Answered step by step

Verified Expert Solution

Question

1 Approved Answer

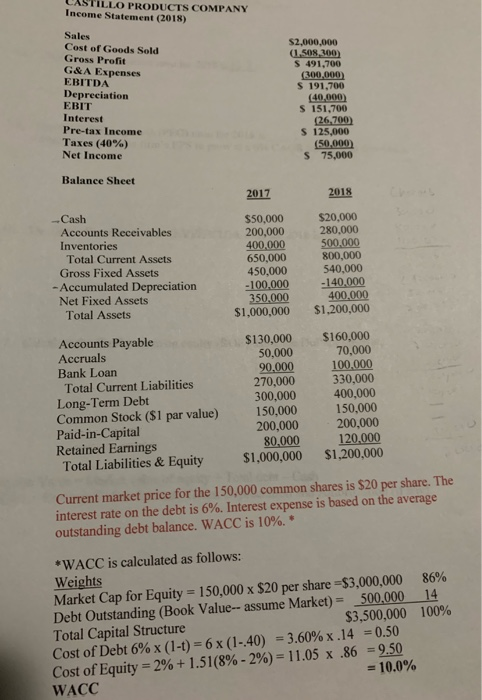

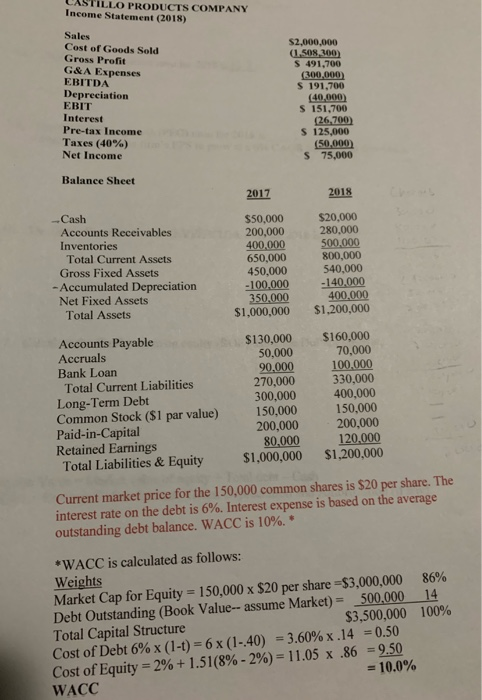

What is the firm's P/E to growth ratio for 2018? Please show work. ILLO PRODUCTS COMPANY Income Statement (2018) Sales Cost of Goods Sold Gross

What is the firm's P/E to growth ratio for 2018?

ILLO PRODUCTS COMPANY Income Statement (2018) Sales Cost of Goods Sold Gross Profit G&A Expenses EBITDA Depreciation EBIT Interest Pre-tax Income Taxes (40%) Net Income $2,000,000 (1,508,300) S 491,700 (300.000) $ 191,700 (40,000) S 151,700 (26 700 $ 125,000 (50.000 $ 75,000 Balance Sheet 2017 2018 -Cash Accounts Receivables Inventories Total Current Assets Gross Fixed Assets -Accumulated Depreciation Net Fixed Assets Total Assets $50,000 200,000 400.000 650,000 450,000 -100.000 350.000 $1.000.000 $20,000 280.000 500.000 800,000 540,000 -140.000 400.000 $1,200,000 Accounts Payable Accruals Bank Loan Total Current Liabilities Long-Term Debt Common Stock ($1 par value) Paid-in-Capital Retained Earnings Total Liabilities & Equity $130,000 50,000 90.000 270,000 300,000 150,000 200,000 80.000 $1,000,000 $160,000 70,000 100.000 330,000 400,000 150,000 200,000 120.000 $1,200,000 Current market price for the 150,000 common shares is $20 per share. The interest rate on the debt is 6%. Interest expense is based on the average outstanding debt balance. WACC is 10% *WACC is calculated as follows: Weights Market Cap for Equity = 150,000 x $20 per share =$3,000,000 86% Debt Outstanding (Book Value-- assume Market) = 500,000 14 Total Capital Structure $3,500,000 100% Cost of Debt 6% x (1-t) = 6 x (1-40) = 3.60% x.14 = 0.50 Cost of Equity = 2% +1.51(8% -2%) = 11.05 x .86 = 9.50 WACC = 10.0% Please show work.

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started