Answered step by step

Verified Expert Solution

Question

1 Approved Answer

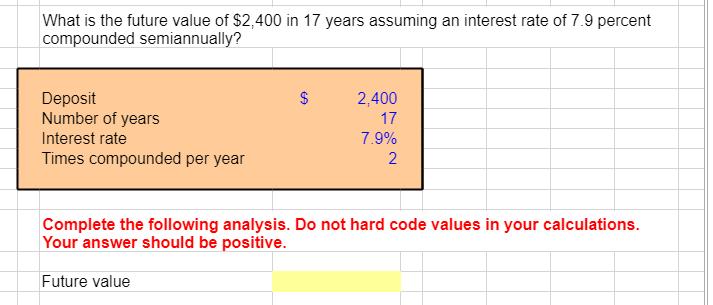

What is the future value of $2,400 in 17 years assuming an interest rate of 7.9 percent compounded semiannually? Deposit Number of years Interest

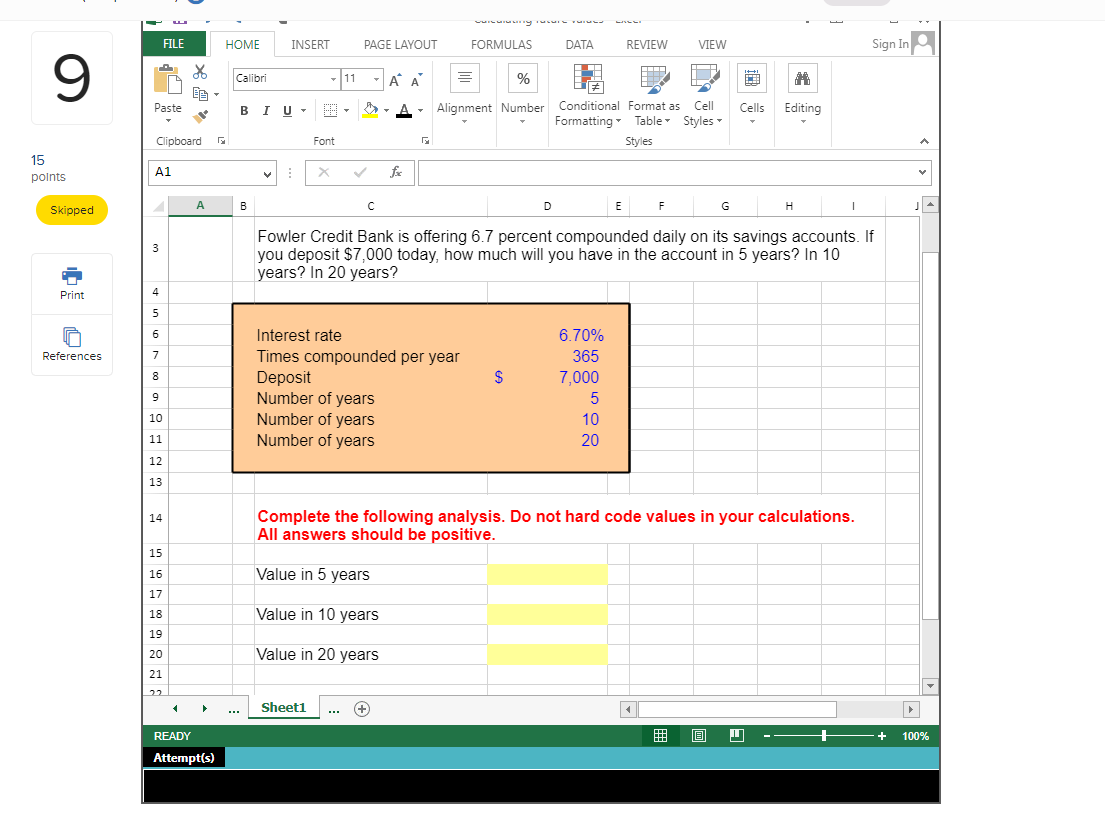

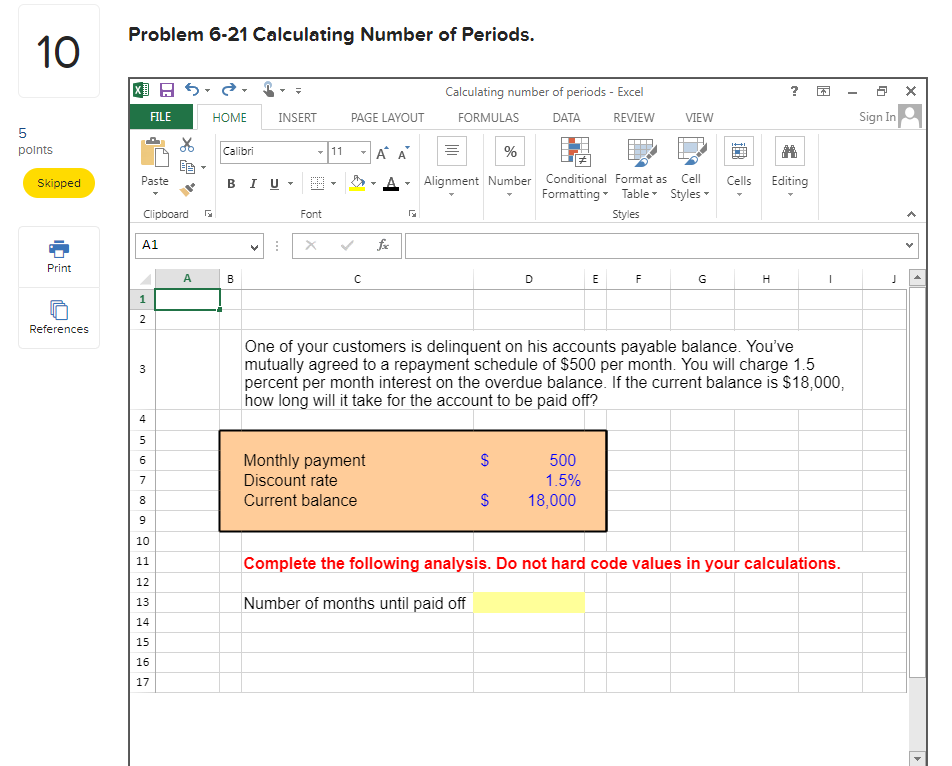

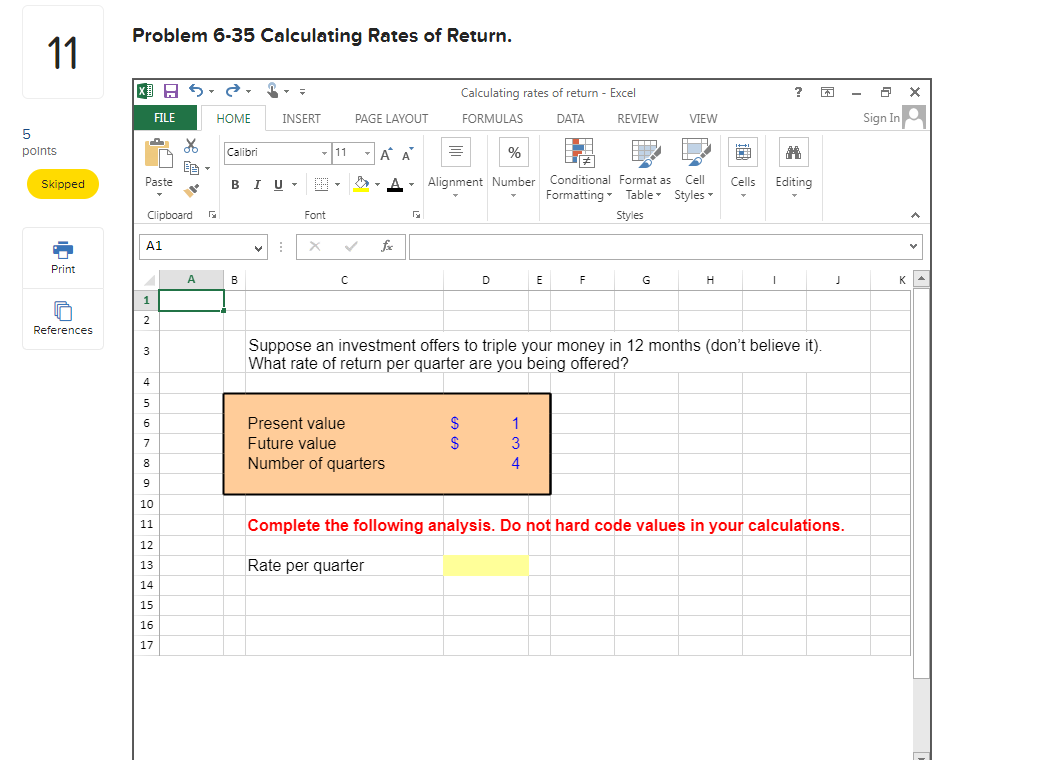

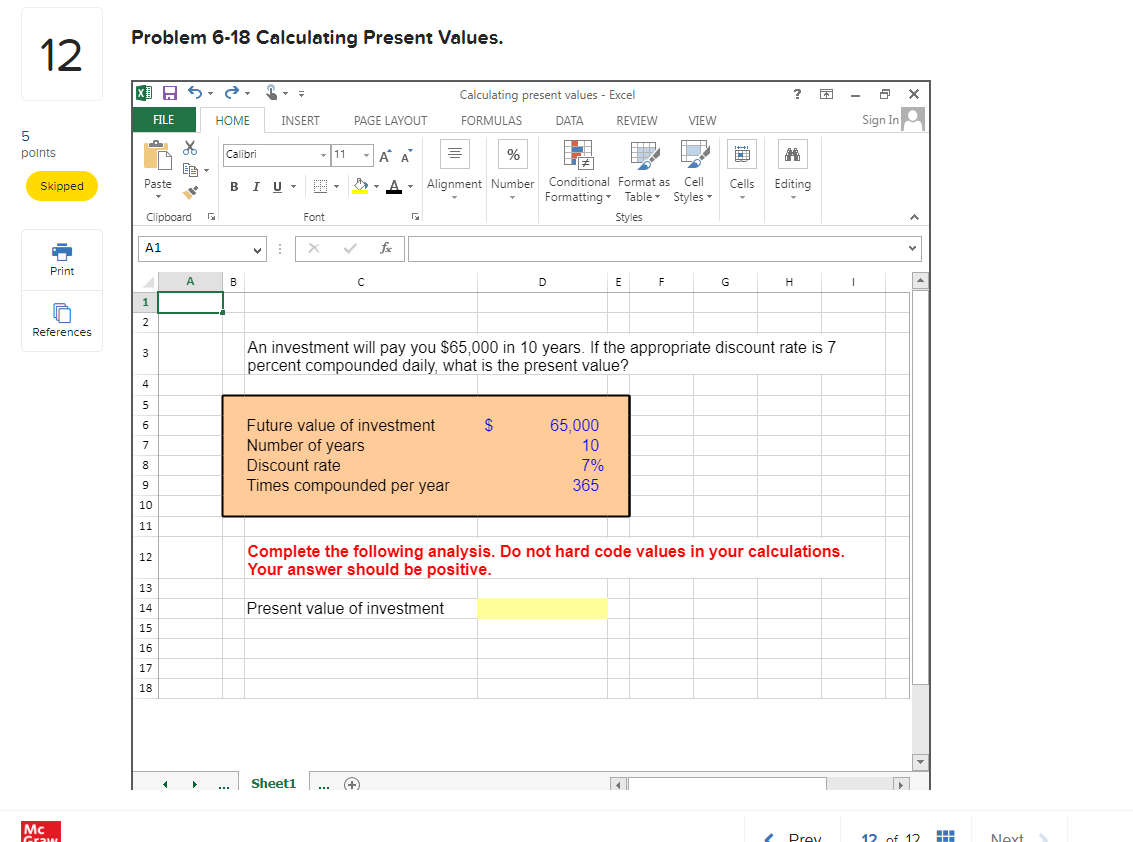

What is the future value of $2,400 in 17 years assuming an interest rate of 7.9 percent compounded semiannually? Deposit Number of years Interest rate Times compounded per year $ 2,400 17 7.9% 2 Complete the following analysis. Do not hard code values in your calculations. Your answer should be positive. Future value 15 9 points Skipped FILE HOME INSERT PAGE LAYOUT FORMULAS DATA REVIEW VIEW Sign In Calibri 11 ' ' % M Paste BIU 4 Alignment Number Conditional Format as Cell Cells Formatting Table Styles Editing Clipboard Font Styles A1 fx 3 A B C D E