Question

What is the correct combination of cash flow (CF) for month 1 and the total cash generated (CG) at the end of month 1? Referring

What is the correct combination of cash flow (CF) for month 1 and the total cash generated (CG) at the end of month 1?

Referring to Question 1, what is the correct combination of cash flow for month 2 and the total cash generated at the end of month 2 after payment from the owner?

Referring to Question 1, what is the correct combination of cash flow for month 3 and the total cash generated at the end of month 3 after payment from the owner?

Referring to Question 1, what is the correct combination of cash flow for month 4 and the total cash generated at the end of month 4 after payment from the owner?

Referring to Question 1, what is the correct combination of cash flow for month 5 and the total cash generated at the end of month 5 after payment from the owner?

Referring to Question 1, what is the correct combination of cash flow for month 6 and the total cash generated at the end of month 6 after payment from the owner?

Referring to Question 1, what is the correct final payment amount from the owner at the end of month 7?

Referring to Question 1, what is the correct combination of cash flow for month 7 and the total cash generated at the end of month 7 after the final payment?

What is the correct interest due on an $85,000 short-term loan, with a term of 180 days and a simple interest rate of 8.99%?

What is the correct combination of the daily interest rate for an APR of 8.99% and its interest charged on a $40,000 loan for a billing period of 31 days?

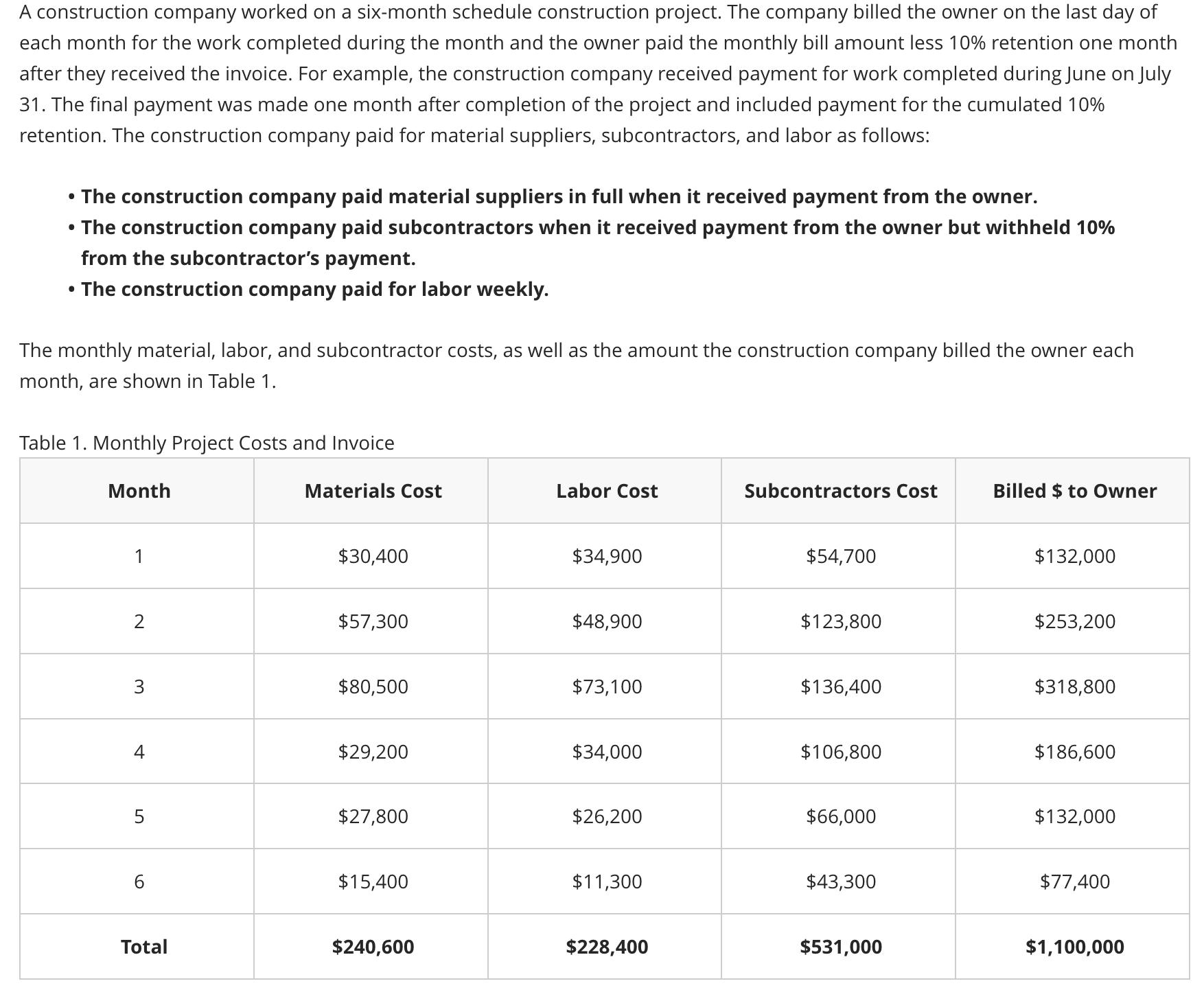

A construction company worked on a six-month schedule construction project. The company billed the owner on the last day of each month for the work completed during the month and the owner paid the monthly bill amount less 10% retention one month after they received the invoice. For example, the construction company received payment for work completed during June on July 31. The final payment was made one month after completion of the project and included payment for the cumulated 10% retention. The construction company paid for material suppliers, subcontractors, and labor as follows: The construction company paid material suppliers in full when it received payment from the owner. The construction company paid subcontractors when it received payment from the owner but withheld 10% from the subcontractor's payment. The construction company paid for labor weekly. The monthly material, labor, and subcontractor costs, as well as the amount the construction company billed the owner each month, are shown in Table 1. Table 1. Monthly Project Costs and Invoice Month 1 2 3 4 5 6 Total Materials Cost $30,400 $57,300 $80,500 $29,200 $27,800 $15,400 $240,600 Labor Cost $34,900 $48,900 $73,100 $34,000 $26,200 $11,300 $228,400 Subcontractors Cost $54,700 $123,800 $136,400 $106,800 $66,000 $43,300 $531,000 Billed $ to Owner $132,000 $253,200 $318,800 $186,600 $132,000 $77,400 $1,100,000

Step by Step Solution

3.43 Rating (162 Votes )

There are 3 Steps involved in it

Step: 1

First lets calculate the CF and CG for each month Month 1 CF1 Billed to Owner Material Cost Labor Co...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started