Answered step by step

Verified Expert Solution

Question

1 Approved Answer

What is the change in NWC for years 1-4? begin{tabular}{|c|c|c|c|c|c|c|c|c|c|c|c|c|c|} hline multirow[t]{2}{*}{ PUTZ } & & & multicolumn{3}{|l|}{ YEAR } & multicolumn{2}{|r|}{1} & multicolumn{2}{|r|}{2} &

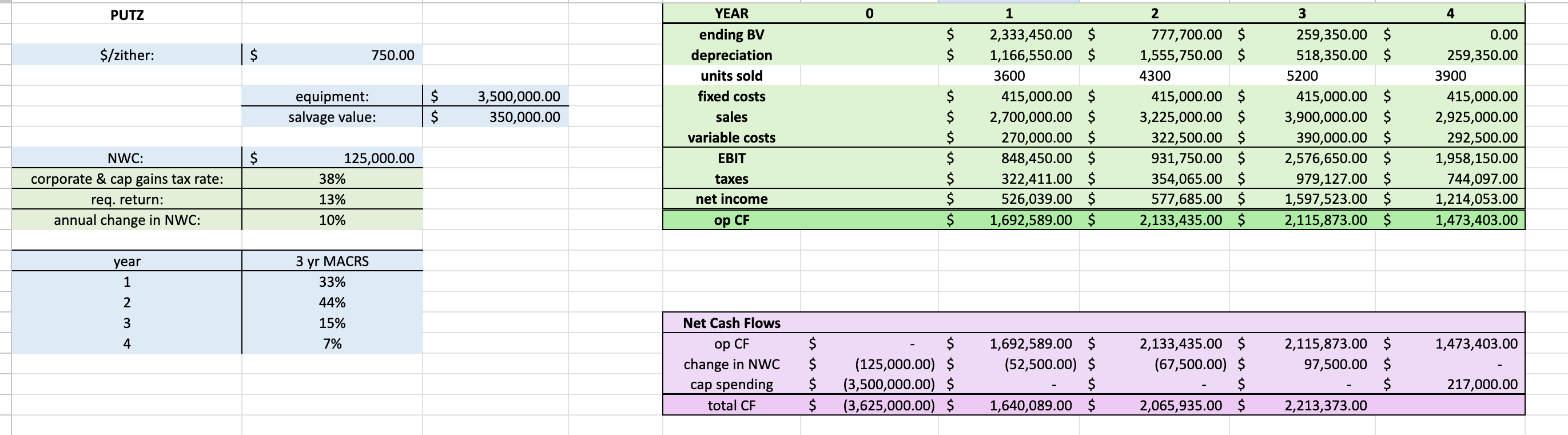

What is the change in NWC for years 1-4?

\begin{tabular}{|c|c|c|c|c|c|c|c|c|c|c|c|c|c|} \hline \multirow[t]{2}{*}{ PUTZ } & & & \multicolumn{3}{|l|}{ YEAR } & \multicolumn{2}{|r|}{1} & \multicolumn{2}{|r|}{2} & \multicolumn{2}{|r|}{3} & \multicolumn{2}{|r|}{4} \\ \hline & & & ending BV & & & $ & 2,333,450.00 & $ & 777,700.00 & $ & 259,350.00 & $ & 0.00 \\ \hline \multirow[t]{5}{*}{ \$/zither: } & 750.00 & & depreciation & & & $ & 1,166,550.00 & $ & 1,555,750.00 & $ & 518,350.00 & $ & 259,350.00 \\ \hline & & & units sold & & & & 3600 & & 4300 & & 5200 & & 3900 \\ \hline & equipment: & $3,500,000.00 & fixed costs & & & $ & 415,000.00 & $ & 415,000.00 & $ & 415,000.00 & $ & 415,000.00 \\ \hline & salvage value: & 350,000.00 & sales & & & $ & 2,700,000.00 & $ & 3,225,000.00 & $ & 3,900,000.00 & $ & 2,925,000.00 \\ \hline & & & variable costs & & & $ & 270,000.00 & $ & 322,500.00 & $ & 390,000.00 & $ & 292,500.00 \\ \hline NWC: & 125,000.00 & & EBIT & & & $ & 848,450.00 & $ & 931,750.00 & $ & 2,576,650.00 & $ & 1,958,150.00 \\ \hline corporate \& cap gains tax rate: & 38% & & taxes & & & $ & 322,411.00 & $ & 354,065.00 & $ & 979,127.00 & $ & 744,097.00 \\ \hline req. return: & 13% & & net income & & & $ & 526,039.00 & $ & 577,685.00 & $ & 1,597,523.00 & $ & 1,214,053.00 \\ \hline annual change in NWC: & 10% & & op CF & & & $ & 1,692,589.00 & $ & 2,133,435.00 & $ & 2,115,873.00 & $ & 1,473,403.00 \\ \hline year & 3vr MACRS & & & & & & & & & & & & \\ \hline11 & 33%3YrIVIACRS & & & & & & & & & & & & \\ \hline 2 & 44% & & & & & & & & & & & & \\ \hline 3 & 15% & & Net Cash Flows & & & & & & & & & & \\ \hline 4 & 7% & & op CF & $ & - & $ & 1,692,589.00 & $ & 2,133,435.00 & $ & 2,115,873.00 & $ & 1,473,403.00 \\ \hline & & & change in NWC & $ & (125,000.00) & $ & (52,500.00) & $ & (67,500.00) & $ & 97,500.00 & $ & - \\ \hline & & & cap spending & $ & (3,500,000.00) & $ & - & $ & - & $ & - & $ & 217,000.00 \\ \hline & & & total CF & $ & (3,625,000.00) & $ & 1,640,089.00 & $ & 2,065,935.00 & $ & 2,213,373.00 & & \\ \hline \end{tabular}

