What is the estimated company's worth (per share) using a DCF valuation? Note: Can use some proxy values if needed. Just provide the assumption and explanation.

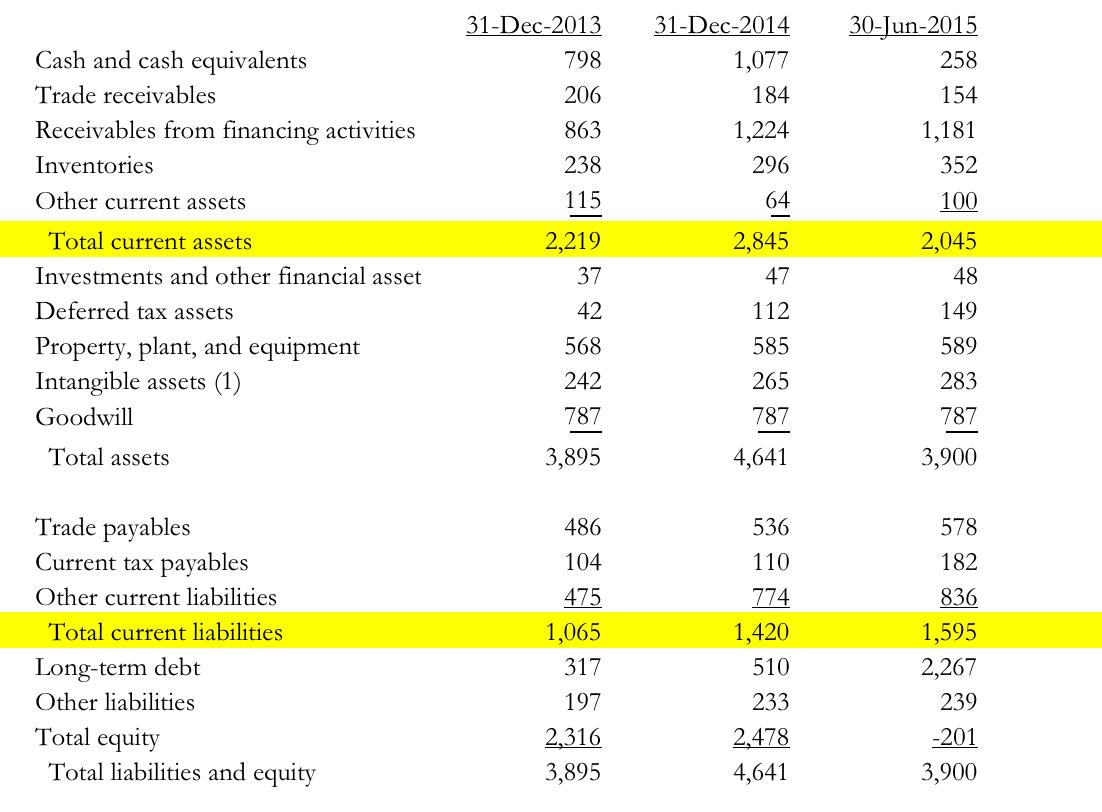

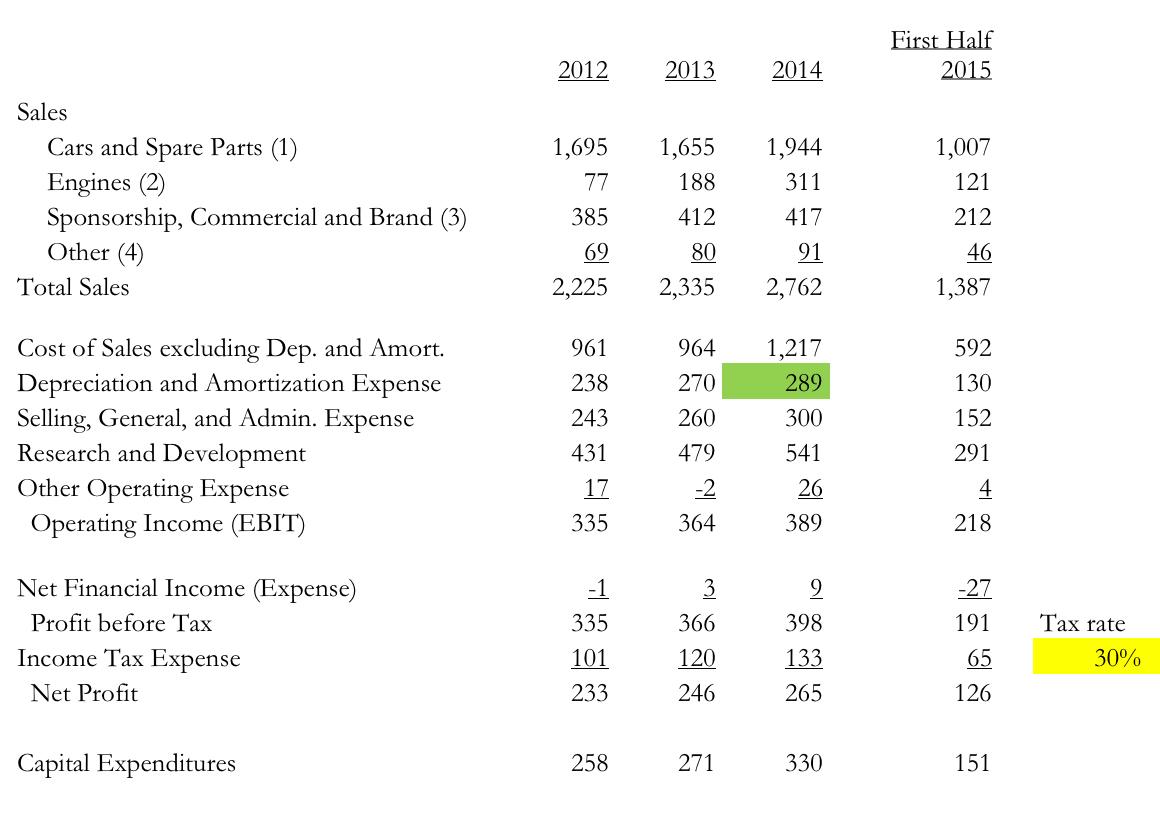

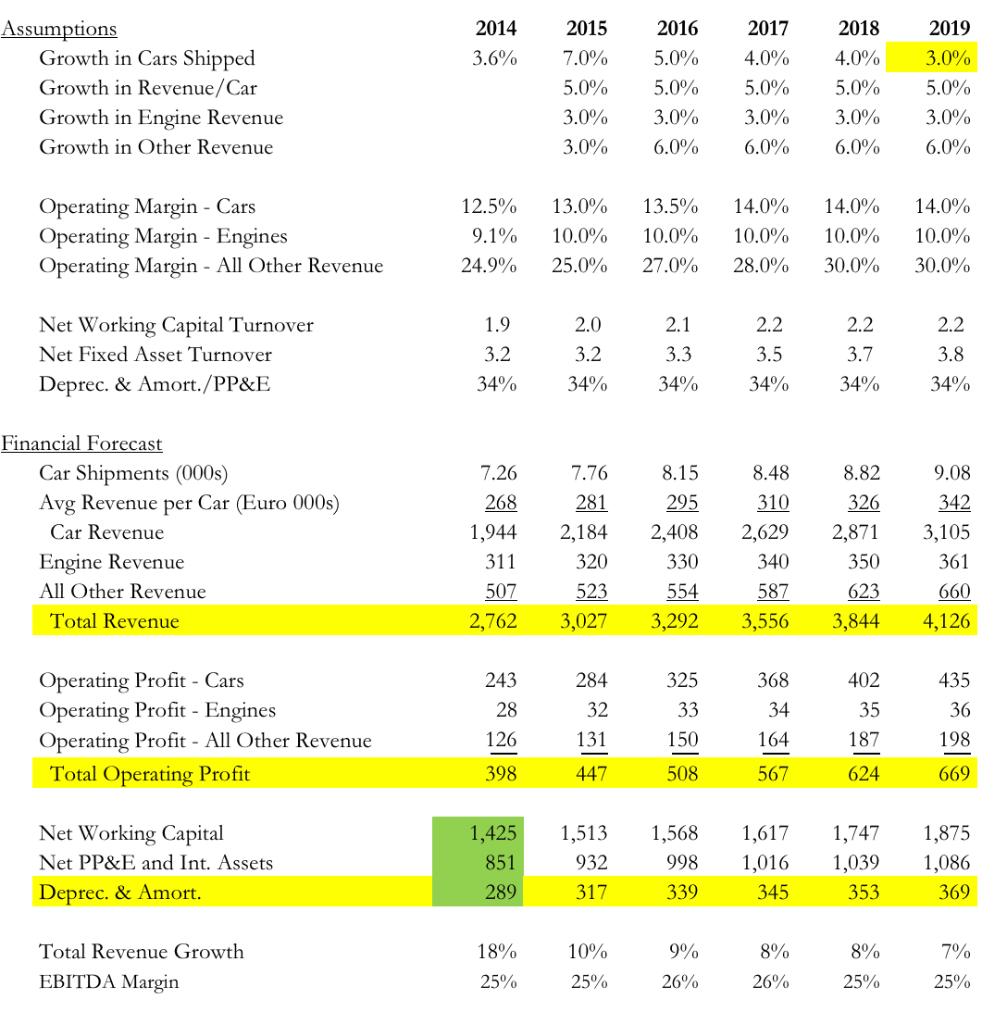

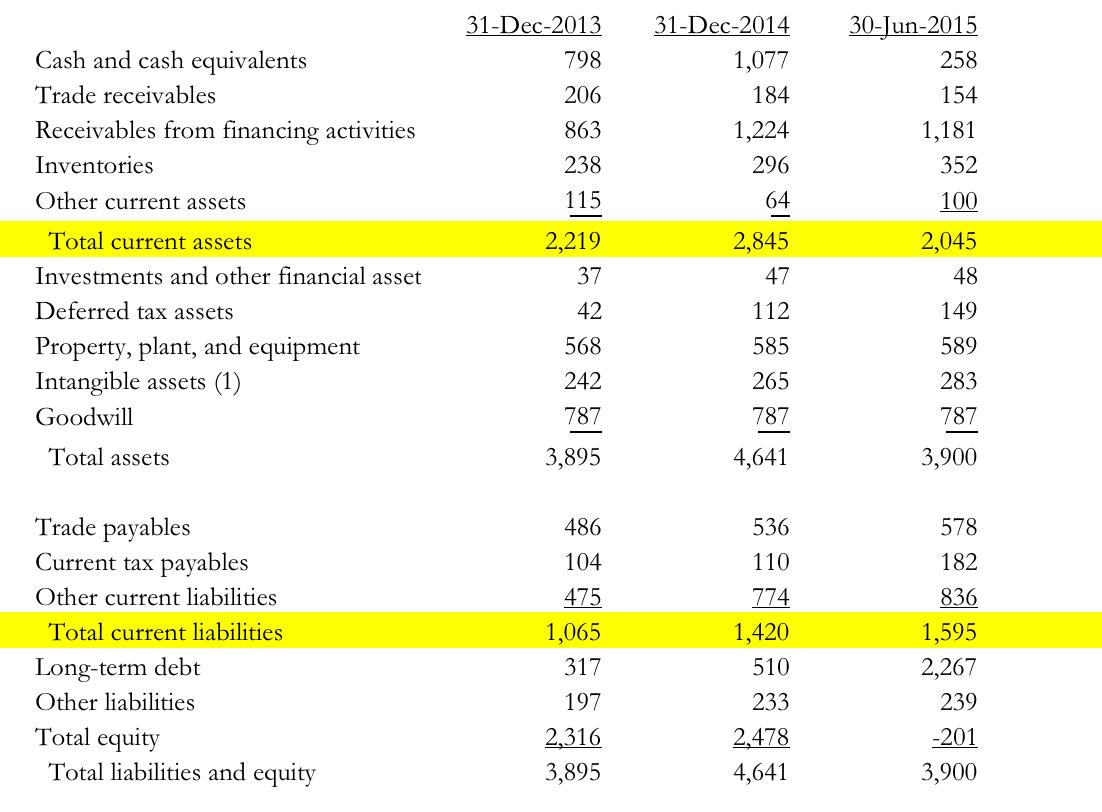

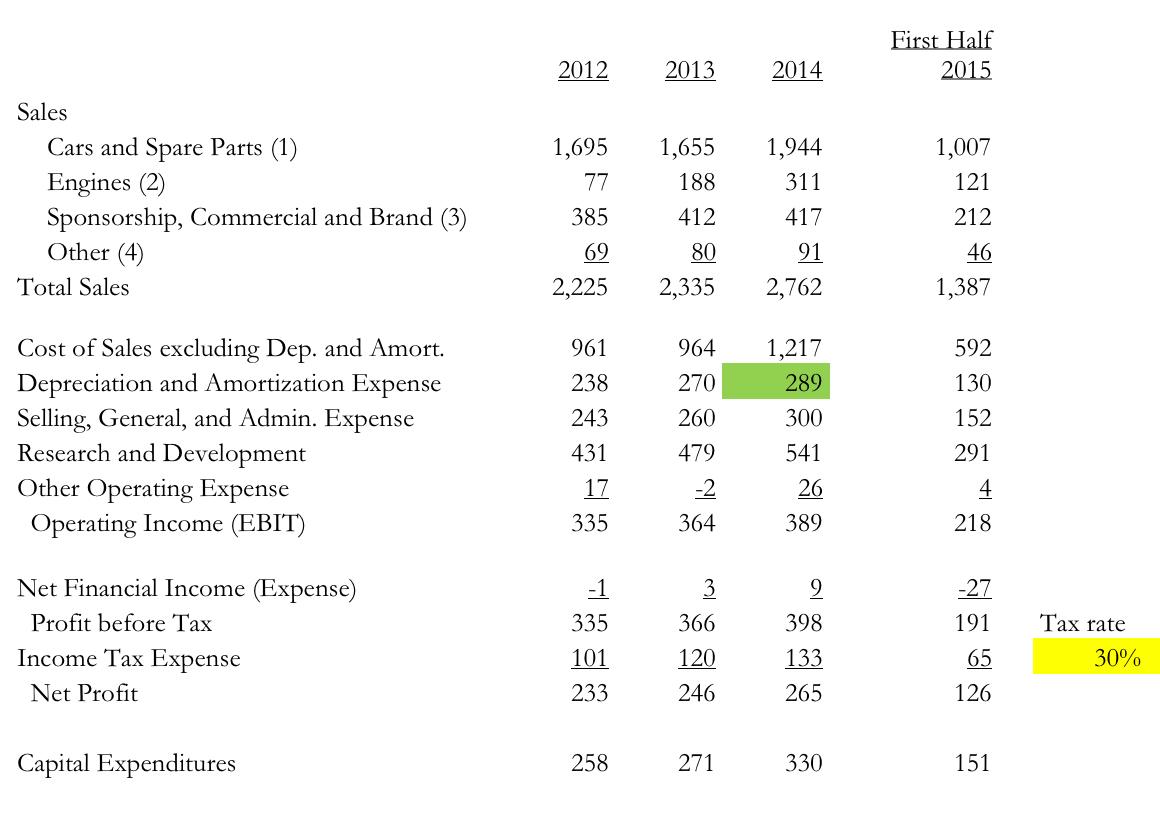

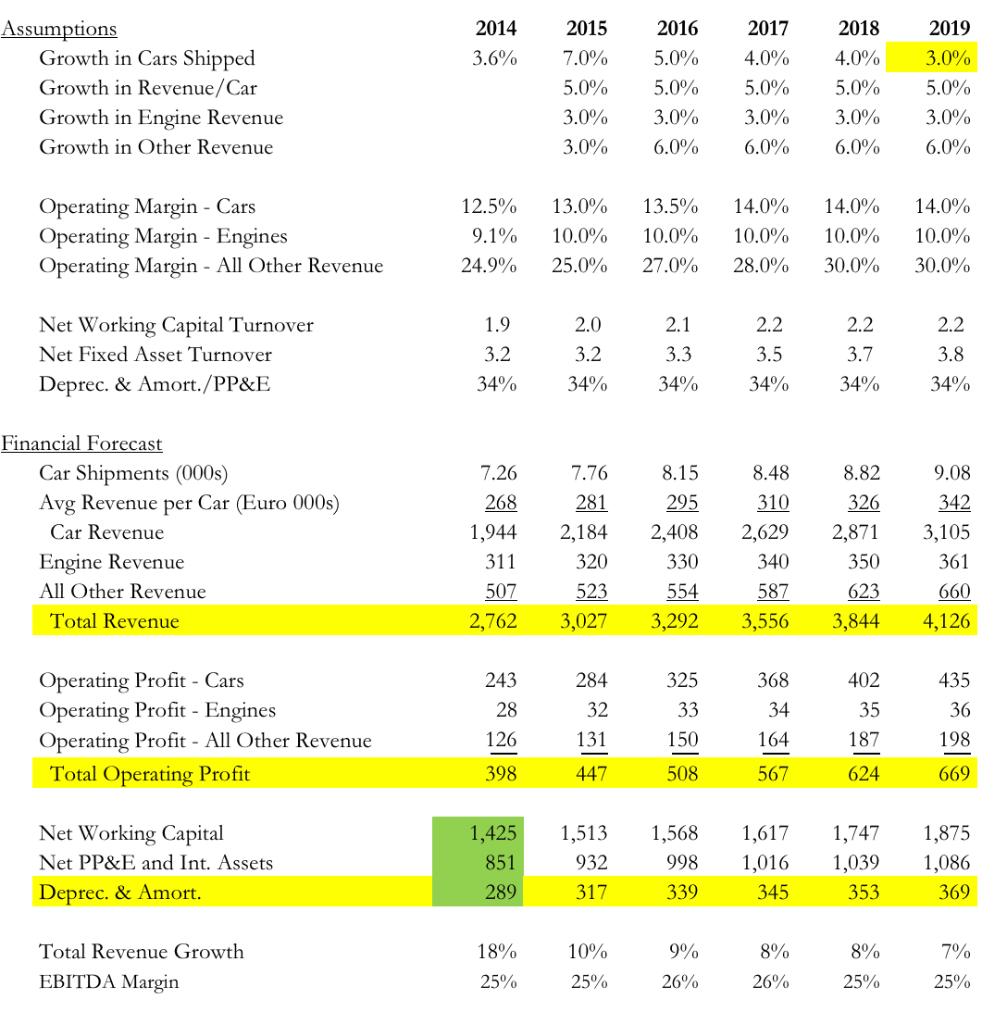

CashandcashequivalentsTradereceivablesReceivablesfromfinancingactivitiesInventoriesOthercurrentassetsTotalcurrentassetsInvestmentsandotherfinancialassetDeferredtaxassetsProperty,plant,andequipmentIntangibleassets(1)GoodwillTotalassetsTradepayablesCurrenttaxpayablesOthercurrentliabilitiesTotalcurrentliabilitiesLong-termdebtOtherliabilitiesTotalequityTotalliabilitiesandequity31-Dec-20137982068632381152,21937425682427873,8954861044751,0653171972,3163,89531-Dec-20141,0771841,224296642,84547112585265787784,6415361107741,4205102332,4784,64130-Jun-20152581541,1813521002,045481495892837873,9005781828361,5952,2672392013,900 