Answered step by step

Verified Expert Solution

Question

1 Approved Answer

What is the cost of preferred Stock for Coleman Technologies Coleman Technologies is currently calculating the cost of capital for a major expansion program. We

What is the cost of preferred Stock for Coleman Technologies

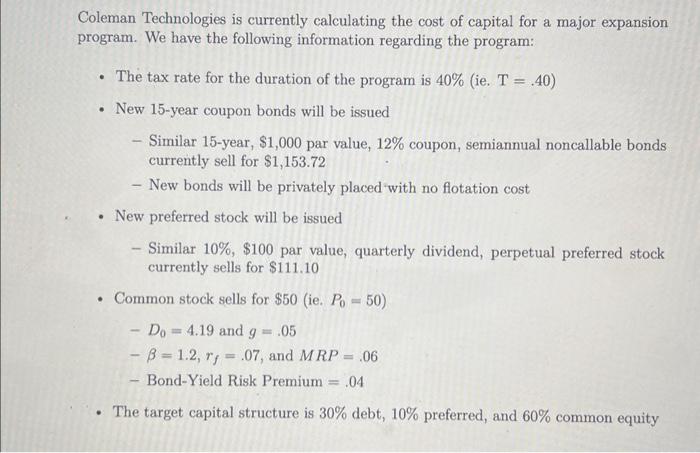

Coleman Technologies is currently calculating the cost of capital for a major expansion program. We have the following information regarding the program: - The tax rate for the duration of the program is 40% (ie. T=.40 ) - New 15-year coupon bonds will be issued - Similar 15-year, $1,000 par value, 12% coupon, semiannual noncallable bonds currently sell for $1,153.72 - New bonds will be privately placed 'with no flotation cost - New preferred stock will be issued - Similar 10%,$100 par value, quarterly dividend, perpetual preferred stock currently sells for $111.10 - Common stock sells for $50( (ie. P0=50) D0=4.19 and g=.05 =1.2,rf=.07, and MRP=.06 - Bond-Yield Risk Premium =.04 - The target capital structure is 30% debt, 10% preferred, and 60% common equity

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started