Answered step by step

Verified Expert Solution

Question

1 Approved Answer

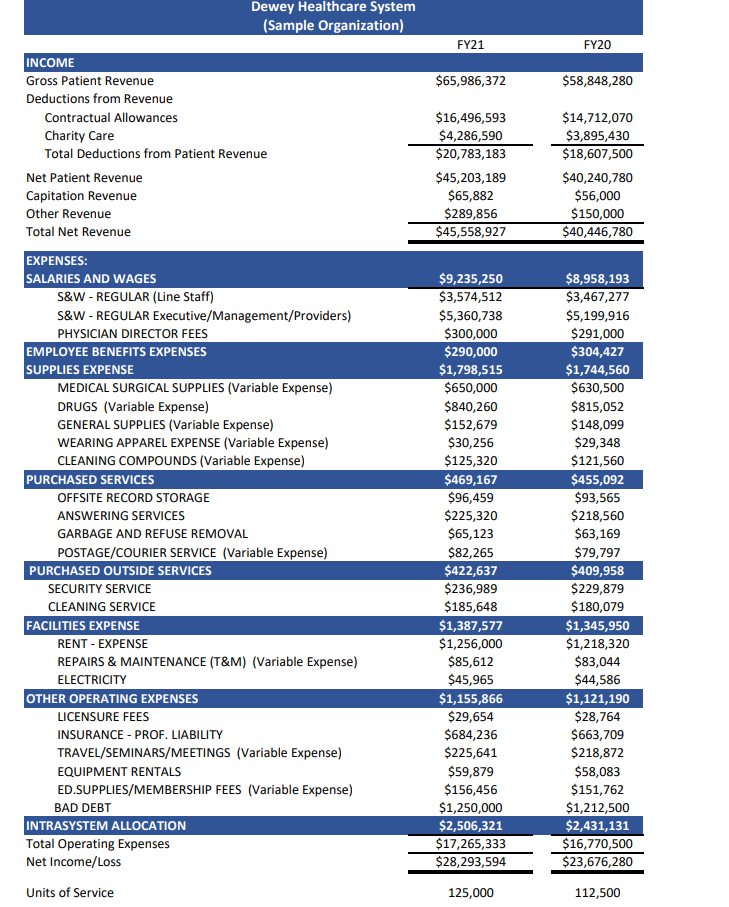

What is the break-even point for this organization? List expenses assigned as variable and fixed. Show the calculations. (Net Operating Revenue - Variable Costs =

What is the break-even point for this organization? List expenses assigned as variable and fixed. Show the calculations. (Net Operating Revenue - Variable Costs = Contribution Margin. Contribution margin/UOS = CM per UOS. Fixed Costs/CM per UOS = # of UOS to Breakeven).

Dewey Healthcare System (Sample Organization) FY21 FY20 INCOME Gross Patient Revenue Deductions from Revenue $65,986,372 $58,848,280 Contractual Allowances $16,496,593 $14,712,070 Charity Care $4,286,590 $3,895,430 Total Deductions from Patient Revenue $20,783,183 $18,607,500 Net Patient Revenue $45,203,189 $40,240,780 Capitation Revenue $65,882 $56,000 Other Revenue $289,856 $150,000 Total Net Revenue $45,558,927 $40,446,780 EXPENSES: SALARIES AND WAGES S&W - REGULAR (Line Staff) $9,235,250 $8,958,193 $3,574,512 $3,467,277 S&W - REGULAR Executive/Management/Providers) PHYSICIAN DIRECTOR FEES $5,360,738 $5,199,916 $300,000 $291,000 EMPLOYEE BENEFITS EXPENSES $290,000 $304,427 SUPPLIES EXPENSE $1,798,515 $1,744,560 MEDICAL SURGICAL SUPPLIES (Variable Expense) $650,000 $630,500 DRUGS (Variable Expense) $840,260 $815,052 GENERAL SUPPLIES (Variable Expense) $152,679 $148,099 WEARING APPAREL EXPENSE (Variable Expense) $30,256 $29,348 CLEANING COMPOUNDS (Variable Expense) $125,320 $121,560 PURCHASED SERVICES $469,167 $455,092 OFFSITE RECORD STORAGE $96,459 $93,565 ANSWERING SERVICES $225,320 $218,560 GARBAGE AND REFUSE REMOVAL $65,123 $63,169 POSTAGE/COURIER SERVICE (Variable Expense) $82,265 $79,797 PURCHASED OUTSIDE SERVICES $422,637 $409,958 SECURITY SERVICE $236,989 $229,879 CLEANING SERVICE $185,648 $180,079 FACILITIES EXPENSE $1,387,577 $1,345,950 RENT - EXPENSE $1,256,000 $1,218,320 REPAIRS & MAINTENANCE (T&M) (Variable Expense) $85,612 $83,044 ELECTRICITY $45,965 $44,586 OTHER OPERATING EXPENSES $1,155,866 $1,121,190 LICENSURE FEES $29,654 $28,764 INSURANCE - PROF. LIABILITY $684,236 $663,709 TRAVEL/SEMINARS/MEETINGS (Variable Expense) $225,641 $218,872 EQUIPMENT RENTALS $59,879 $58,083 ED.SUPPLIES/MEMBERSHIP FEES (Variable Expense) $156,456 $151,762 BAD DEBT $1,250,000 $1,212,500 INTRASYSTEM ALLOCATION $2,506,321 $2,431,131 Total Operating Expenses $17,265,333 $16,770,500 Net Income/Loss $28,293,594 $23,676,280 Units of Service 125,000 112,500

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started