Answered step by step

Verified Expert Solution

Question

1 Approved Answer

WHAT IS THE DEBT BETA AND EQUITY BETA Macbeth Spot Removers is entirely equity financed. Use the following information. Macbeth now decides to issue $10,400

WHAT IS THE DEBT BETA AND EQUITY BETA

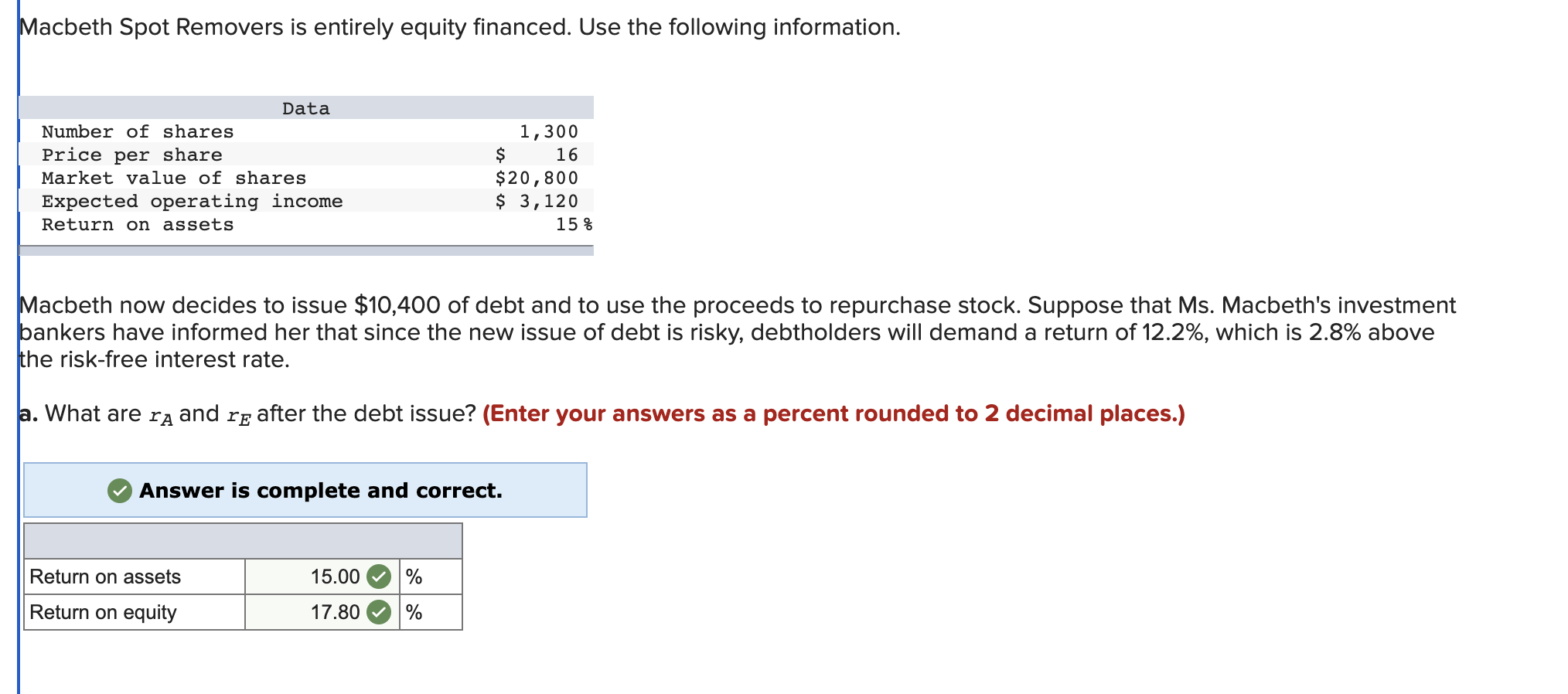

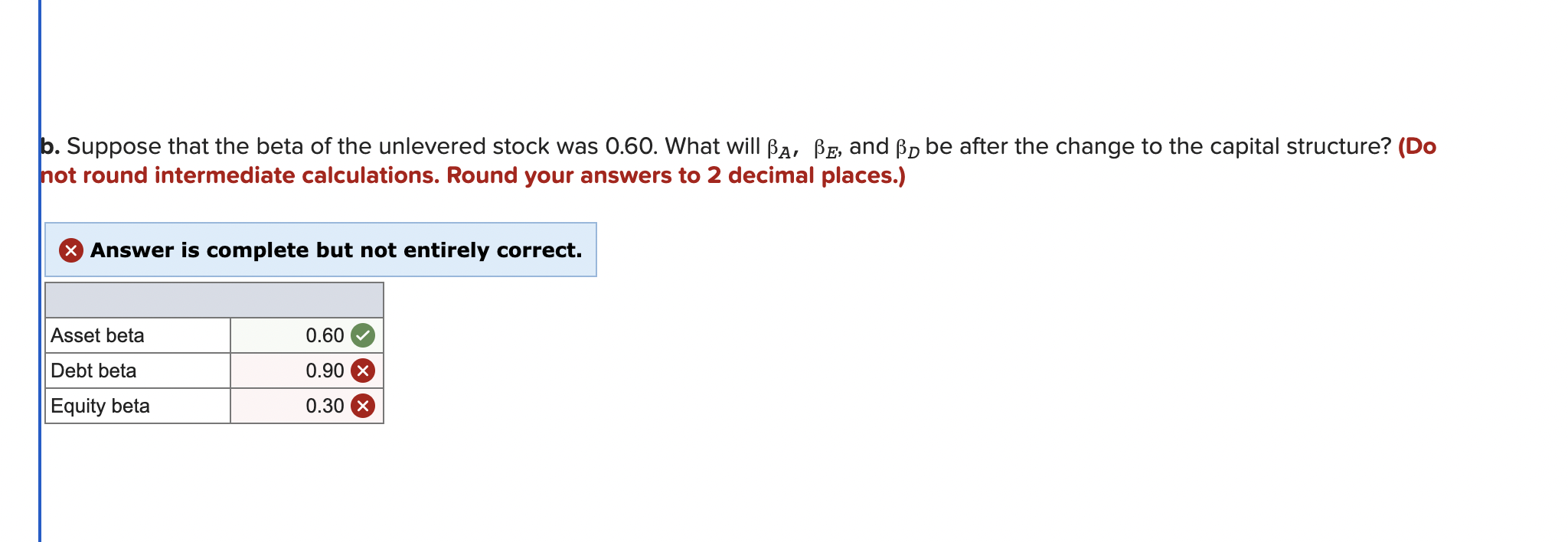

Macbeth Spot Removers is entirely equity financed. Use the following information. Macbeth now decides to issue $10,400 of debt and to use the proceeds to repurchase stock. Suppose that Ms. Macbeth's investment bankers have informed her that since the new issue of debt is risky, debtholders will demand a return of 12.2%, which is 2.8% above the risk-free interest rate. a. What are rA and rE after the debt issue? (Enter your answers as a percent rounded to 2 decimal places.) Suppose that the beta of the unlevered stock was 0.60. What will A,E, and D be after the change to the capital structure? (Do ot round intermediate calculations. Round your answers to 2 decimal places.) Answer is complete but not entirely correct

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started