Question

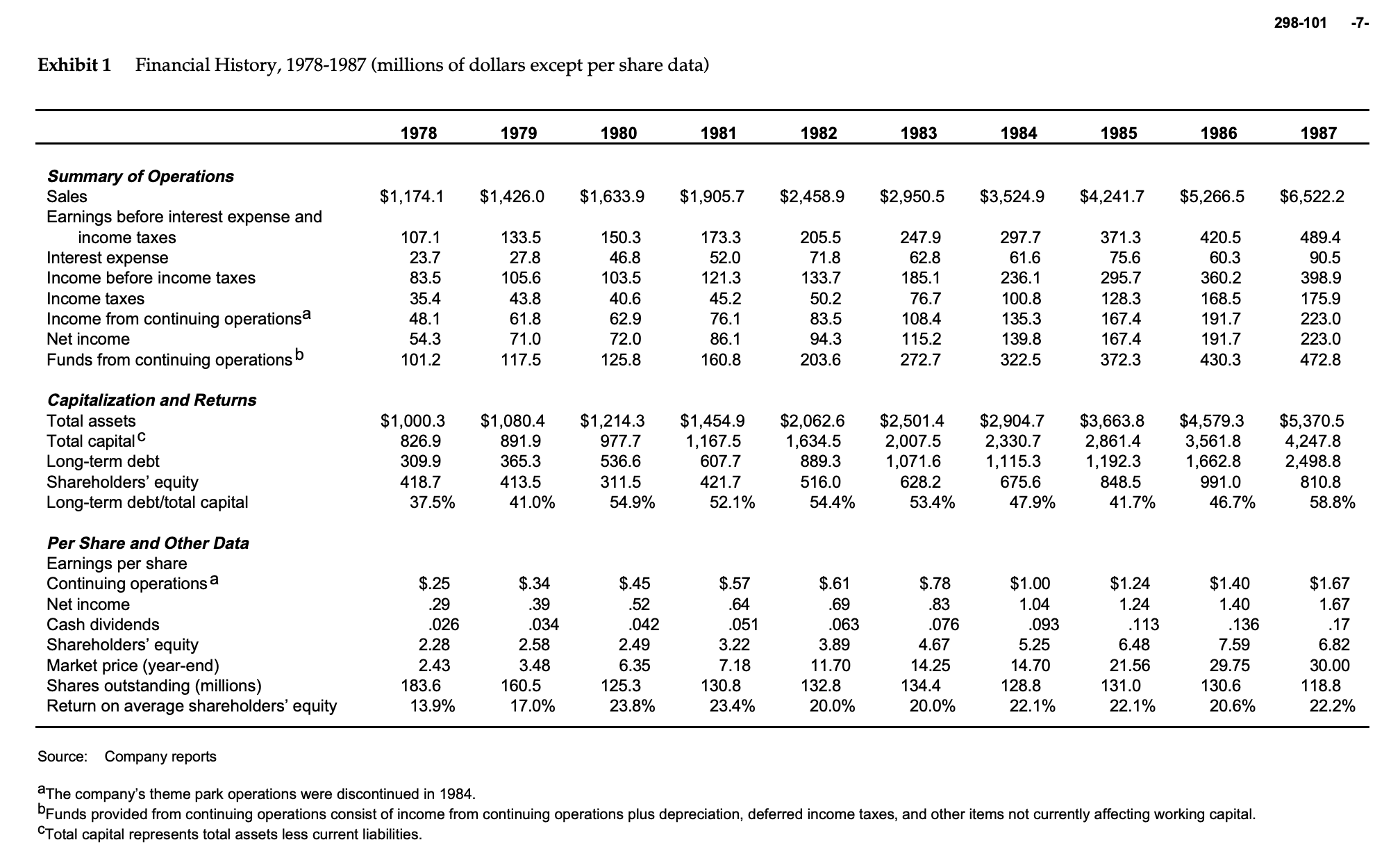

What is the cost of capital calculated using Weighted Average Cost of Capital formula) of Marriott Corp? What is the cost of capital of hotels

