Answered step by step

Verified Expert Solution

Question

1 Approved Answer

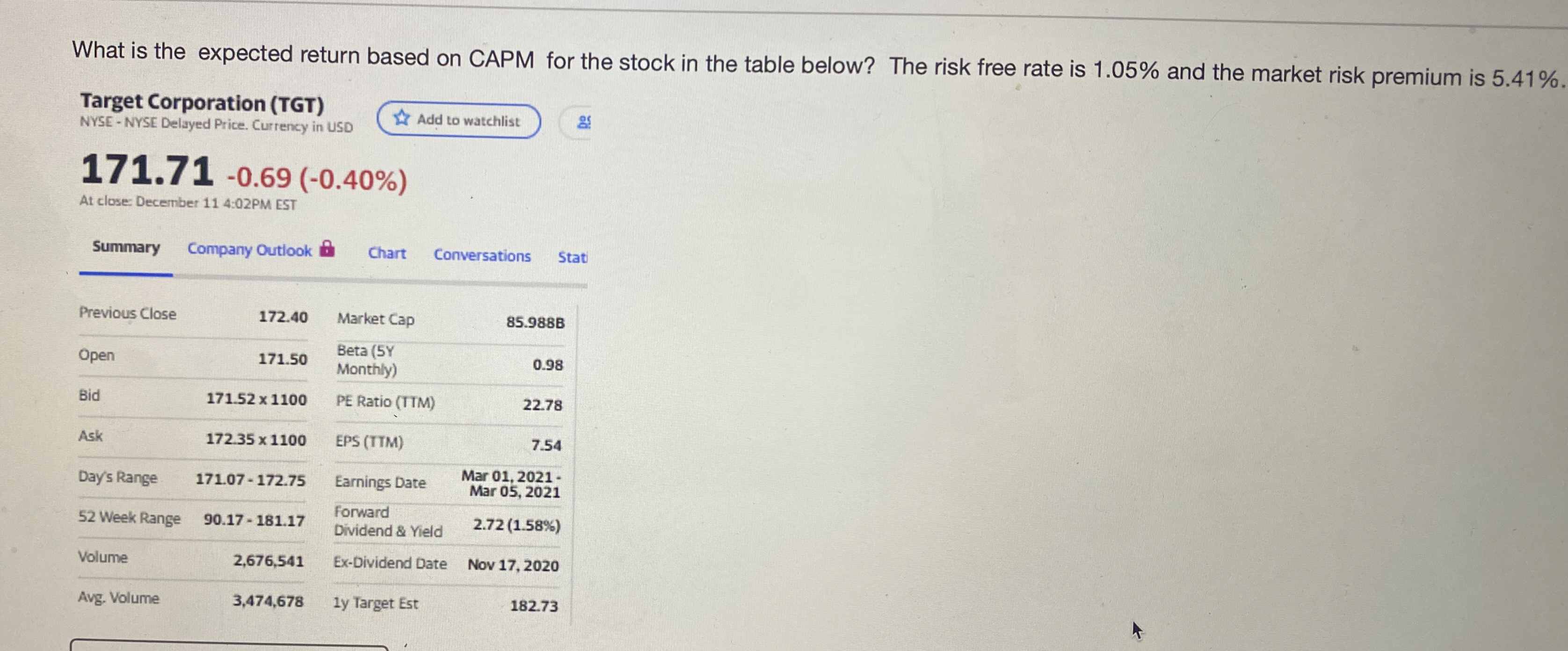

What is the expected return based on CAPM for the stock in the table below? The risk free rate is 1 . 0 5 %

What is the expected return based on CAPM for the stock in the table below? The risk free rate is and the market risk premium is

Target Corporation TGT

NYSENYSE Delayed Price. Currency in USD

At close: Decembet :PM EST

tableSummaryCompany Outlook,Chart,versationsPrevious Close,Market Cap, BOpentableBeta YMonthlyBidPE Ratio TTMAskEPS TTMDays Range,Earnings Date,tableMar Mar Week Range,tableforwardDividend & Yield

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started