SalesCarsandSpareParts(1)Engines(2)Sponsorship,CommercialandBrand(3)Other(4)TotalSalesCostofSalesexcludingDep.andAmort.DepreciationandAmortizationExpenseSelling,General,andAdmin.ExpenseResearchandDevelopmentOtherOperatingExpenseOperatingIncome(EBIT)1,69577385692,225961238243431173351,655188412802,33596427026047923641,944311417912,7621,217289300541263891,007121212461,3875921301522914218 NetFinancialIncome(Expense)ProfitbeforeTaxIncomeTaxExpenseNetProfit1335101233336612024693981332652719165126 CapitalExpenditures258271330151 \begin{tabular}{lrrrrrr} Assumptions & 2014 & 2015 & 2016 & 2017 & 2018 & 2019 \\ \hline Growth in Cars Shipped & 3.6% & 7.0% & 5.0% & 4.0% & 4.0% & 3.0% \\ Growth in Revenue/Car & & 5.0% & 5.0% & 5.0% & 5.0% & 5.0% \\ Growth in Engine Revenue & & 3.0% & 3.0% & 3.0% & 3.0% & 3.0% \\ Growth in Other Revenue & & 3.0% & 6.0% & 6.0% & 6.0% & 6.0% \\ & 12.5% & 13.0% & 13.5% & 14.0% & 14.0% & 14.0% \\ Operating Margin - Cars & 9.1% & 10.0% & 10.0% & 10.0% & 10.0% & 10.0% \\ Operating Margin - Engines & 24.9% & 25.0% & 27.0% & 28.0% & 30.0% & 30.0% \\ Operating Margin - All Other Revenue & & & & & & \\ & 1.9 & 2.0 & 2.1 & 2.2 & 2.2 & 2.2 \\ Net Working Capital Turnover & 3.2 & 3.2 & 3.3 & 3.5 & 3.7 & 3.8 \\ Net Fixed Asset Turnover & 34% & 34% & 34% & 34% & 34% & 34% \end{tabular} Financial Forecast CarShipments(000s)AvgRevenueperCar(Euro000s)CarRevenueEngineRevenueAllOtherRevenueTotalRevenue7.262681,9443115072,7627.762812,1843205233,0278.152952,4083305543,2928.483102,6293405873,5568.823262,8713506233,8449.083423,1053616604,126 \begin{tabular}{|lrrrrrr|} \hline Net Working Capital & 1,425 & 1,513 & 1,568 & 1,617 & 1,747 & 1,875 \\ \hline Net PP\&E and