What is the difference between technical efficiency and allocation efficiency.

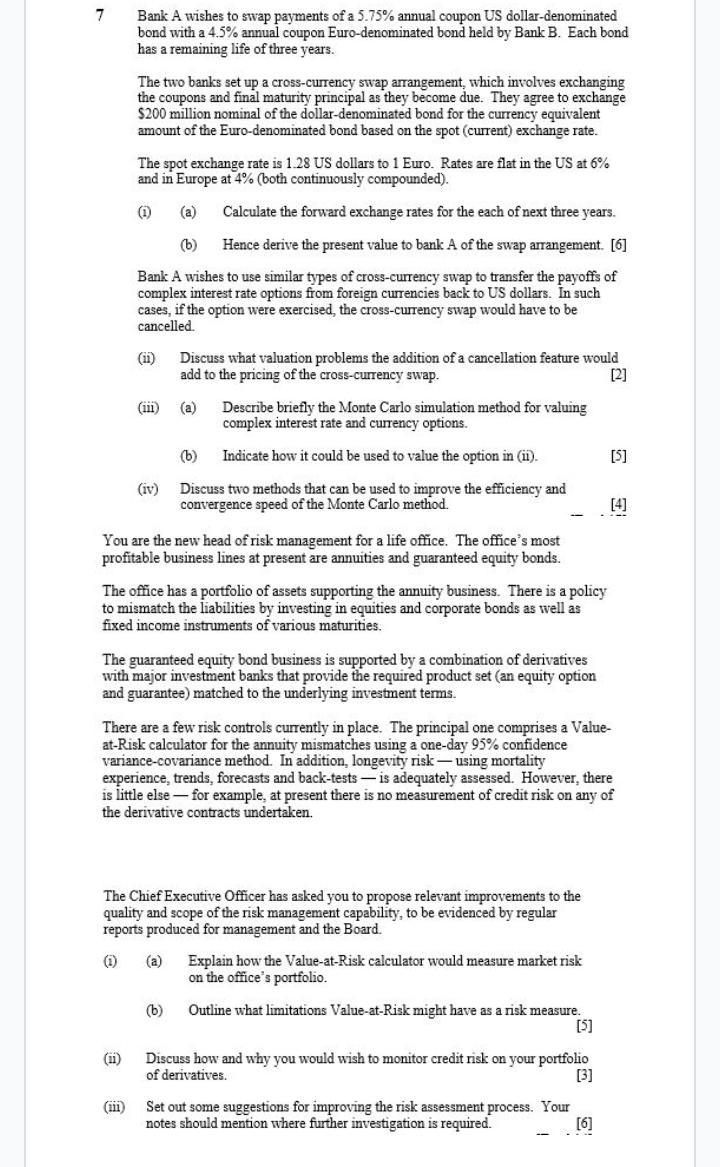

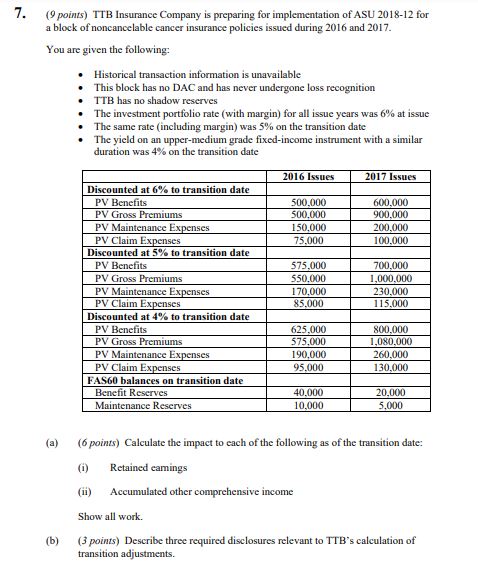

7 Bank A wishes to swap payments of a 5.75% annual coupon US dollar-denominated bond with a 4.5% annual coupon Euro-denominated bond held by Bank B. Each bond has a remaining life of three years. The two banks set up a cross-currency swap arrangement, which involves exchanging the coupons and final maturity principal as they become due. They agree to exchange $200 million nominal of the dollar-denominated bond for the currency equivalent amount of the Euro-denominated bond based on the spot (current) exchange rate. The spot exchange rate is 1.28 US dollars to 1 Euro. Rates are flat in the US at 6% and in Europe at 4% (both continuously compounded). () (a) Calculate the forward exchange rates for the each of next three years. ( b ) Hence derive the present value to bank A of the swap arrangement. [6] Bank A wishes to use similar types of cross-currency swap to transfer the payoffs of complex interest rate options from foreign currencies back to US dollars. In such cases, if the option were exercised, the cross-currency swap would have to be cancelled. (ii) Discuss what valuation problems the addition of a cancellation feature would add to the pricing of the cross-currency swap. [2] (iii) (a) Describe briefly the Monte Carlo simulation method for valuing complex interest rate and currency options. ( b ) Indicate how it could be used to value the option in (ii). [S] (iv) Discuss two methods that can be used to improve the efficiency and convergence speed of the Monte Carlo method. [4] You are the new head of risk management for a life office. The office's most profitable business lines at present are annuities and guaranteed equity bonds. The office has a portfolio of assets supporting the annuity business. There is a policy to mismatch the liabilities by investing in equities and corporate bonds as well as fixed income instruments of various maturities. The guaranteed equity bond business is supported by a combination of derivatives with major investment banks that provide the required product set (an equity option and guarantee) matched to the underlying investment terms. There are a few risk controls currently in place. The principal one comprises a Value- at-Risk calculator for the annuity mismatches using a one-day 