\begin{tabular}{|c|c|c|c|c|c|c|c|c|c|c|c|c|c|} \hline \multirow[t]{2}{*}{ PUTZ } & & & \multicolumn{3}{|l|}{ YEAR } & \multicolumn{2}{|r|}{1} & \multicolumn{2}{|r|}{2} & \multicolumn{2}{|r|}{3} & \multicolumn{2}{|r|}{4} \\ \hline & & & ending BV & & & $ & 2,333,450.00 & $ & 777,700.00 & $ & 259,350.00 & $ & 0.00 \\ \hline \multirow[t]{5}{*}{ \$/zither: } & 750.00 & & depreciation & & & $ & 1,166,550.00 & $ & 1,555,750.00 & $ & 518,350.00 & $ & 259,350.00 \\ \hline & & & units sold & & & & 3600 & & 4300 & & 5200 & & 3900 \\ \hline & equipment: & $3,500,000.00 & fixed costs & & & $ & 415,000.00 & $ & 415,000.00 & $ & 415,000.00 & $ & 415,000.00 \\ \hline & salvage value: & 350,000.00 & sales & & & $ & 2,700,000.00 & $ & 3,225,000.00 & $ & 3,900,000.00 & $ & 2,925,000.00 \\ \hline & & & variable costs & & & $ & 270,000.00 & $ & 322,500.00 & $ & 390,000.00 & $ & 292,500.00 \\ \hline NWC: & 125,000.00 & & EBIT & & & $ & 848,450.00 & $ & 931,750.00 & $ & 2,576,650.00 & $ & 1,958,150.00 \\ \hline corporate \& cap gains tax rate: & 38% & & taxes & & & $ & 322,411.00 & $ & 354,065.00 & $ & 979,127.00 & $ & 744,097.00 \\ \hline req. return: & 13% & & net income & & & $ & 526,039.00 & $ & 577,685.00 & $ & 1,597,523.00 & $ & 1,214,053.00 \\ \hline annual change in NWC: & 10% & & op CF & & & $ & 1,692,589.00 & $ & 2,133,435.00 & $ & 2,115,873.00 & $ & 1,473,403.00 \\ \hline year & 3vr MACRS & & & & & & & & & & & & \\ \hline11 & 33%3YrIVIACRS & & & & & & & & & & & & \\ \hline 2 & 44% & & & & & & & & & & & & \\ \hline 3 & 15% & & Net Cash Flows & & & & & & & & & & \\ \hline 4 & 7% & & op CF & $ & - & $ & 1,692,589.00 & $ & 2,133,435.00 & $ & 2,115,873.00 & $ & 1,473,403.00 \\ \hline & & & change in NWC & $ & (125,000.00) & $ & (52,500.00) & $ & (67,500.00) & $ & 97,500.00 & $ & - \\ \hline & & & cap spending & $ & (3,500,000.00) & $ & - & $ & - & $ & - & $ & 217,000.00 \\ \hline & & & total CF & $ & (3,625,000.00) & $ & 1,640,089.00 & $ & 2,065,935.00 & $ & 2,213,373.00 & & \\ \hline \end{tabular} Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started