Question

What is the human way to handle this? AN ACCOUNTING CAULDRON CASE Pierre, the CFO and Camille, the Chief Accounting Officer; were sitting in their

What is the human way to handle this? AN ACCOUNTING CAULDRON

What is the human way to handle this? AN ACCOUNTING CAULDRON

CASE

Pierre, the CFO and Camille, the Chief Accounting Officer; were sitting in their quarterly corporate board meeting when negative thoughts started to produce needless wear and tear on their metal motors. Mr. Guillaume, the CEO had a very tough target to meet, and his financial statements were not matching with their budgets.

Looking straight at Pierre and Camille, Guillaume said, What is wrong with you guys. I work, day-in and day-out to keep my Company ahead of our competition and then I see YOU. OMG ! you always seem to have a problem for every solution. Seriously, stop giving me this IFRS explanation! Please speak in plain English with me and just give me the results that I want to see or else I will find those accountants who can!

Listening to this relentless tirade from Guillaume was enough to put Pierre and Camille off their foot and make them defensive. Seeing the pitch flowing away from them, Pierre quickly replied, Yes, Guillaume, dont worry. We are working on it, and we are just slipping by fractions, in my opinion. Underneath these temporary accounting problems, I see an opportunity and I think we are closing-in on a solution.

Now that sounds like a great plan, said Guillaume, as he continued with other agenda items for the meeting.

Now its clear that there is a mismatch in the managements expectations and the accounting results that are reflected in the financial statements. Pierre and Camille have been in intense daily discussions about this issue. After the meeting Camille politely approached Pierre as she could sense the coldness in his mood because of the intense boardroom diatribe and said, Well its clear we have been doing everything we can but now its time to think of creative solutions. We cant allow our mind to work against us. I think we need to stop thinking of negative thoughts otherwise they will just hinder our progress.

I cant agree more! said Pierre, as he continued Okay, lets take a time-out and meet again tomorrow to see what we can do.

