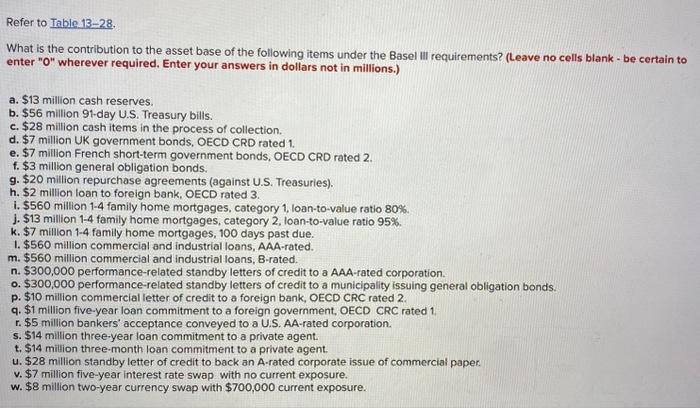

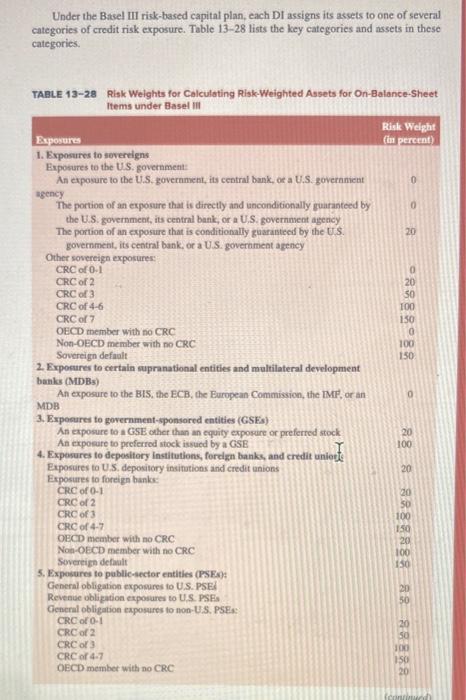

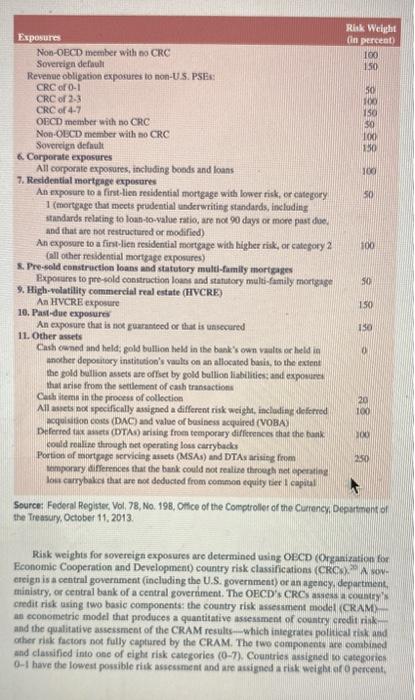

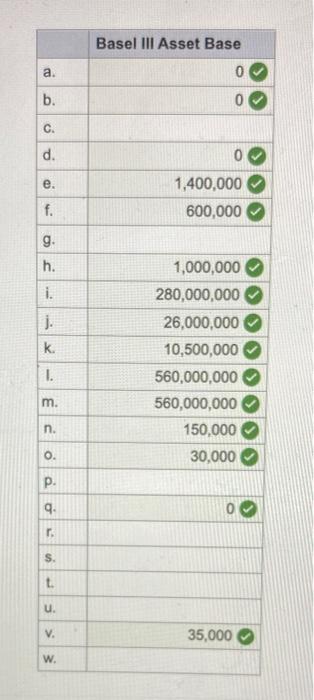

What is the contribution to the asset base of the following items under the Basel ill requirements? (Leave no cells blank - be certain to enter "O" wherever required. Enter your answers in dollars not in millions.) a. $13 million cash reserves. b. $56 million 91-day U.S. Treasury bills. c. $28 million cash items in the process of collection. d. $7 million UK government bonds, OECD CRD rated 1. e. $7 million French short-term government bonds, OECD CRD rated 2 . f. $3 million general obligation bonds. g. \$20 million repurchase agreements (against U.S. Treasuries). h. $2 million loan to foreign bank, OECD rated 3 . i. $560 million 1-4 family home mortgages, category 1 , loan-to-value ratio 80% j. $13 million 14 family home mortgages, category 2 , loan-to-value ratio 95%. k. $7 million 1-4 family home mortgages, 100 days past due. 1. $560 million commercial and industrial loans, AAA-rated. m. $560 million commercial and industrial loans, B-rated. n. $300,000 performance-related standby letters of credit to a AAA-rated corporation. o. $300,000 performance-related standby letters of credit to a municipality issuing general obligation bonds. p. $10 million commercial letter of credit to a foreign bank, OECD CRC rated 2. q. \$1 million five-year loan commitment to a foreign government, OECD CRC rated 1. r. $5 million bankers' acceptance conveyed to a U.S. AA-rated corporation. s. $14 million three-year loan commitment to a private agent. t. $14 milion three-month loan commitment to a private agent. u. $28 million standby letter of credit to back an A-rated corporate issue of commercial paper. v. $7 million five-year interest rate swap with no current exposure. w. $8 million two-year currency swap with $700,000 current exposure. Under the Basel III risk-based capital plan, each DI assigns its assets to one of several categories of credit risk exposure. Table 13-28 lists the key categories and assets in these catcgories. TABLE 13-28 Risk Weights for Calculating Risk-Weighted Assets for On-Balance-Sheet ltems under Basel Iil banks (MDBs) An exposure to the BIS, the ECB, the European Commission, the IMP, or an 0 MDB 3. Expoures to government-sponsored entities (GSFs) As exposure to a GSE other than an equity exposure or preferred stock An exposure to preferrod stock issucd by a GSE Y 20 5. Exposures to public-sector entities (PSEs)A General obligation expomures to U.S. PSEi Revenue oblipation exposures to U.S. PSEs General obligation exposures to non-US. PSEs: CRC or O-1 CrC of 2 CRC of 3 CRC of 47 OECD member with no CRC the Treasury, October 11,2013 . Risk weights for sovereign exposures are determined using OECD (Organization for Economic Cooperation and Development) country risk classifications (CROr), An A soven crcign is a central goverament (incleding the U.S. government) or an ageney. department, ministry, of central bank of a central government. The OECD's CRCs assess a coentsy is credit risk asing two basic components: the country risk assessment asodel (CRAM) ) an cconometric model that produces a quantitative assessment of country crodit risk and the qualitative assessment of the CRAM results - which integratei political risk agd caher riak factors not fully captured by the CRAM. The two camponent are oumbined and claskifiod into oee of cight risk calegories (07). Countrics assigaed to categories 0-I have the loweat possible rikk assesmeat and are atsigned a risk weigbt at 0 perceut