Answered step by step

Verified Expert Solution

Question

1 Approved Answer

What is the fiscal 2013 and 2014 ROS? What were the major contributing factors to the change in ROS? What is the fiscal 2014 ROA?

What is the fiscal 2013 and 2014 ROS?

- What were the major contributing factors to the change in ROS?

- What is the fiscal 2014 ROA?

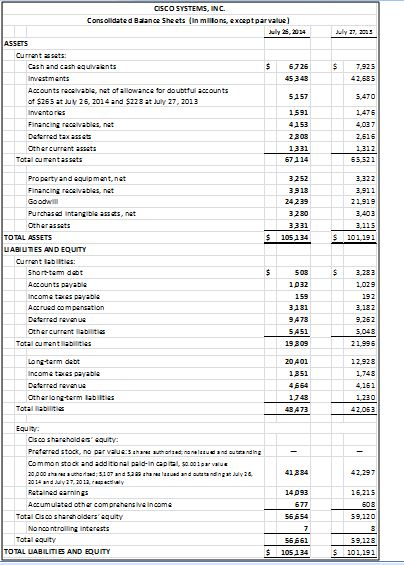

- What were the major changes in the asset base in fiscal 2014?

- What is thefiscal 2014 ROE?

- What were the major changes in the equity value in fiscal 2014?

- In fiscal 2014 the assets increased and the equity decreased which means that liabilities went up significantly (15.2%). At the same time Sales and Net Income fell.Given these effects, what does Cisco management need to focus on in fiscal 2015?

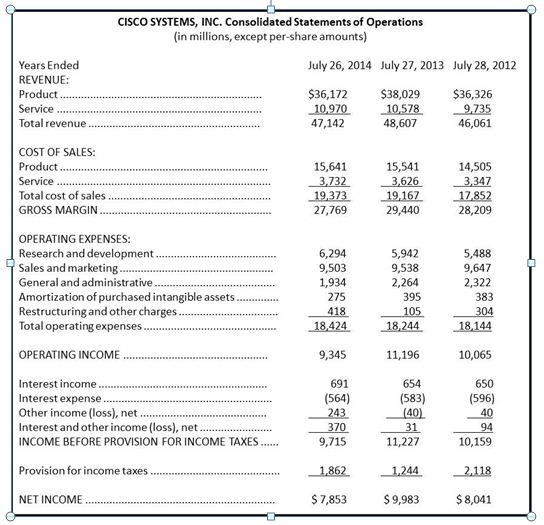

Years Ended REVENUE: Product. Service Total revenue COST OF SALES: Product Service Total cost of sales. GROSS MARGIN CISCO SYSTEMS, INC. Consolidated Statements of Operations (in millions, except per-share amounts) July 26, 2014 July 27, 2013 July 28, 2012 $36,172 $38,029 $36,326 10,970 10,578 9,735 47,142 48,607 46,061 15,641 15,541 14,505 3,732 3,626 3,347 19,373 19,167 17,852 27,769 29,440 28,209 OPERATING EXPENSES: Research and development. 6,294 5,942 5,488 Sales and marketing... 9,503 9,538 9,647 General and administrative. 1,934 2,264 2,322 Amortization of purchased intangible assets. 275 395 383 Restructuring and other charges.. 418 105 304 Total operating expenses. 18,424 18,244 18,144 OPERATING INCOME. 9,345 11,196 10,065 Interest income 691 654 Interest expense. (564) (583) 650 (596) Other income (loss), net. 243 (40) Interest and other income (loss), net. 370 31 INCOME BEFORE PROVISION FOR INCOME TAXES. 9,715 11,227 10,159 Provision for income taxes. 1,862 1,244 2,118 NET INCOME $ 7,853 $9,983 $8,041

Step by Step Solution

There are 3 Steps involved in it

Step: 1

ANSWER Factors contributing to changes in ROS ROA and ROE Revenue and Net Income Declines in sales and net income can lower ROS and ROA as these metri...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Document Format ( 2 attachments)

663e37bcc0365_959581.pdf

180 KBs PDF File

663e37bcc0365_959581.docx

120 KBs Word File

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started