Answered step by step

Verified Expert Solution

Question

1 Approved Answer

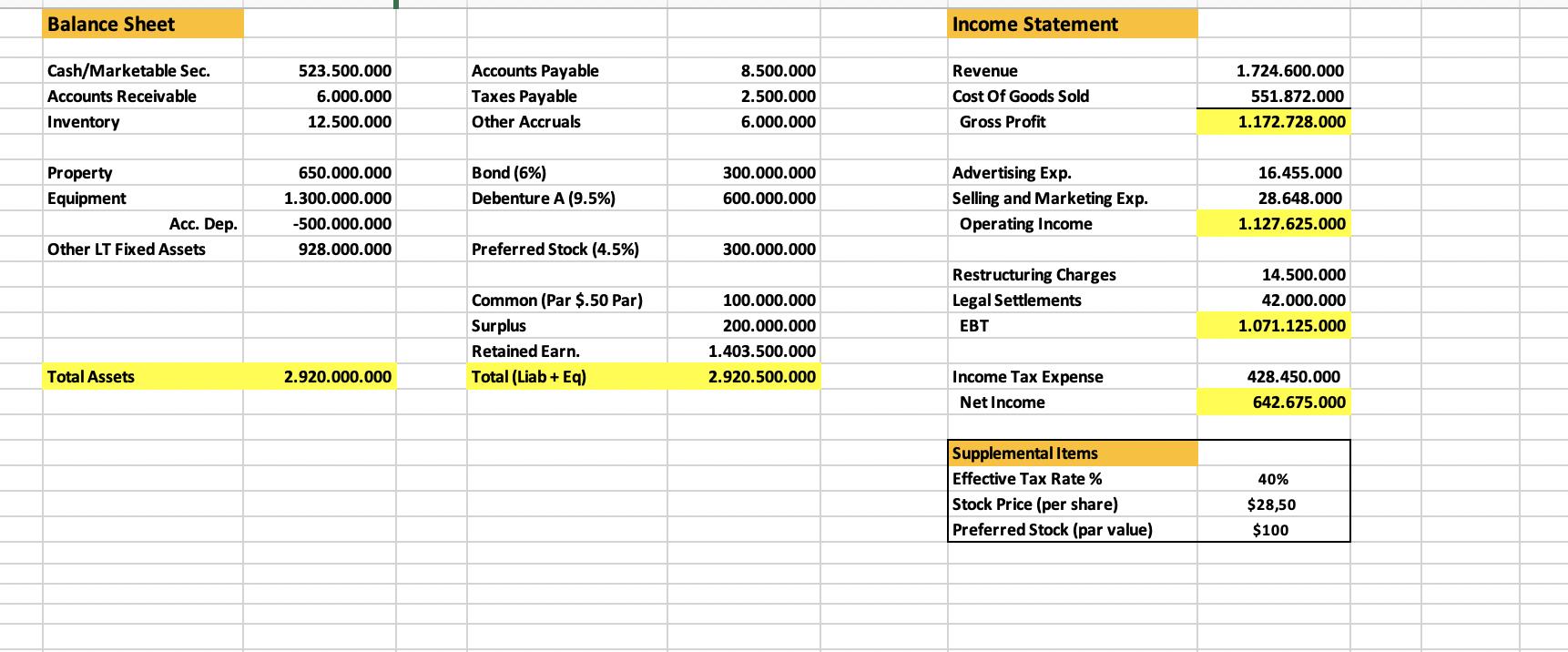

What is the firm's earnings per share for this company? 2) What is the total amount of the preferred stock dividends that were paid? 3)

What is the firm's earnings per share for this company?

2) What is the total amount of the preferred stock dividends that were paid?

3) If the company paid $2.00 per share, what is the total amount of the common stock dividends that were paid?

4) What is the "payout ratio" for the company?

5) If the company executed a 10% stock dividend, please list all of the changes that would be related to the company's balance and/or income statement. What would the price of a share of stock be after the stock dividend?

6) If the company executed a 4 for 1 stock split, please list all of the changes that would be related to the company's balance and/or income statement. What would the price of a share of stock be after the stock split?

7) If the company executed a stock buyback transaction in which it repurchased 2 million shares at a price of $30 in the open market, please list all of the changes that would be related to the company's balance sheet and/or income statement. Why might a company decide to execute a buyback of stock? (list as many reasons as you think might be important)

2) What is the total amount of the preferred stock dividends that were paid?

3) If the company paid $2.00 per share, what is the total amount of the common stock dividends that were paid?

4) What is the "payout ratio" for the company?

5) If the company executed a 10% stock dividend, please list all of the changes that would be related to the company's balance and/or income statement. What would the price of a share of stock be after the stock dividend?

6) If the company executed a 4 for 1 stock split, please list all of the changes that would be related to the company's balance and/or income statement. What would the price of a share of stock be after the stock split?

7) If the company executed a stock buyback transaction in which it repurchased 2 million shares at a price of $30 in the open market, please list all of the changes that would be related to the company's balance sheet and/or income statement. Why might a company decide to execute a buyback of stock? (list as many reasons as you think might be important)

Balance Sheet Cash/Marketable Sec. Accounts Receivable Inventory Property Equipment Acc. Dep. Other LT Fixed Assets Total Assets 523.500.000 6.000.000 12.500.000 650.000.000 1.300.000.000 -500.000.000 928.000.000 2.920.000.000 Accounts Payable Taxes Payable Other Accruals Bond (6%) Debenture A (9.5%) Preferred Stock (4.5%) Common (Par $.50 Par) Surplus Retained Earn. Total (Liab + Eq) 8.500.000 2.500.000 6.000.000 300.000.000 600.000.000 300.000.000 100.000.000 200.000.000 1.403.500.000 2.920.500.000 Income Statement Revenue Cost Of Goods Sold Gross Profit Advertising Exp. Selling and Marketing Exp. Operating Income Restructuring Charges Legal Settlements EBT Income Tax Expense Net Income Supplemental Items Effective Tax Rate % Stock Price (per share) Preferred Stock (par value) 1.724.600.000 551.872.000 1.172.728.000 16.455.000 28.648.000 1.127.625.000 14.500.000 42.000.000 1.071.125.000 428.450.000 642.675.000 40% $28,50 $100

Step by Step Solution

★★★★★

3.38 Rating (151 Votes )

There are 3 Steps involved in it

Step: 1

To answer the questions related to the finance information provided lets go through each question step by step 1 To calculate the firms earnings per share EPS we need to divide the net income by the n...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started