Answered step by step

Verified Expert Solution

Question

1 Approved Answer

What is the collateral in the above Asset Backed Security? Which is the special purpose entity in this securitization is: What is the purpose of

What is the collateral in the above Asset Backed Security?

Which is the special purpose entity in this securitization is:

What is the purpose of Harley-Davidson Credit Corp. is responsible for

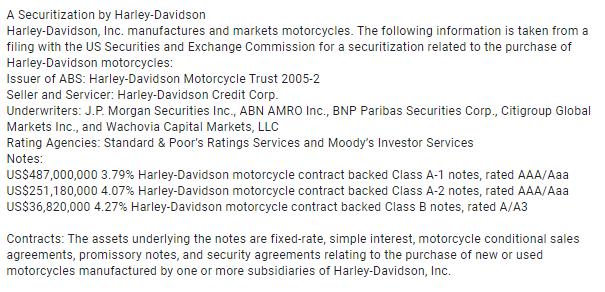

A Securitization by Harley-Davidson Harley-Davidson, Inc. manufactures and markets motorcycles. The following information is taken from a filing with the US Securities and Exchange Commission for a securitization related to the purchase of Harley-Davidson motorcycles: Issuer of ABS: Harley-Davidson Motorcycle Trust 2005-2 Seller and Servicer: Harley-Davidson Credit Corp. Underwriters: J.P. Morgan Securities Inc., ABN AMRO Inc., BNP Paribas Securities Corp., Citigroup Global Markets Inc., and Wachovia Capital Markets, LLC Rating Agencies: Standard & Poor's Ratings Services and Moody's Investor Services Notes: US$487,000,000 3.79% Harley-Davidson motorcycle contract backed Class A-1 notes, rated AAA/Aaa US$251,180,000 4.07% Harley-Davidson motorcycle contract backed Class A-2 notes, rated AAA/Aaa US$36,820,000 4.27% Harley-Davidson motorcycle contract backed Class B notes, rated A/A3 Contracts: The assets underlying the notes are fixed-rate, simple interest, motorcycle conditional sales agreements, promissory notes, and security agreements relating to the purchase of new or used motorcycles manufactured by one or more subsidiaries of Harley-Davidson, Inc.

Step by Step Solution

★★★★★

3.41 Rating (160 Votes )

There are 3 Steps involved in it

Step: 1

Generally collateral in case of securitization is u...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started