Answered step by step

Verified Expert Solution

Question

1 Approved Answer

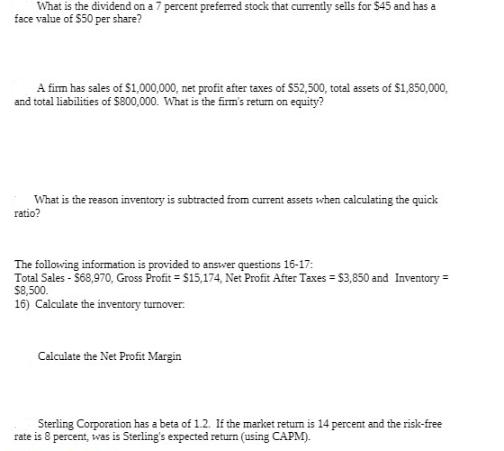

What is the dividend on a 7 percent preferred stock that currently sells for $45 and has a face value of $50 per share?

What is the dividend on a 7 percent preferred stock that currently sells for $45 and has a face value of $50 per share? A firm has sales of $1,000,000, net profit after taxes of $52,500, total assets of $1,850,000, and total liabilities of $800,000. What is the firm's return on equity? What is the reason inventory is subtracted from current assets when calculating the quick ratio? The following information is provided to answer questions 16-17: Total Sales - $68,970, Gross Profit = $15,174, Net Profit After Taxes = $3,850 and Inventory = $8,500. 16) Calculate the inventory turnover: Calculate the Net Profit Margin Sterling Corporation has a beta of 1.2. If the market return is 14 percent and the risk-free rate is 8 percent, was is Sterling's expected return (using CAPM).

Step by Step Solution

★★★★★

3.55 Rating (166 Votes )

There are 3 Steps involved in it

Step: 1

Lets address each of your questions one by one 1 Dividend on Preferred Stock To calculate the divide...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started