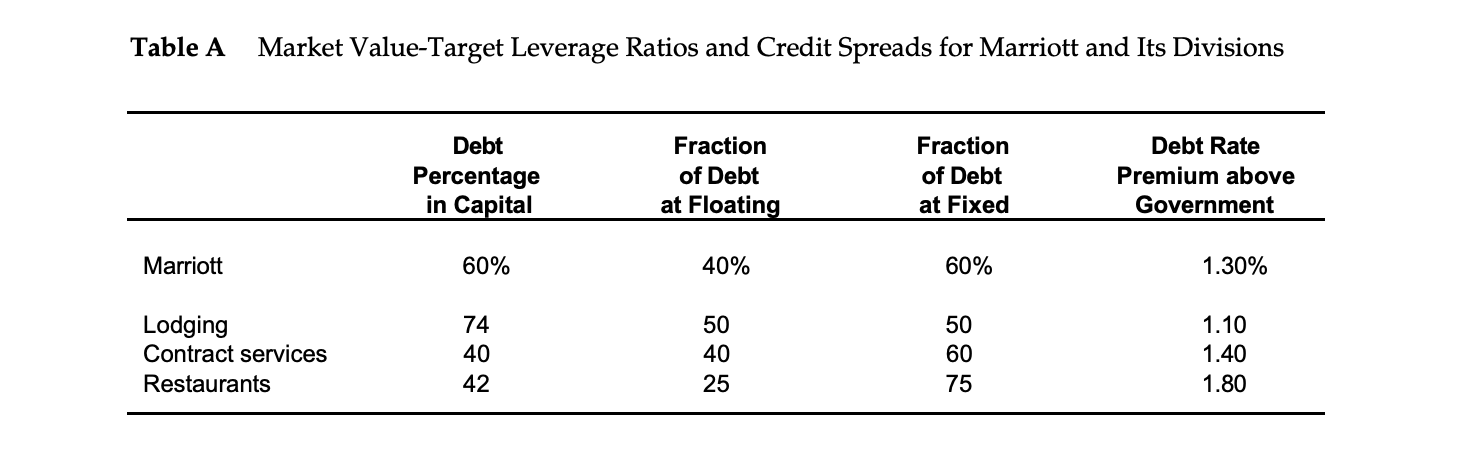

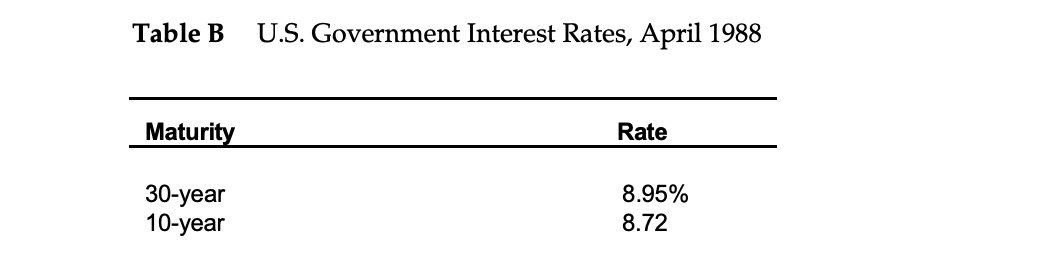

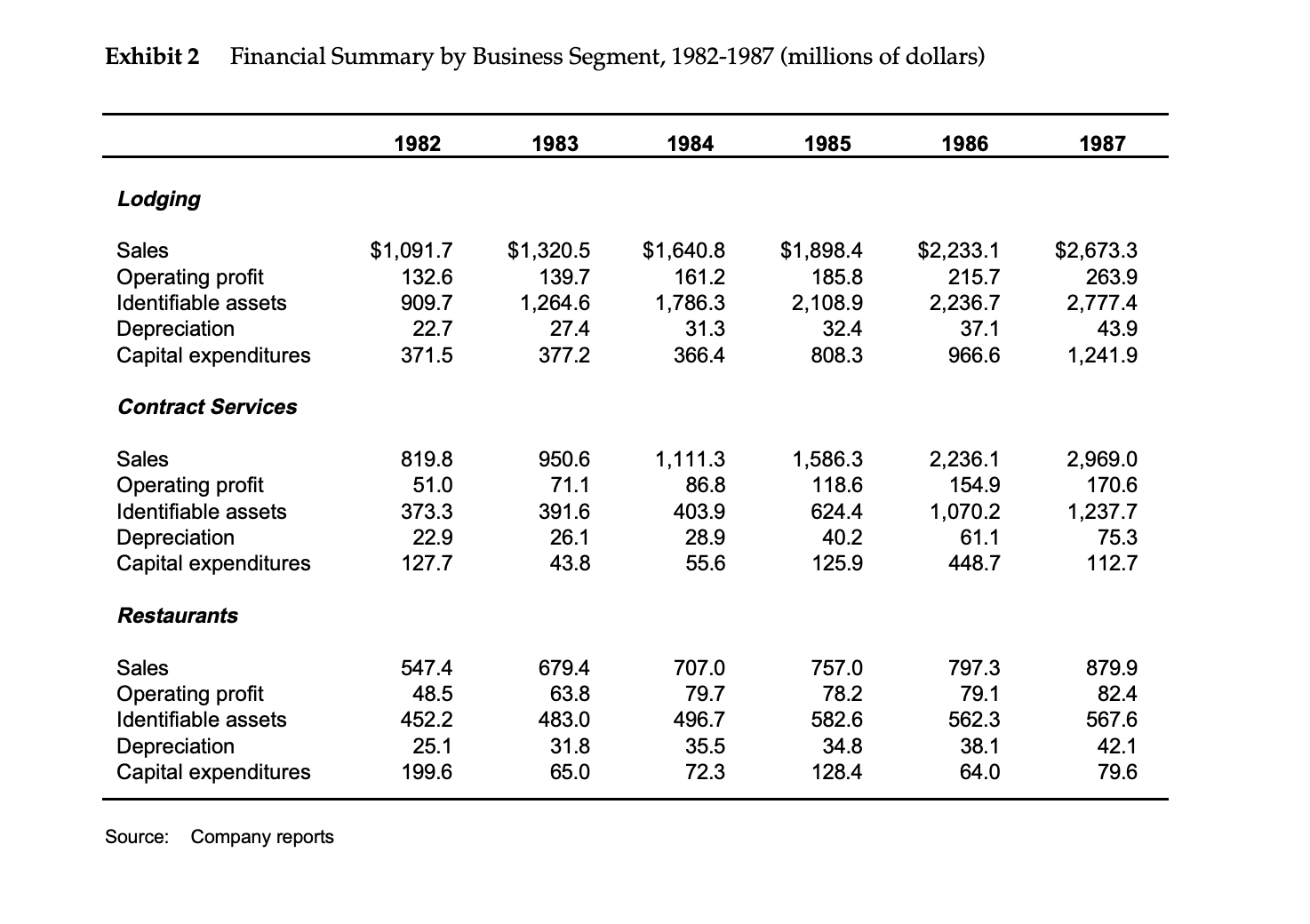

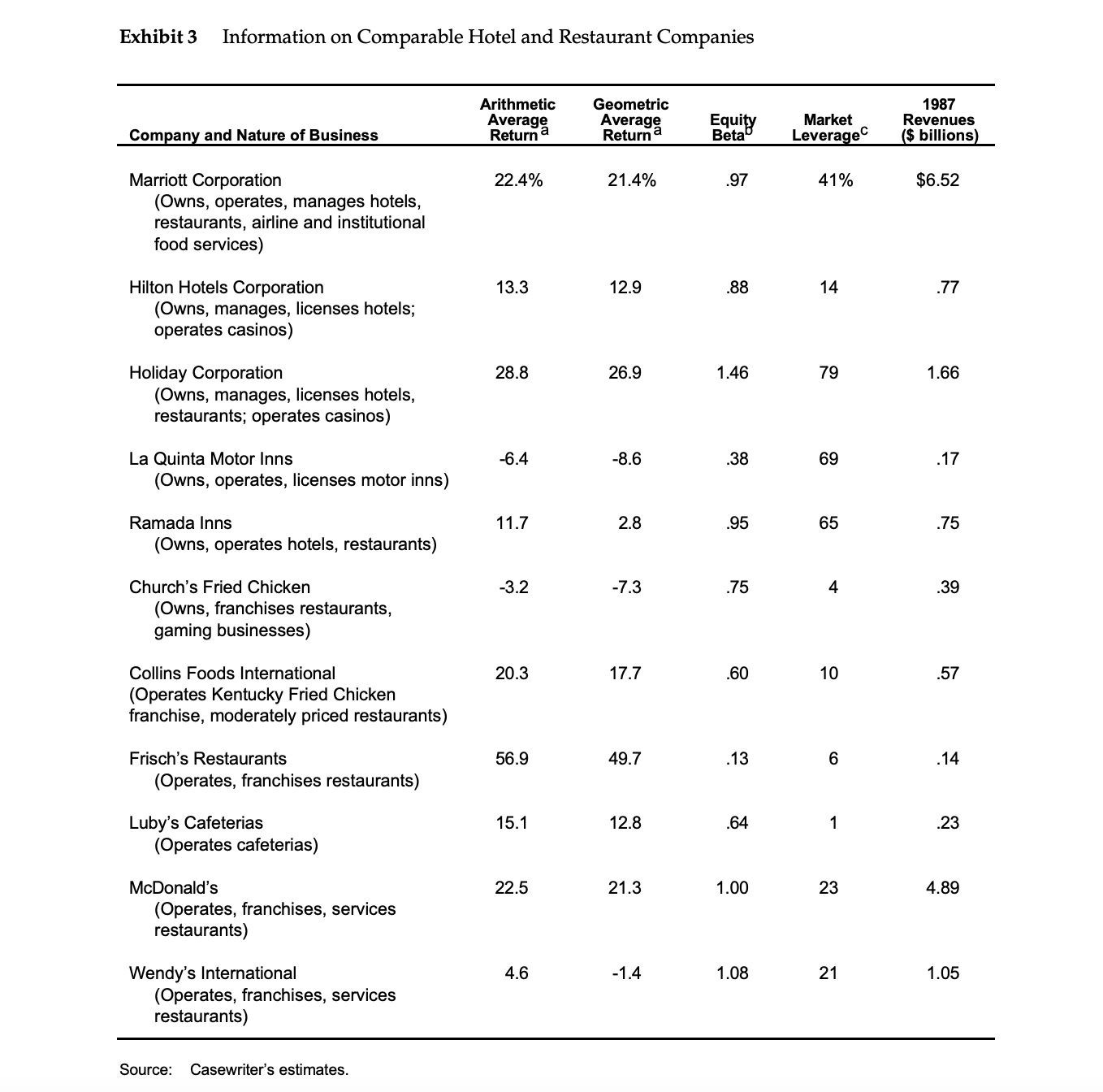

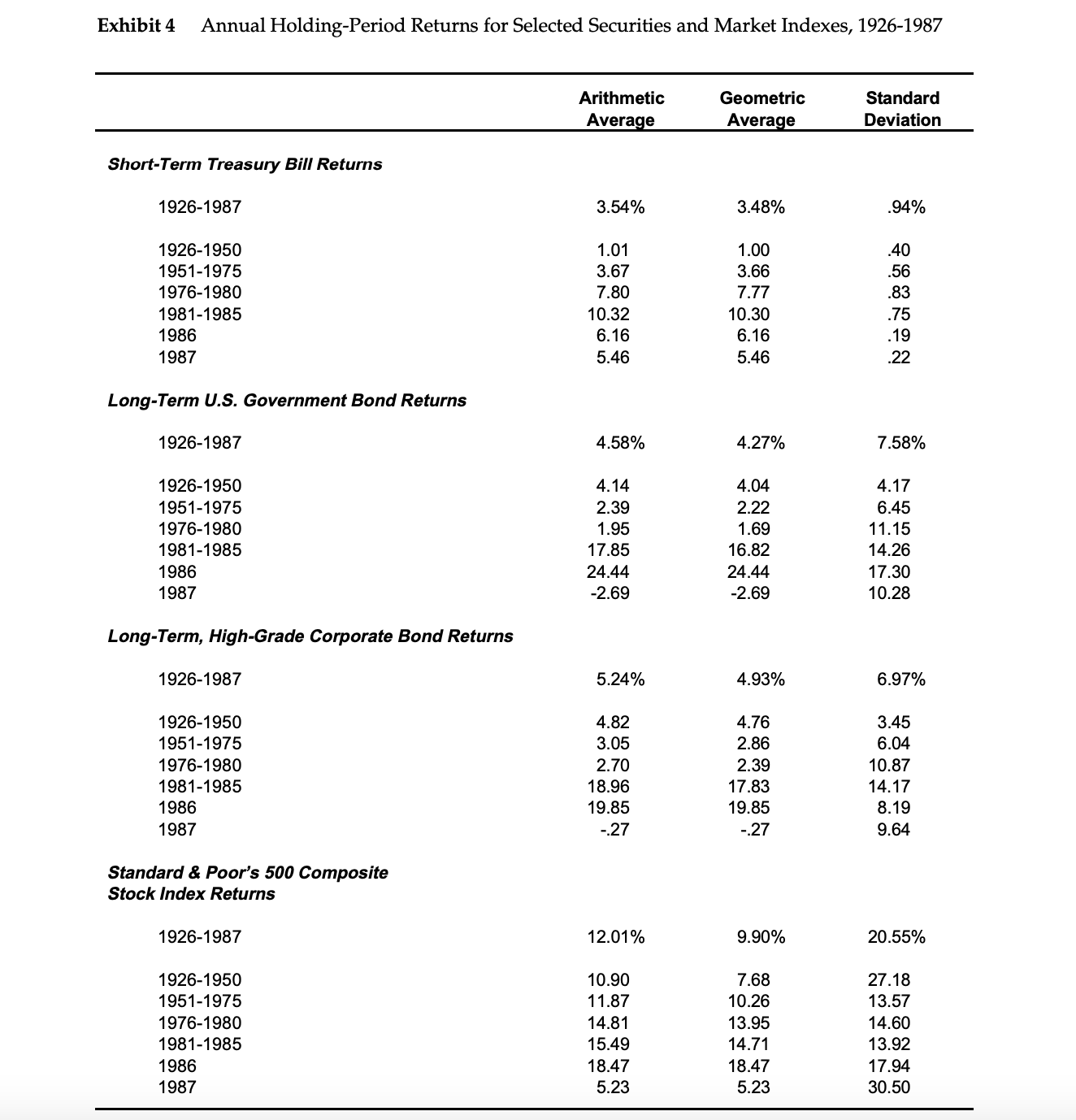

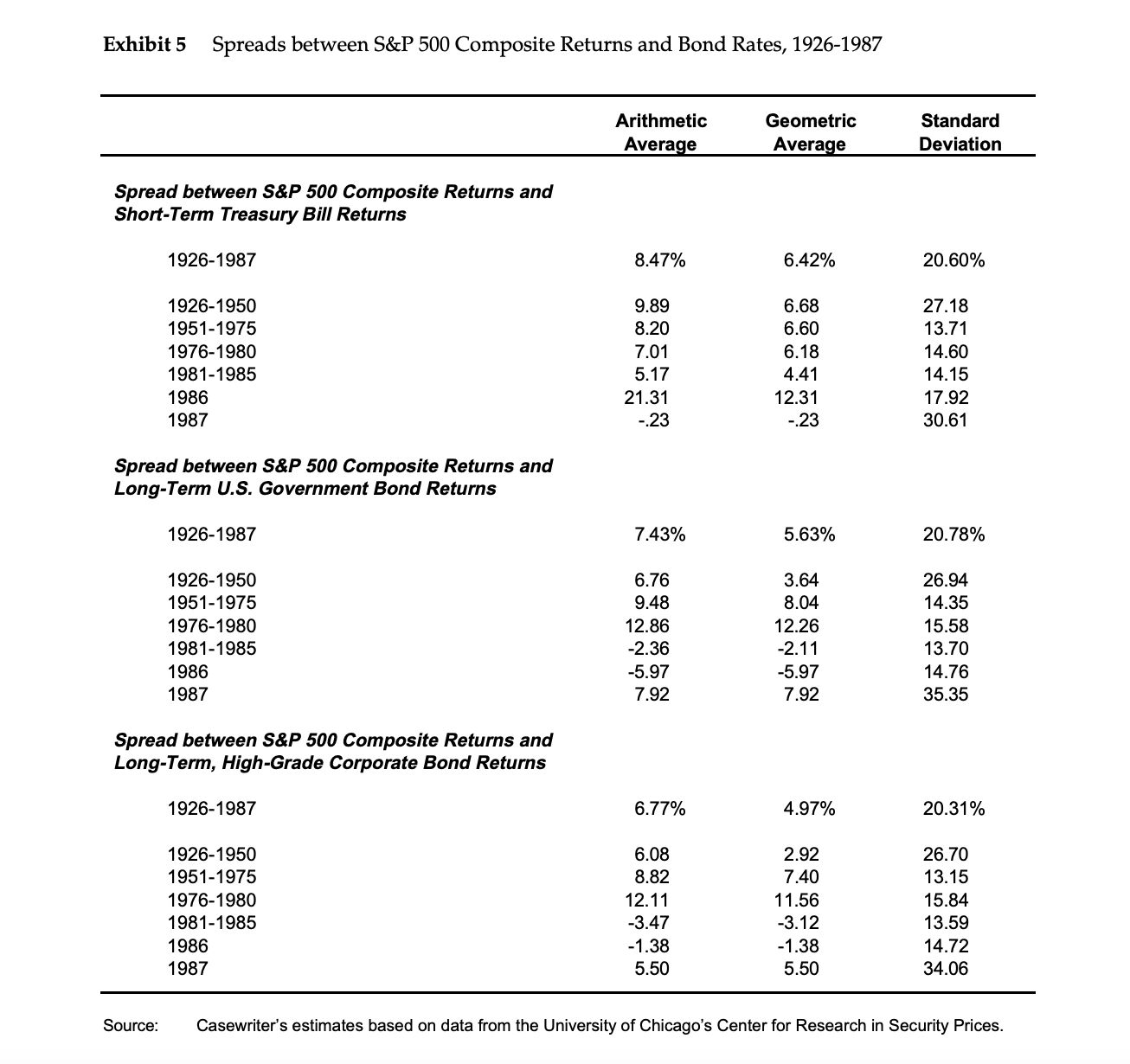

What is the cost of capital calculated using Weighted Average Cost of Capital formula) of Marriott Corp? What is the cost of capital of hotels (lodging) division of Marriott? A) To approximate divisional beta, take equity (levered) beta of comparable firms, convert it to asset (unlevered) beta for each comparable firm, take average asset (unlevered) betas for some or all comparable firms, and find equity (levered) beta of the Marriott hotels division to use in CAPM. B) Cost of debt is risk-free rate + divisional premium C) Weights obtained from target leverage by divisions

3) What is the cost of capital of restaurants division of Marriott?

4) What is the cost of capital of consumer services division of Marriott? A) Assume risk of the whole company a weighted average of the risks of individual divisions. You can assume that risk is approximated by asset (unlevered) beta here. You can use divisional sales as weights. You can find asset (unlevered) beta for Marriott corporate, and you have divisional asset betas for hotels and restaurants, and weights. You can obtain asset beta of consumer services from that formula.

Table A Market Value-Target Leverage Ratios and Credit Spreads for Marriott and Its Divisions Debt Percentage Fraction Fraction of Debt in Capital at Floating of Debt at Fixed Debt Rate Premium above Marriott 60% 40% Lodging Contract services 40 Restaurants 42 422 74 8220 50 40 25 6650 60% Government 1.30% 1.10 1.40 75 1.80

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started