95% confidence variance-covariance method. In addition, longevity risk - using mortality experience, trends, forecasts and back-tests - is adequately assessed. However, there is little else - for example, at present there is no measurement of credit risk on any of the derivative contracts undertaken. The Chief Executive Officer has asked you to propose relevant improvements to the quality and scope of the risk management capability, to be evidenced by regular reports produced for management and the Board. (1) (a) Explain how the Value-at-Risk calculator would measure market risk on the office's portfolio. (b) Outline what limitations Value-at-Risk might have as a risk measure. [5] (mi) Discuss how and why you would wish to monitor credit risk on your portfolio of derivatives. [3] (iii) Set out some suggestions for improving the risk assessment process. Your notes should mention where further investigation is required.7. (9 points) TTB Insurance Company is preparing for implementation of ASU 2018-12 for a block of noncancelable cancer insurance policies issued during 2016 and 2017. You are given the following: Historical transaction information is unavailable This block has no DAC and has never undergone loss recognition ITB has no shadow reserves The investment portfolio rate (with margin) for all issue years was 6% at issue The same rate (including margin) was 5% on the transition date The yield on an upper-medium grade fixed-income instrument with a similar duration was 4% on the transition date 2016 Issues 2017 Issues Discounted at 6% to transition date PV Benefits 500.000 600.000 PV Gross Premiums 500.000 900.000 PV Maintenance Expenses 150,000 200.000 PV Claim Expenses 75.000 100,000 Discounted at 5% to transition date PV Benefits 575.000 700.000 PV Gross Premiums $50.000 1,000.000 PV Maintenance Expenses 170,000 230.000 PV Claim Expenses 85.000 115.000 Discounted at 4% to transition date PV Benefits $25.000 80D.000 PV Gross Premiums $75,000 1,080.000 PV Maintenance Expenses 190,000 260,000 PV Claim Expenses 95.000 130.000 FAS60 balances on transition date Benefit Reserves 40.000 20.000 Maintenance Reserves 10,000 5.000 (a) (6 points) Calculate the impact to each of the following as of the transition date: (i) Retained camings Accumulated other comprehensive income Show all work. (b) (3 points) Describe three required disclosures relevant to TTB's calculation of transition adjustments