Answered step by step

Verified Expert Solution

Question

1 Approved Answer

What is the estimated horizon, or continuing, value of the acquisition; that is, what is the estimated value of the L divisions cash flows beyond

What is the estimated horizon, or continuing, value of the acquisition; that is, what is the estimated value of the L divisions cash flows beyond 2020? What is LLs value to Hagers shareholders? Suppose another firm were evaluating LL as an acquisition candidate. Would it obtain the same value? Explain.

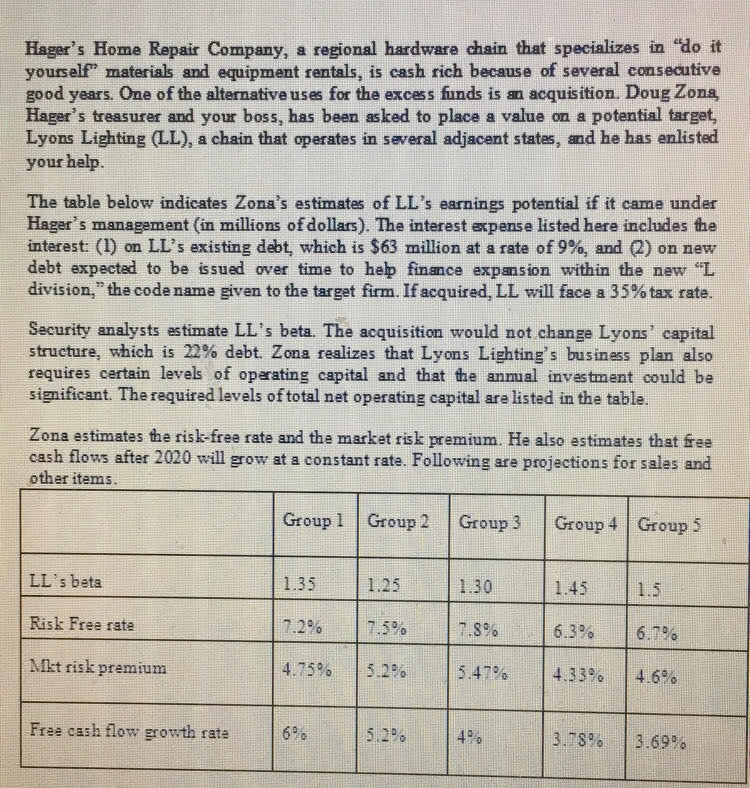

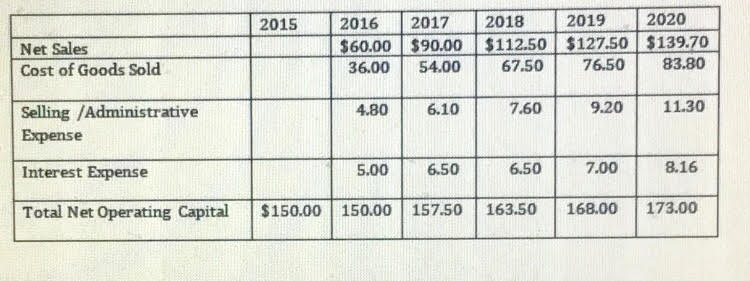

Hager's Home Repair Company, a regional hardware chain that specializes in "do it yourself" materials and equipment rentals, is cash rich because of several consecutive good years. One of the alternative uses for the excess funds is an acquisition. Doug Zona Hager's treasurer and your boss, has been asked to place a value on a potential target, Lyons Lighting (LL), a chain that operates in several adjacent states, and he has enlisted your help. The table below indicates Zona's estimates of LL's earnings potential if it came under Hager's management (in millions of dollars). The interest expense listed here includes the interest: (1) on LL's existing debt, which is $63 million at a rate of 9%, and (2) on new debt expected to be issued over time to hep finance expansion within the new "L division," the code name given to the target firm. Ifacquired, LL will face a 35% tax rate. Security analysts estimate LL's beta. The acquisition would not change Lyons capital structure, which is 22% debt. Zona realizes that Lyons Lighting's business plan also requires certain levels of operating capital and that the anmual investment could be significant. The required levels of total net operating capital are listed in the table. Zona estimates the risk-free rate and the market risk premium. He also estimates that free cash flows after 2020 will grow at a constant rate. Following are projections for sales and other items Group l Group 2 Group 3 Group 4 Group 5 LL's beta Risk Free rate Mkt risk premium 1.35 7,2% 4.75% 1.25 | 7,5% | 5.2% 1.30 7.8 | 5.47% 1.45 16.7% | 4.33% | 4.6% 6.3% Free cash flow growth rate 3.78% | 3.69%Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started