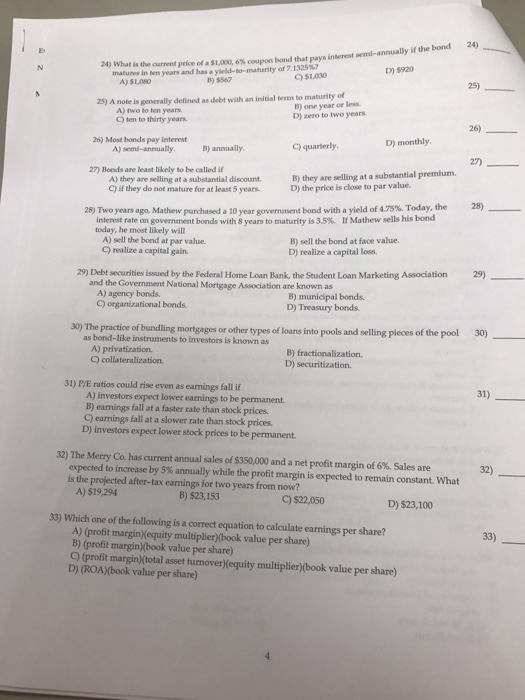

What is the current price of a $ 1,000. 6% coupon bond that pays interest semi-annually if the bond matures in ten years and has a yield-to-maturity of 7.1325%? A)$1, 080 B) $567 C)$1, 030 D) $920 A note is generally defined as debt with an initial term to maturity of A) two to ten years. B) one year or less. C) ten to thirty years. D) zero to two years. Most bonds pay interest A) semi-annually. B) annually. C) quarterly. D) monthly. Bonds are least likely to be called if A) they are selling at a substantial discount. B) they are selling at a substantial premium. C) if they do not mature for at least 5 years. D) the price is close to par value. Two years ago, Mathew purchased a 10 year government bond with a yield of 4.75%. Today, the interest rate on government bonds with 8 years to maturity is 3.5%. If Mathew sells his bond today, he most likely will A) sell the bond at par value. B) sell the bond at face value. C) realize a capital gain. D) realize a capital loss. Debt securities issued by the Federal Home Loan Bank, the Student Loan Marketing Association and the Government National Mortgage Association are known as A) agency bonds. B) municipal bonds. C) organization bonds. D) Treasury bonds. The practice of bundling mortgages or other types of loans into pools and selling pieces of the pool as bond-like instruments to investors is known as A) privatization. B) fractionalization. C) collateralization. D) securitization. P/E ratios could rise even as earnings fall if A) investors expect lower earnings to be permanent. B) earnings fall at a faster rate than stock prices. C) earnings fall at a slower rate than stock prices. D) investors expect lower stock prices to be permanent The Merry Co. has current annual sales of $350,000 and a net profit margin of 6%. Sales are expected to increase by 5% annually while the profit margin is expected to remain constant. What is the projected after-tax earnings for two years from now? A) $19, 294 B) $23, 153 C) $22, 050 D) $23, 100 Which one of the following is a correct equation to calculate earnings per share? A) (profit margin)(equity multiplier)(book value per share) B) (profit margin)(book value per share) C) (profit margin)(total asset turnover)(equity multiplier)(book value per share) D) (ROA)(book value per share)