Answered step by step

Verified Expert Solution

Question

1 Approved Answer

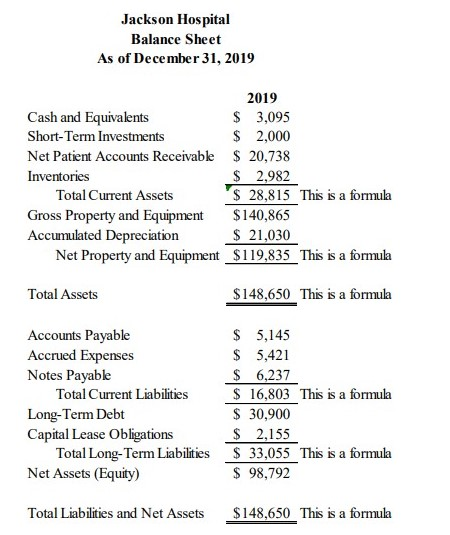

What is the Debt Ratio, Debt to Equity Ratio, Times Interest Earned Ratio, Fixed Assets Turnover Ratio for Jackson Hospital in 2019? Please look at

What is the Debt Ratio, Debt to Equity Ratio, Times Interest Earned Ratio, Fixed Assets Turnover Ratio for Jackson Hospital in 2019?

Please look at the images and also the options that are available for answers

Debt Ratio

A: 100%

B: 33.5%

C: 0.0%

D: 24.2%

Debt to Equity Ratio

A: 50.5%

B: 61.2%

C: 30.0%

D: 25.8%

Times Interest Earned Ratio

A: 8.4 times

B: 1.0 times

C: 5.1 times

D: 2.6 times

Fixed Assets Turnover Ratio

A: 0.51 times

B: 0.87 times

C: 1.00 times

D: 0.33 times

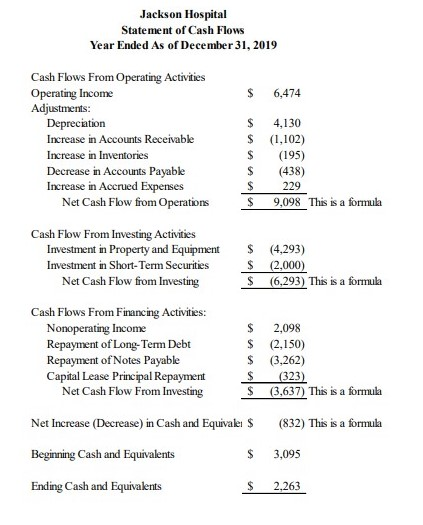

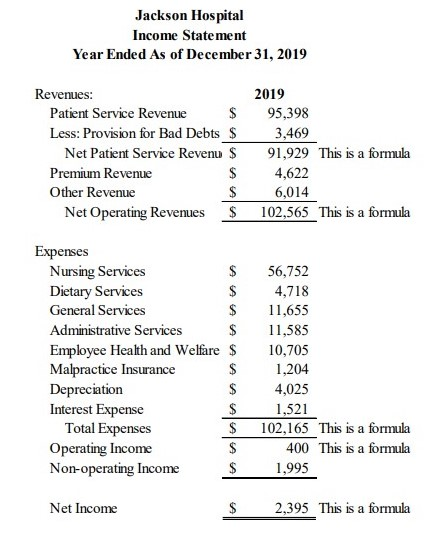

Jackson Hospital Statement of Cash Flows Year Ended As of December 31, 2019 $ 6,474 Cash Flows From Operating Activities Operating Income Adjustments: Depreciation Increase in Accounts Receivable Increase in Inventories Decrease in Accounts Payable Increase in Accrued Expenses Net Cash Flow from Operations $ $ $ $ $ $ 4,130 (1,102) (195) (438) 229 9,098 This is a formula Cash Flow From Investing Activities Investment in Property and Equipment Investment in Short-Term Securities Net Cash Flow from Investing $ $ $ (4,293) (2,000) (6,293) This is a formula Cash Flows From Financing Activities: Nonoperating Income Repayment of Long-Term Debt Repayment of Notes Payable Capital Lease Principal Repayment Net Cash Flow From Investing $ $ $ $ $ 2,098 (2,150) (3,262) (323) (3,637) This is a formula Net Increase (Decrease) in Cash and Equivales $ (832) This is a formula Beginning Cash and Equivalents $ 3,095 Ending Cash and Equivalents $ 2.263 Jackson Hospital Income Statement Year Ended As of December 31, 2019 Revenues: Patient Service Revenue $ Less: Provision for Bad Debts $ Net Patient Service Revenu $ Premium Revenue $ Other Revenue $ Net Operating Revenues $ 2019 95,398 3,469 91,929 This is a formula 4,622 6,014 102,565 This is a formula Expenses Nursing Services Dietary Services General Services Administrative Services $ Employee Health and Welfare $ Malpractice Insurance $ Depreciation Interest Expense Total Expenses $ Operating Income Non-operating Income $ 56,752 4,718 11,655 11,585 10,705 1,204 4,025 1,521 102,165 This is a formula 400 This is a formula 1,995 Net Income $ 2,395 This is a formula Jackson Hospital Balance Sheet As of December 31, 2019 2019 Cash and Equivalents $ 3,095 Short-Term Investments $ 2,000 Net Patient Accounts Receivable $ 20,738 Inventories $ 2,982 Total Current Assets '$ 28,815 This is a formula Gross Property and Equipment $140,865 Accumulated Depreciation $ 21,030 Net Property and Equipment $119,835 This is a formula Total Assets $ 148,650 This is a formula Accounts Payable Accrued Expenses Notes Payable Total Current Liabilities Long-Term Debt Capital Lease Obligations Total Long-Term Liabilities Net Assets (Equity) $ 5,145 $ 5,421 $ 6,237 $ 16,803 This is a formula $ 30,900 $ 2,155 $ 33,055 This is a formula $ 98,792 Total Liabilities and Net Assets $148,650 This is a formulaStep by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started