Answered step by step

Verified Expert Solution

Question

1 Approved Answer

What is the correct balance of inventory as of December 31,2018? What is the correct net purchases for the period ended December 31, 2018? What

- What is the correct balance of inventory as of December 31,2018?

- What is the correct net purchases for the period ended December 31, 2018?

- What is the correct 2018 gross profit?

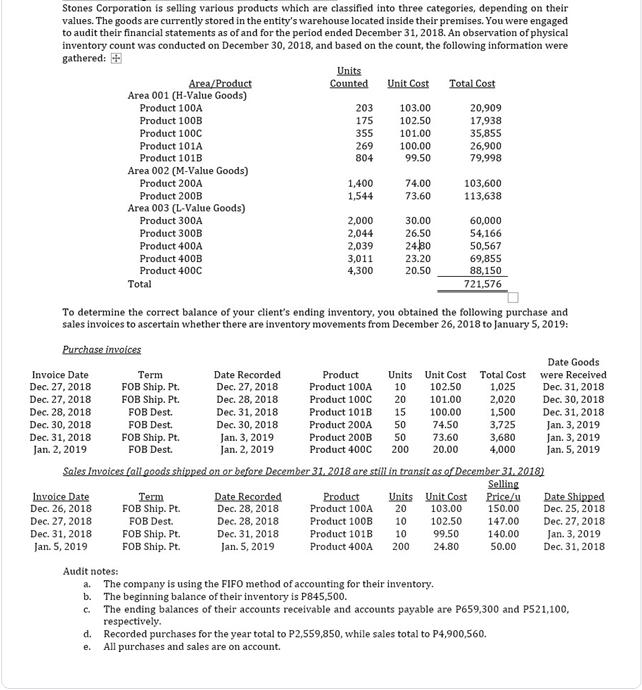

Stones Corporation is selling various products which are classified into three categories, depending on their values. The goods are currently stored in the entity's warehouse located inside their premises. You were engaged to audit their financial statements as of and for the period ended December 31, 2018. An observation of physical inventory count was conducted on December 30, 2018, and based on the count, the following information were gathered: + Invoice Date Dec. 27, 2018 Dec. 27, 2018 Dec. 28, 2018 Dec. 30, 2018 Dec. 31, 2018 Jan. 2, 2019 Invoice Date Dec. 26, 2018 Dec. 27, 2018 Dec. 31, 2018 Jan. 5, 2019 Area/Product Area 001 (H-Value Goods) Product 100A Product 100B Audit notes: Product 100C Product 101A Product 101B Area 002 (M-Value Goods) Product 200A Product 2008 Area 003 (L-Value Goods) Product 300A Product 300B Product 400A Product 400B Product 400C a. b. c. Total Term FOB Ship. Pt. FOB Ship. Pt. FOB Dest. FOB Dest. FOB Ship. Pt. FOB Dest. Date Recorded Dec. 27, 2018 Dec. 28, 2018 Dec. 31, 2018 Dec. 30, 2018 Jan. 3, 2019 Jan. 2, 2019 Term FOB Ship. Pt. FOB Dest. FOB Ship. Pt. FOB Ship. Pt. Units Counted 203 175 355 269 804 Date Recorded Dec. 28, 2018 Dec. 28, 2018 Dec. 31, 2018 Jan. 5, 2019 1,400 1,544 2,000 2,044 2,039 3,011 4,300 Unit Cost 103.00 102.50 101.00 To determine the correct balance of your client's ending inventory, you obtained the following purchase and sales invoices to ascertain whether there are inventory movements from December 26, 2018 to January 5, 2019: Purchase invoices 100.00 99.50 Product Product 100A Product 100B Product 101B Product 400A 74.00 73.60 30.00 26.50 24,80 23.20 20.50 Total Cost Units Product Product 100A Product 100C Product 101B Product 200A Product 200B 50 Product 400C 200 20.00 10 20 15 50 73.60 20,909 17,938 35,855 26,900 79,998 103,600 113,638 60,000 54,166 50,567 69,855 88,150 721,576 Sales Invoices (all goods shipped on or before December 31, 2018 are still in transit as of December 31, 2018) Selling 103.00 102.50 99.50 24.80 Unit Cost Total Cost 102.50 101.00 100.00 74.50 Units Unit Cost 20 10 10 200 1,025 2,020 1,500 3,725 3,680 4,000 Price/u 150.00 147.00 140.00 50.00 d. Recorded purchases for the year total to P2,559,850, while sales total to P4,900,560. e. All purchases and sales are on account. Date Goods were Received Dec. 31, 2018 Dec. 30, 2018 Dec. 31, 2018 Jan. 3, 2019 Jan. 3, 2019 Jan. 5, 2019 Date Shipped Dec. 25, 2018 Dec. 27, 2018 Jan. 3, 2019. Dec. 31, 2018 The company is using the FIFO method of accounting for their inventory. The beginning balance of their inventory is P845,500. The ending balances of their accounts receivable and accounts payable are P659,300 and P521,100, respectively.

Step by Step Solution

★★★★★

3.31 Rating (157 Votes )

There are 3 Steps involved in it

Step: 1

1 Inventory Physical count 721576 Product 100A 1025 ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started