Answered step by step

Verified Expert Solution

Question

1 Approved Answer

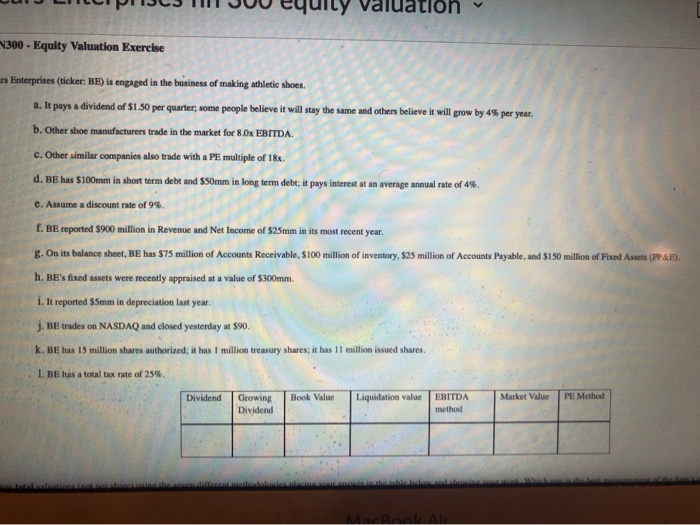

What is the equity valuation using the EBITDA multiple method? U LILLIPICS T Jou equity valuation 300 - Equity Valuation Exercise s Enterprises (ticker: BE)

What is the equity valuation using the EBITDA multiple method?

U LILLIPICS T Jou equity valuation 300 - Equity Valuation Exercise s Enterprises (ticker: BE) is engaged in the business of making athletic shoes a. It pays a dividend of $150 per quarter, some people believe it will stay the same and others believe it will grow by 49 per year. b. Other shoe manufacturers trade in the market for 8.0x EBITDA. c. Other similar companies also trade with a PE multiple of 18% d. Be has $100mm in short term debt and $50mm in long term debt; it pays interest at an average annual rate of 4% e. Assume a discount rate of 9%. 1. BE reported $900 million in Revenue and Net Income of $25mm in its most recent year g. On its balance sheet, BE has $75 million of Accounts Receivable, 5100 million of inventory S25 million of Accounts Payable, and S150 million of Fixed Assets (PPE h. BE's fixed assets were recently appraised at a value of $300mm. i. It reported $5mm in depreciation last year j. BEtrades on NASDAQ and closed yesterday at $90. K. BE has 15 million shares authorized; it has 1 million treasury shares; it has 11 million issued shares 1. BE has a total tax rate of 25%. Dividend Book Value Book Value Liquidation value Market Value PE Method Growing Dividend ERITDA method U LILLIPICS T Jou equity valuation 300 - Equity Valuation Exercise s Enterprises (ticker: BE) is engaged in the business of making athletic shoes a. It pays a dividend of $150 per quarter, some people believe it will stay the same and others believe it will grow by 49 per year. b. Other shoe manufacturers trade in the market for 8.0x EBITDA. c. Other similar companies also trade with a PE multiple of 18% d. Be has $100mm in short term debt and $50mm in long term debt; it pays interest at an average annual rate of 4% e. Assume a discount rate of 9%. 1. BE reported $900 million in Revenue and Net Income of $25mm in its most recent year g. On its balance sheet, BE has $75 million of Accounts Receivable, 5100 million of inventory S25 million of Accounts Payable, and S150 million of Fixed Assets (PPE h. BE's fixed assets were recently appraised at a value of $300mm. i. It reported $5mm in depreciation last year j. BEtrades on NASDAQ and closed yesterday at $90. K. BE has 15 million shares authorized; it has 1 million treasury shares; it has 11 million issued shares 1. BE has a total tax rate of 25%. Dividend Book Value Book Value Liquidation value Market Value PE Method Growing Dividend ERITDA methodStep by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started