Int. Assets & 851 & 932 & 998 & 1,016 & 1,039 & 1,086 \\ \hline Deprec. \& Amort. & 289 & 317 & 339 & 345 & 353 & 369 \\ \hline \end{tabular} Total Revenue Growth EBITDA Margin 18%25%10%25%9%26%8%26%8%25%7%25% CashandcashequivalentsTradereceivablesReceivablesfromfinancingactivitiesInventoriesOthercurrentassetsTotalcurrentassetsInvestmentsandotherfinancialassetDeferredtaxassetsProperty,plant,andequipmentIntangibleassets(1)GoodwillTotalassetsTradepayablesCurrenttaxpayablesOthercurrentliabilitiesTotalcurrentliabilitiesLong-termdebtOtherliabilitiesTotalequityTotalliabilitiesandequity31-Dec-20137982068632381152,21937425682427873,8954861044751,0653171972,3163,89531-Dec-20141,0771841,224296642,84547112585265787784,6415361107741,4205102332,4784,64130-Jun-20152581541,1813521002,045481495892837873,9005781828361,5952,2672392013,900 SalesCarsandSpareParts(1)Engines(2)Sponsorship,CommercialandBrand(3)Other(4)TotalSalesCostofSalesexcludingDep.andAmort.DepreciationandAmortizationExpenseSelling,General,andAdmin.ExpenseResearchandDevelopmentOtherOperatingExpenseOperatingIncome(EBIT)1,69577385692,225961238243431173351,655188412802,33596427026047923641,944311417912,7621,217289300541263891,007121212461,3875921301522914218 NetFinancialIncome(Expense)ProfitbeforeTaxIncomeTaxExpenseNetProfit1335101233336612024693981332652719165126 CapitalExpenditures258271330151 \begin{tabular}{lrrrrrr} Assumptions & 2014 & 2015 & 2016 & 2017 & 2018 & 2019 \\ \hline Growth in Cars Shipped & 3.6% & 7.0% & 5.0% & 4.0% & 4.0% & 3.0% \\ Growth in Revenue/Car & & 5.0% & 5.0% & 5.0% & 5.0% & 5.0% \\ Growth in Engine Revenue & & 3.0% & 3.0% & 3.0% & 3.0% & 3.0% \\ Growth in Other Revenue & & 3.0% & 6.0% & 6.0% & 6.0% & 6.0% \\ & 12.5% & 13.0% & 13.5% & 14.0% & 14.0% & 14.0% \\ Operating Margin - Cars & 9.1% & 10.0% & 10.0% & 10.0% & 10.0% & 