F G H Fowler Credit Bank is offering 6.7 percent compounded daily on its savings accounts. If you deposit $7,000 today, how much will you have in the account in 5 years? In 10 years? In 20 years? 4 Print 5 6 Interest rate References 7 Times compounded per year 8 Deposit 9 Number of years 10 Number of years 11 Number of years 12 13 14 6.70% 365 $ 7,000 5 10 20 Complete the following analysis. Do not hard code values in your calculations. All answers should be positive. Value in 5 years 15 16 17 18 Value in 10 years 19 20 Value in 20 years 21 22 READY Attempt(s) Sheet1 + 100% Problem 6-21 Calculating Number of Periods. 10 FILE HOME INSERT LO 5 points Skipped Paste Clipboard A1 Print References 12 3 4 E| Calibri Calculating number of periods - Excel ? PAGE LAYOUT FORMULAS DATA REVIEW VIEW 11 ' ' % A Alignment Number F| Conditional Format as Cell Formatting Table Styles Styles Cells Editing B I U Font fx A B C - Sign In D E F G H | J One of your customers is delinquent on his accounts payable balance. You've mutually agreed to a repayment schedule of $500 per month. You will charge 1.5 percent per month interest on the overdue balance. If the current balance is $18,000, how long will it take for the account to be paid off? in 6 5 Monthly payment 7 8 Discount rate Current balance 9 10 11 12 13 14 15 16 17 $ 500 1.5% $ 18,000 Complete the following analysis. Do not hard code values in your calculations. Number of months until paid off 11 Problem 6-35 Calculating Rates of Return. Calculating rates of return - Excel FILE HOME INSERT PAGE LAYOUT FORMULAS DATA REVIEW VIEW Sign In 5 points Calibri Skipped Paste 11 ' ' % BIU Alignment Number Clipboard F| Font Conditional Format as Cell Formatting Table Styles Styles Cells Editing A1 Print x fx D E F G H J K A B 1 2 References 3 10 11 12 13 14 15 16 17 45678995 Suppose an investment offers to triple your money in 12 months (don't believe it). What rate of return per quarter are you being offered? Present value Future value Number of quarters $ $ 13 4 Complete the following analysis. Do not hard code values in your calculations. Rate per quarter 12 Problem 6-18 Calculating Present Values. Calculating present values - Excel FILE HOME INSERT PAGE LAYOUT FORMULAS DATA REVIEW VIEW 5 points Calibri Skipped Paste BIU 11 ' ' % Alignment Number Cell Conditional Format as Formatting Table Styles Cells Editing FI Font Styles Clipboard A1 Print A B C 1 2 References 3 Mc Grow fx D E F G H | An investment will pay you $65,000 in 10 years. If the appropriate discount rate is 7 percent compounded daily, what is the present value? 4567897 Future value of investment $ 65,000 Number of years 10 Discount rate 7% Times compounded per year 365 10 11 12 13 14 15 16 17 18 Complete the following analysis. Do not hard code values in your calculations. Your answer should be positive. Present value of investment Sheet1 Sign In Prov 12 of 12 Next

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started