Answered step by step

Verified Expert Solution

Question

1 Approved Answer

What is the Cost of Equity and WACC for each division of Midland? i) Estemate asset(unlevered) beta for teh E&P and R&M divisions using the

What is the Cost of Equity and WACC for each division of Midland?

i) Estemate asset(unlevered) beta for teh E&P and R&M divisions using the comparable firms

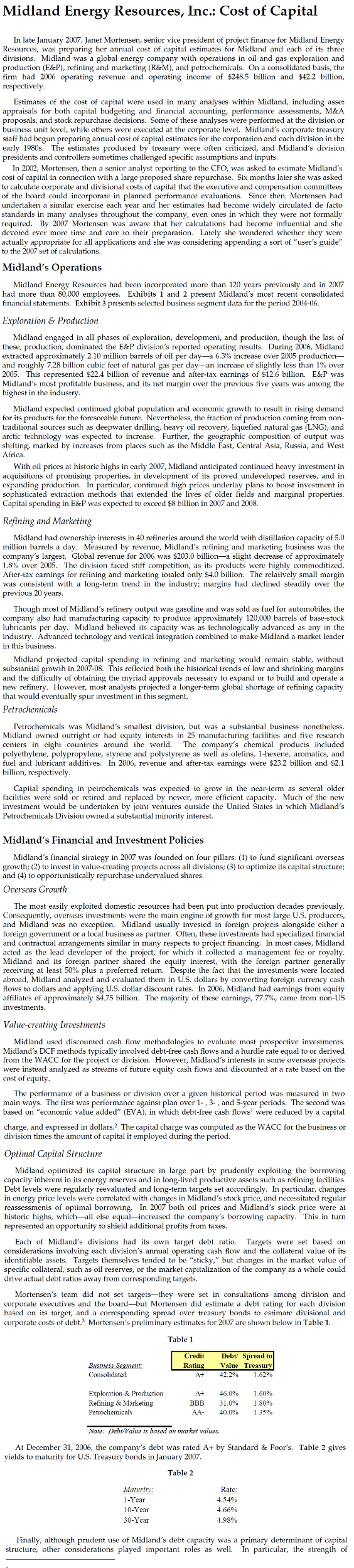

| Balance Sheet | |||||

| Assets: | 2005 | 2006 | |||

| Cash & Cash equivalents | 16,707 | 19,206 | |||

| Restricted Cash | 3,131 | 3,131 | |||

| Notes Receivable | 18,689 | 19,681 | |||

| Inventory | 6,338 | 7,286 | |||

| Prepaid Expenses | 2,218 | 2,226 | |||

| Total Current Assets | 47,083 | 51,528 | |||

| Investments & Advances | 30,140 | 34,205 | |||

| Net Property, Plant & Equipment | 156,630 | 167,350 | |||

| Other Assets | 10,818 | 9,294 | |||

| Total Assets | 244,671 | 262,378 | |||

| Liabilities & Owners' Equity: | |||||

| Accounts Payable & Accrued Liabilities | 24,562 | 26,576 | |||

| Current Portion of Long Term Debt | 26,534 | 20,767 | |||

| Taxes Payable | 5,723 | 5,462 | |||

| Total Current Liabilities | 56,819 | 52,805 | |||

| Long Term Debt | 82,414 | 81,078 | |||

| Post Retirement Benefit Obligations | 6,950 | 9,473 | |||

| Accrued Liabilities | 4,375 | 4,839 | |||

| Deferred Taxes | 14,197 | 14,179 | |||

| Other Long Term Liabilities | 2,423 | 2,725 | |||

| Total Shareholders' Equity | 77,493 | 97,280 | |||

| Total Liabilities & Owners' Equity | 244,671 | 262,378 | |||

| Business Segments | |||||

| Exploration & Production: | 2004 | 2005 | 2006 | ||

| Operating Revenue | 15,931 | 20,870 | 22,357 | ||

| After-Tax Earnings | 6,781 | 13,349 | 12,556 | ||

| Capital Expenditures | 6,000 | 7,180 | 7,940 | ||

| Depreciation | 4,444 | 4,790 | 5,525 | ||

| Total Assets | 76,866 | 125,042 | 140,100 | ||

| Refining & Marketing: | 2004 | 2005 | 2006 | ||

| Operating Revenue | 166,280 | 206,719 | 202,971 | ||

