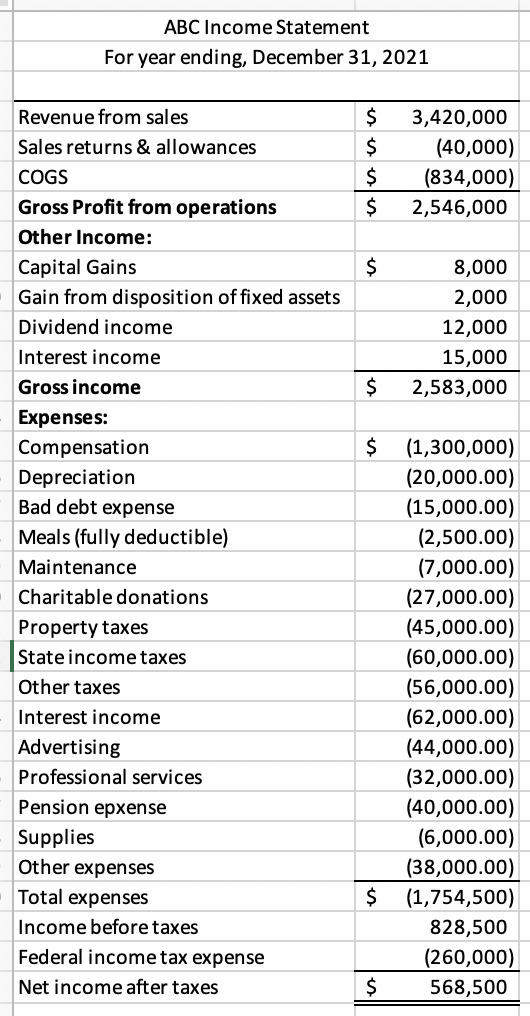

What is the Book-Tax difference to report on form 1120 and Schedule M-1? 1. ABC has a capital loss carryover to this year from last

What is the Book-Tax difference to report on form 1120 and Schedule M-1?

1. ABC has a capital loss carryover to this year from last year in the amount of $5,000.

2. Of the $15,000 interest income, $2,500 was from a City of Fremont bond issued in 2018, $3,500 was from a Pleasanton city bond issued in 2019, $3,000 was from a US Treasury bond, and the remaining $6,000 was from a money market account.

3. ABC sold equipment for $10,000. It originally purchased the equipment for $12,000 and, through the date of the sale, had recorded a cumulative total of $4,000 of book depreciation on the asset and a cumulative total of $6,000 of tax depreciation. For tax purposes, the entire gain was recaptured as ordinary income under section 1245.

4. ABC wrote off $10,000 in A/R as uncollectible during the year.

5. Tax Depreciation was $31,000.

6. Other expenses included $3,000 for premiums paid on term life insurance policies for which Company is the beneficiary. The policies cover the lives of Ben and Henry.

ABC Income Statement For year ending, December 31, 2021 ABC Income Statement For year ending, December 31, 2021

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started