Answered step by step

Verified Expert Solution

Question

1 Approved Answer

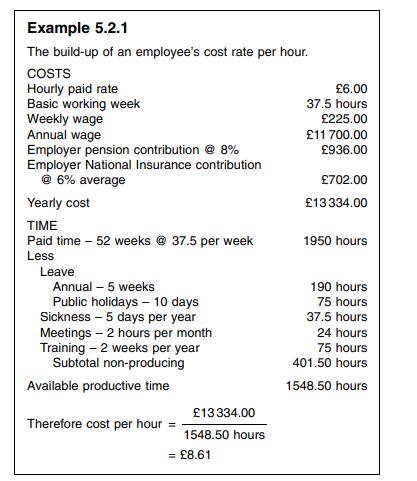

What is the cost rate per hour of overtime for the employee in Example 5.2.1, if a payment of 25% is made for overtime working?

What is the cost rate per hour of overtime for the employee in Example 5.2.1, if a payment of 25% is made for overtime working? Hint: Only pension and National Insurance is added and there are no deductions for leave, etc. (£8.55)

Example 5.2.1 The build-up of an employee's cost rate per hour. COSTS Hourly paid rate Basic working week Weekly wage Annual wage Employer pension contribution @ 8% Employer National Insurance contribution @ 6% average Yearly cost TIME Paid time - 52 weeks @ 37.5 per week Less Leave Annual - 5 weeks Public holidays - 10 days Sickness -5 days per year Meetings - 2 hours per month Training - 2 weeks per year Subtotal non-producing Available productive time 6.00 37.5 hours 225.00 11 700.00 936.00 702.00 13334.00 1950 hours 190 hours 75 hours 37.5 hours 24 hours 75 hours 401.50 hours 1548.50 hours 13334.00 Therefore cost per hour = 1548.50 hours = 8.61

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started