Answered step by step

Verified Expert Solution

Question

1 Approved Answer

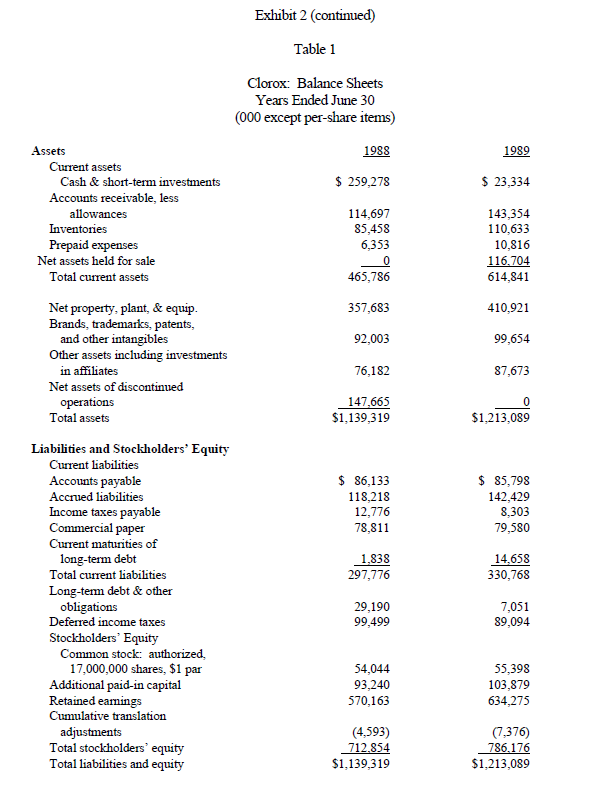

What is the companies cost of capital? Exhibit 2 (continued) Table 1 Clorox: Balance Sheets Years Ended June 30 (000 except per-share items) Assets 1988

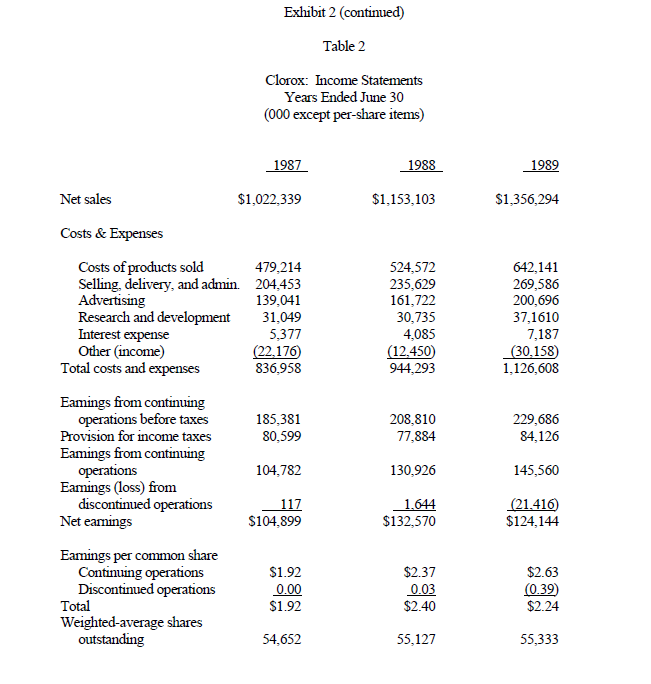

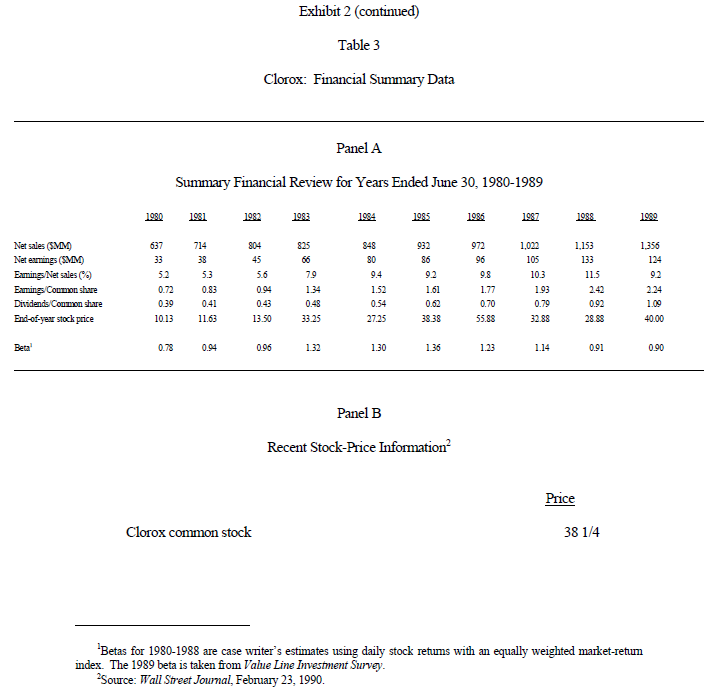

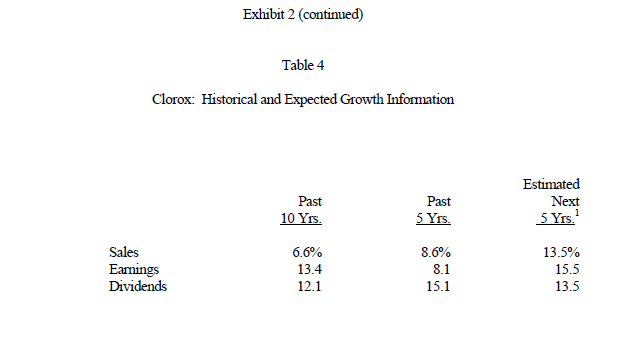

What is the companies cost of capital?

Exhibit 2 (continued) Table 1 Clorox: Balance Sheets Years Ended June 30 (000 except per-share items) Assets 1988 1989 Current assets Cash & short-term investments 259,278 23,334 Accounts receivable, less 114,697 85,458 6,353 143,354 110,633 10,816 116.704 614,841 Inventories Prepaid expenses Total current assets Net property, plant, & equip Net assets held for sale 465,786 357,683 92,003 76,182 410,921 99,654 87,673 Brands, trademarks, patents, and other intangibles Other assets including investments in affiliates Net assets of discontinued 147,665 $1,139,319 Total assets $1,213,089 Liabilities and Stockholders' Equity Current liabilities Accounts payable Accrued liabilities Income taxes payable Commercial paper Current maturities of $ 86,133 118,218 12,776 78,811 $ 85,798 142,429 8,303 79,580 long-term debt Total current liabilities Long-term debt & other 1,838 297,776 14,658 330,768 obligations Deferred income taxes Stockholders' Equity 29,190 99,499 7,051 89,094 Common stock: authorized, 17,000,000 shares, $1 par Additional paid-in capital Retained eamings Cumulative translation 54,044 93,240 570,163 55,398 103,879 634,275 (7,376) adjustments Total stockholders' equity Total liabilities and equity (4,593) $1,139,319 $1,213,089Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started