Answered step by step

Verified Expert Solution

Question

1 Approved Answer

What is the going-in capitalization rate of the investment assuming an acquisition price of $8,500,000 and that year 1 NOI is calculated using an

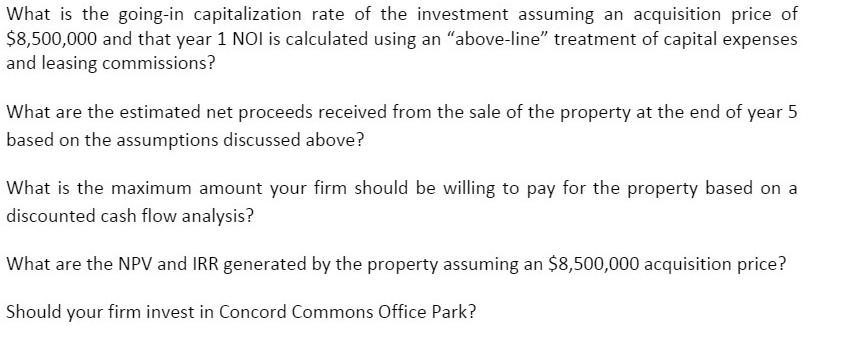

What is the going-in capitalization rate of the investment assuming an acquisition price of $8,500,000 and that year 1 NOI is calculated using an "above-line" treatment of capital expenses and leasing commissions? What are the estimated net proceeds received from the sale of the property at the end of year 5 based on the assumptions discussed above? What is the maximum amount your firm should be willing to pay for the property based on a discounted cash flow analysis? What are the NPV and IRR generated by the property assuming an $8,500,000 acquisition price? Should your firm invest in Concord Commons Office Park?

Step by Step Solution

★★★★★

3.44 Rating (154 Votes )

There are 3 Steps involved in it

Step: 1

Answer 1 The goingin capitalization rate of the investment assuming an acquisition price of 8500000 and that year 1 NOI is calculated using an aboveline treatment of capital expenses and leasing commi...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started