| After-Tax Earnings | 2,320 | 4,382 | 4,047 | ||

| Capital Expenditures | 1,455 | 1,550 | 1,683 | ||

| Depreciation | 1,620 | 1,591 | 1,596 | ||

| Total Assets | 60,688 | 91,629 | 93,829 | ||

| Petrochemicals: | 2004 | 2005 | 2006 | ||

| Operating Revenue | 19,215 | 21,657 | 23,189 | ||

| After-Tax Earnings | 1,394 | 2,162 | 2,097 | ||

| Capital Expenditures | 305 | 330 | 436 | ||

| Depreciation | 578 | 591 | 642 | ||

| Total Assets | 19,943 | 28,000 | 28,450 | ||

| Income Statement | ||||||

| Operating Results: | 2004 | 2005 | 2006 | |||

| Operating Revenues | 201,425 | 249,246 | 248,518 | |||

| Plus: Other Income | 1,239 | 2,817 | 3,524 | |||

| Total Revenue & Other Income | 202,664 | 252,062 | 252,042 | |||

| Less: Crude Oil & Product Purchases | 94,672 | 125,949 | 124,131 | |||

| Less: Production & Manufacturing | 15,793 | 18,237 | 20,079 | |||

| Less: Selling, General & Administrative | 9,417 | 9,793 | 9,706 | |||

| Less: Depreciation & Depletion | 6,642 | 6,972 | 7,763 | |||

| Less: Exploration Expense | 747 | 656 | 803 | |||

| Less: Sales Based Taxes | 18,539 | 20,905 | 20,659 | |||

| Less: Other Taxes & Duties | 27,849 | 28,257 | 26,658 | |||

| Operating Income | 29,005 | 41,294 | 42,243 | |||

| Less: Interest Expense | 10,568 | 8,028 | 11,081 | |||

| Less: Other Non-Operating Expenses | 528 | 543 | 715 | |||

| Income Before Taxes | 17,910 | 32,723 | 30,447 | |||

| Less: Taxes | 7,414 | 12,830 | 11,747 | |||

| Net Income | 10,496 | 19,893 | 18,701 | |||

| Stock and Dividend Data | ||||||||

| Stock Prices: | 2001 | 2002 | 2003 | 2004 | 2005 | 2006 | ||

| Fourth Quarter | $27.16 | $31.29 | $32.59 | $34.37 | $38.32 | $44.11 | ||

| Third Quarter | $27.90 | $30.41 | $29.42 | $35.78 | $40.29 | $39.75 | ||

| Second Quarter | $28.33 | $27.80 | $32.45 | $36.98 | $37.52 | $46.32 | ||

| First Quarter | $24.13 | $26.85 | $31.57 | $31.28 | $34.58 | $38.81 | ||

| Dividends Per Share: | ||||||||

| Fourth Quarter | $0.28 | $0.29 | $0.30 | $0.31 | $0.34 | $0.36 | ||

