Answered step by step

Verified Expert Solution

Question

1 Approved Answer

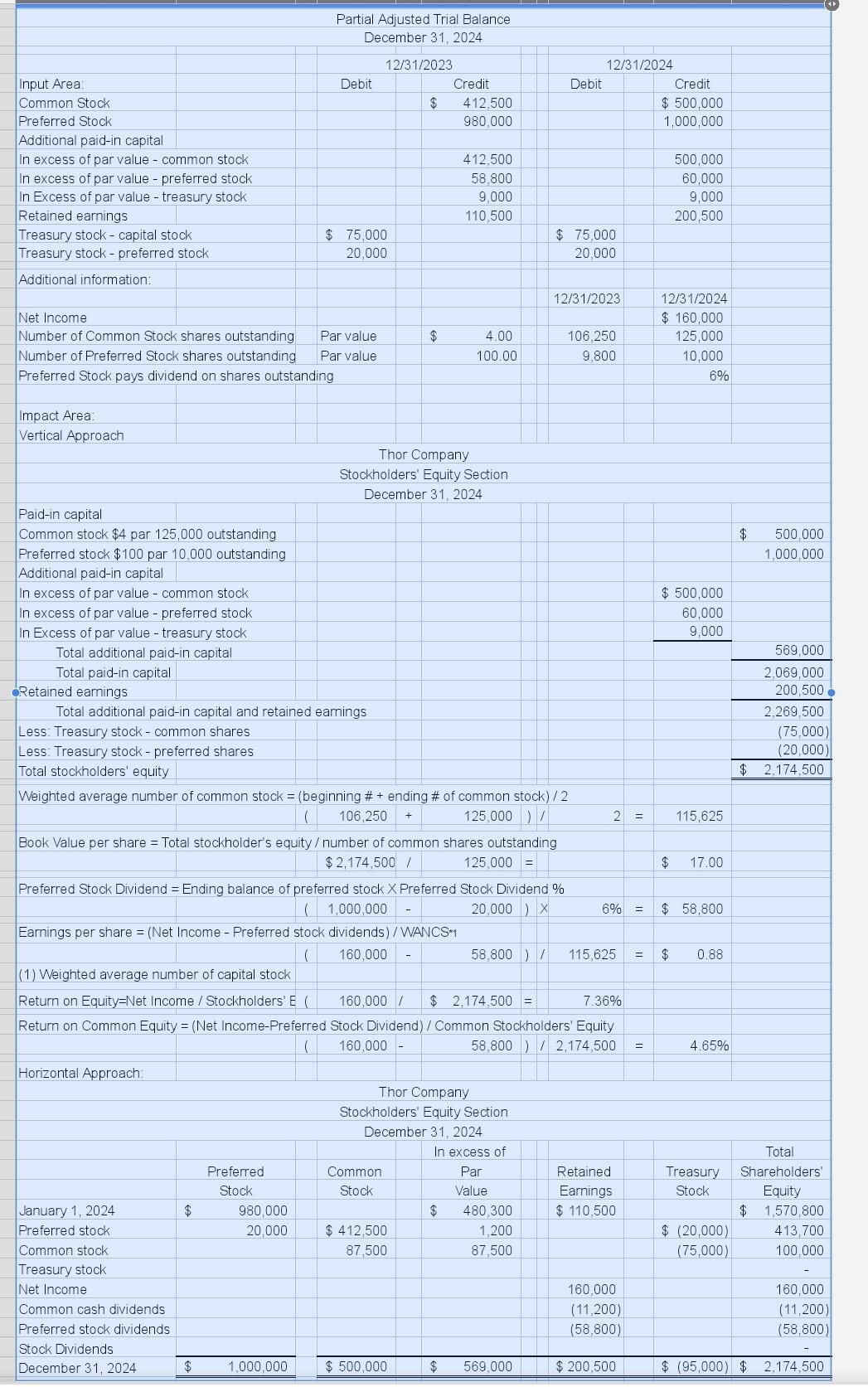

what is the formula for common cash dividends the answer is (11,200) cell I 74, but I dont know the formula and need to show

what is the formula for common cash dividends the answer is (11,200) cell I 74, but I dont know the formula and need to show this?

Partial Adjusted Trial Balance December 31, 2024 Debit 12/31/2023 Credit $ 412.500 980.000 12/31/2024 Debit Credit $ 500,000 1,000,000 Input Area Common Stock Preferred Stock Additional paid-in capital in excess of par value - common stock In excess of par value - preferred stock in Excess of par value - treasury stock Retained earnings Treasury stock - capital stock Treasury stock - preferred stock 412.500 58,800 9.000 110,500 500,000 60,000 9,000 200,500 $ 75,000 20,000 $ 75,000 20.000 Additional information: 12/31/2023 $ Net Income Number of Common Stock shares outstanding Par value Number of Preferred Stock shares outstanding Par value Preferred Stock pays dividend on shares outstanding 4.00 100.00 106.250 9,800 12/31/2024 $ 160,000 125,000 10,000 6% $ 500,000 1,000,000 Impact Area: Vertical Approach Thor Company Stockholders' Equity Section December 31, 2024 Paid-in capital Common stock $4 par 125,000 outstanding Preferred stock $100 par 10,000 outstanding Additional paid-in capital In excess of par value - common stock In excess of par value - preferred stock In Excess of par value - treasury stock Total additional paid-in capital Total paid-in capital Retained earnings Total additional paid-in capital and retained earnings Less: Treasury stock - common shares Less: Treasury stock - preferred shares Total stockholders' equity Weighted average number of common stock = (beginning # + ending # of common stock)/2 106,250 125,000) Book Value per share = Total stockholder's equity / number of common shares outstanding $ 2,174,500 / 125,000 = $ 500,000 60.000 9,000 569,000 2,069,000 200,500 2.269,500 (75,000 (20,000) $ 2,174,500 2 115,625 $ 17.00 = $ 58,800 $ 0.88 Preferred Stock Dividend = Ending balance of preferred stock X Preferred Stock Dividend % ( 1,000,000 20.000 x 6% Earnings per share = (Net Income - Preferred stock dividends) / WANCS1 160,000 58,800 ) / 115,625 (1) Weighted average number of capital stock Return on Equity=Net Income / Stockholders' E ( 160,000/ $ 2.174.500 = 7.36% Return on Common Equity = (Net Income-Preferred Stock Dividend) / Common Stockholders' Equity 160,000 58,800 ) / 2,174,500 4.65% Horizontal Approach Thor Company Stockholders' Equity Section December 31, 2024 In excess of Common Par Stock Value $ 480 300 $ 412,500 1,200 87,500 87,500 Preferred Stock 980,000 20.000 Retained Earnings $ 110,500 Treasury Stock Total Shareholders Equity $ 1,570,800 413,700 100,000 $ $ (20,000) (75,000) January 1, 2024 Preferred stock Common stock Treasury stock Net Income Common cash dividends Preferred stock dividends Stock Dividends December 31, 2024 160,000 (11,200) (58,800) 160,000 (11,200) (58,800) $ 1,000,000 $ 500,000 $ 569.000 $ 200,500 $ (95,000) $ 2.174,500Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started