10.0% \\ Operating Margin - Engines & 24.9% & 25.0% & 27.0% & 28.0% & 30.0% & 30.0% \\ Operating Margin - All Other Revenue & & & & & & \\ & 1.9 & 2.0 & 2.1 & 2.2 & 2.2 & 2.2 \\ Net Working Capital Turnover & 3.2 & 3.2 & 3.3 & 3.5 & 3.7 & 3.8 \\ Net Fixed Asset Turnover & 34% & 34% & 34% & 34% & 34% & 34% \end{tabular} Financial Forecast CarShipments(000s)AvgRevenueperCar(Euro000s)CarRevenueEngineRevenueAllOtherRevenueTotalRevenue7.262681,9443115072,7627.762812,1843205233,0278.152952,4083305543,2928.483102,6293405873,5568.823262,8713506233,8449.083423,1053616604,126 \begin{tabular}{|lrrrrrr|} \hline Net Working Capital & 1,425 & 1,513 & 1,568 & 1,617 & 1,747 & 1,875 \\ \hline Net PP\&E and Int. Assets & 851 & 932 & 998 & 1,016 & 1,039 & 1,086 \\ \hline Deprec. \& Amort. & 289 & 317 & 339 & 345 & 353 & 369 \\ \hline \end{tabular} Total Revenue Growth EBITDA Margin 18%25%10%25%9%26%8%26%8%25%7%25%