| Third Quarter | $0.28 | $0.29 | $0.29 | $0.31 | $0.34 | $0.36 | ||

| Second Quarter | $0.28 | $0.29 | $0.29 | $0.31 | $0.34 | $0.36 | ||

| First Quarter | $0.28 | $0.29 | $0.29 | $0.31 | $0.34 | $0.36 | ||

| Annual Dividend | $1.11 | $1.14 | $1.17 | $1.24 | $1.35 | $1.46 | ||

| Selected Financial Data: | ||||||||

| Net Income | 15,303 | 11,448 | 11,848 | 0 | 0 | 0 | ||

| Shares Outstanding | 2,049 | 2,025 | 2,035 | 2,055 | 2,945 | 2,951 | ||

| EPS | 7.47 | 5.65 | 5.82 | 0.00 | 0.00 | 0.00 | ||

| Payout Ratio | 14.8% | 20.2% | 19.9% | #DIV/0! | #DIV/0! | 23.0% | ||

| DPS | 1.11 | 1.14 | 1.16 | 1.24 | 1.35 | 1.46 | ||

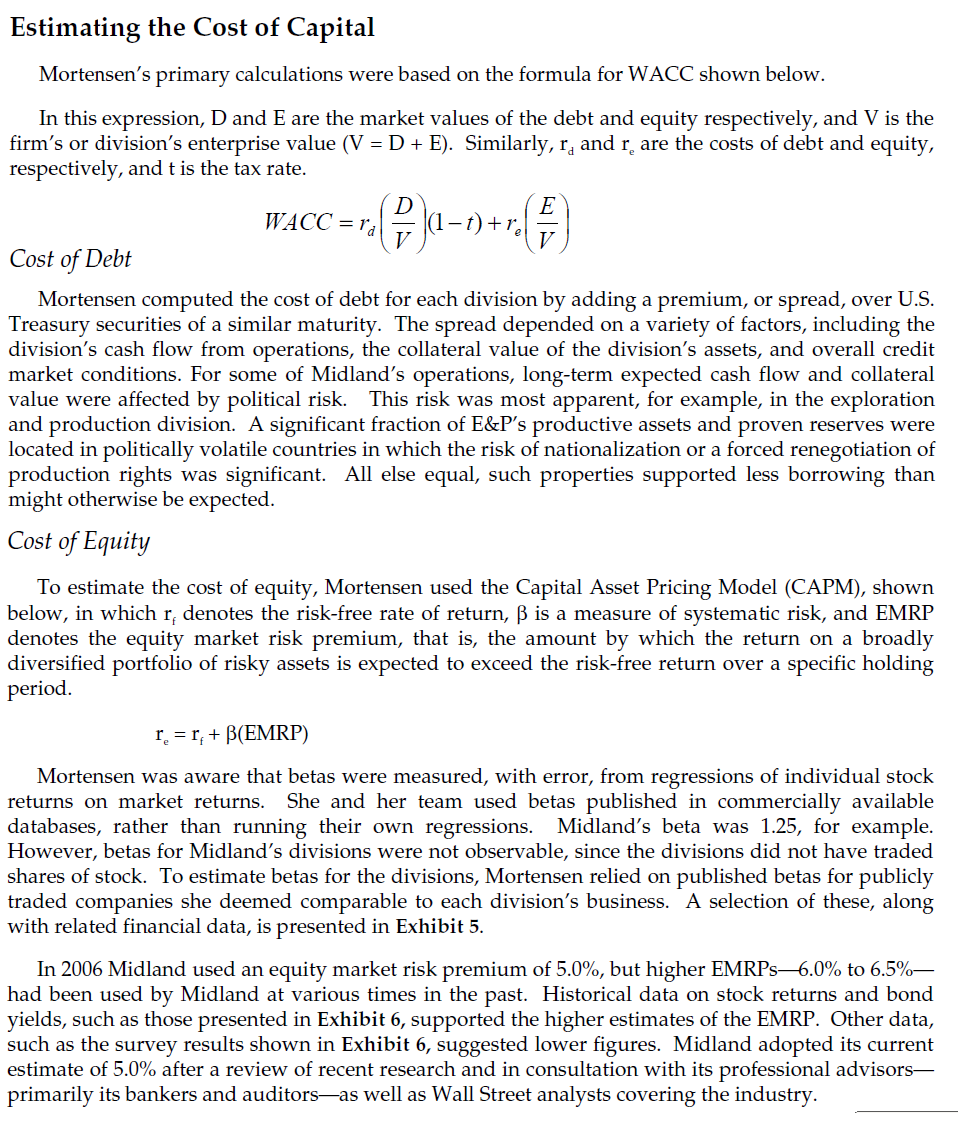

| Comparable Companies | |||||||||

| Equity | Net | Equity | LTM | LTM | |||||

| Exploration & Production: | Market Value | Debt | D/E | Beta | Revenue | Earnings | |||

| Jackson Energy, Inc. | 57,931 | 6,480 | 11.2% | 0.89 | 18,512 | 4,981 | |||

| Wide Palin Petroleum | 46,089 | 39,375 | 85.4% | 1.21 | 17,827 | 8,495 | |||

| Corsicana Energy Corp. | 42,263 | 6,442 | 15.2% | 1.11 | 14,505 | 4,467 | |||

| Worthington Petroleum | 27,591 | 13,098 | 47.5% | 1.39 | 12,820 | 3,506 | |||

| Average | 39.8% | 1.15 | |||||||

| Refining & Marketing: | |||||||||

| Bexar Energy, Inc. | 60,356 | 6,200 | 10.3% | 1.70 | 160,708 | 9,560 | |||

| Kirk Corp. | 15,567 | 3,017 | 19.4% | 0.94 | 67,751 | 1,713 | |||

| White Point Energy | 9,204 | 1,925 | 20.9% | 1.78 | 31,682 | 1,402 | |||

| Petrarch Fuel Services | 2,460 | (296) | -12.0% | 0.24 | 18,874 | 112 | |||

| Arkana Petroleum Corp. | 18,363 | 5,931 | 32.3% | 1.25 | 49,117 | 3,353 | |||

| Beaumont Energy, Inc. | 32,662 | 6,743 | 20.6% | 1.04 | 59,989 | 1,467 | |||

| Dameron Fuel Services | 48,796 | 24,525 | 50.3% | 1.42 | 58,750 | 4,646 | |||

| Average | 20.3% | 1.20 | |||||||

| Midland Energy Resources | 134,114 | 79,508 | 59.3% | 1.25 | 251,003 | 18,888 | |||

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started