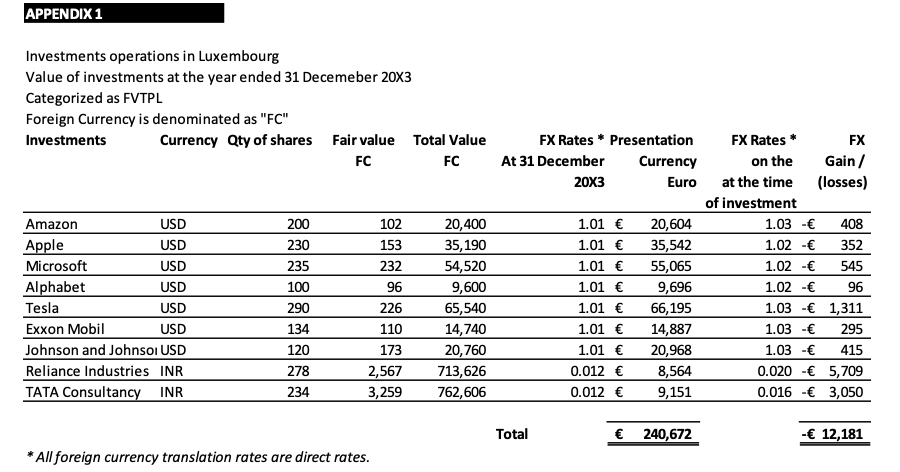

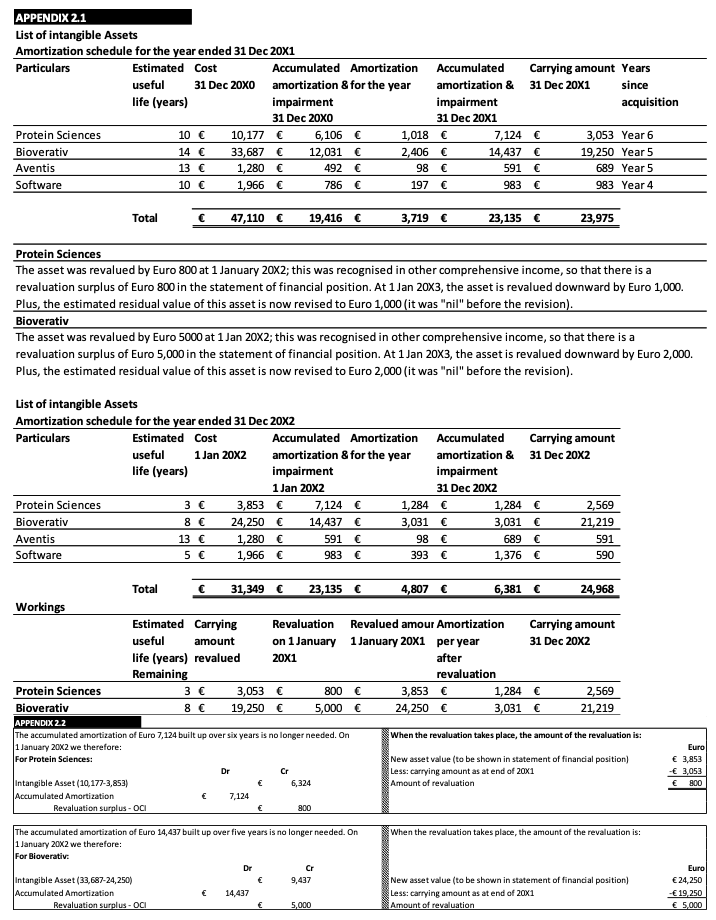

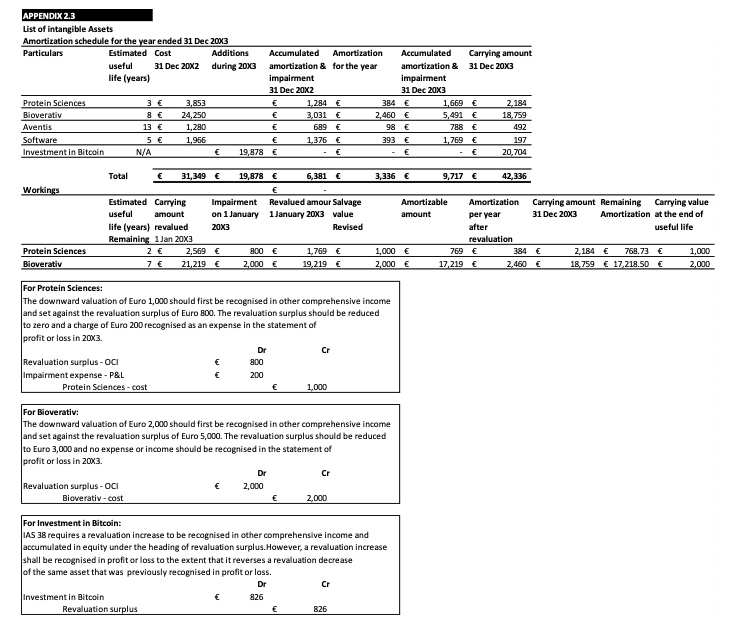

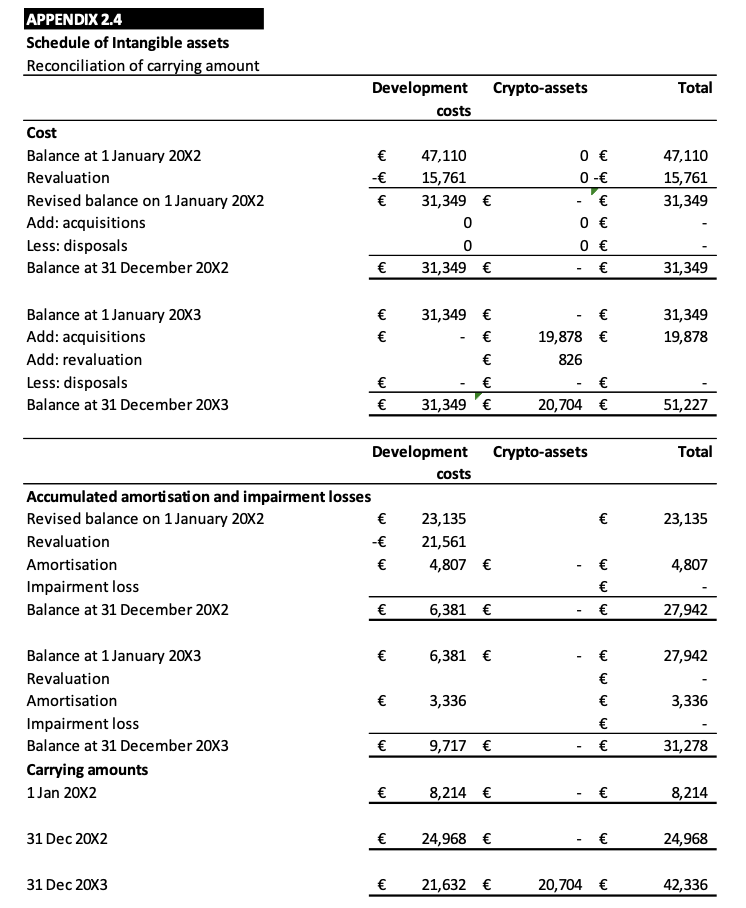

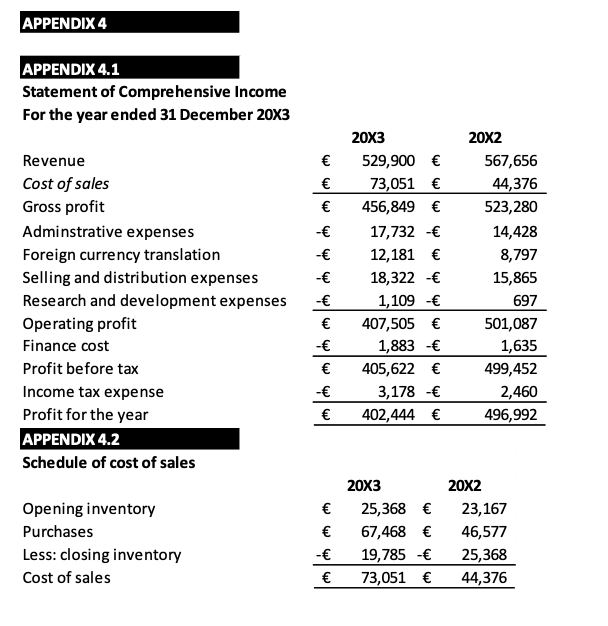

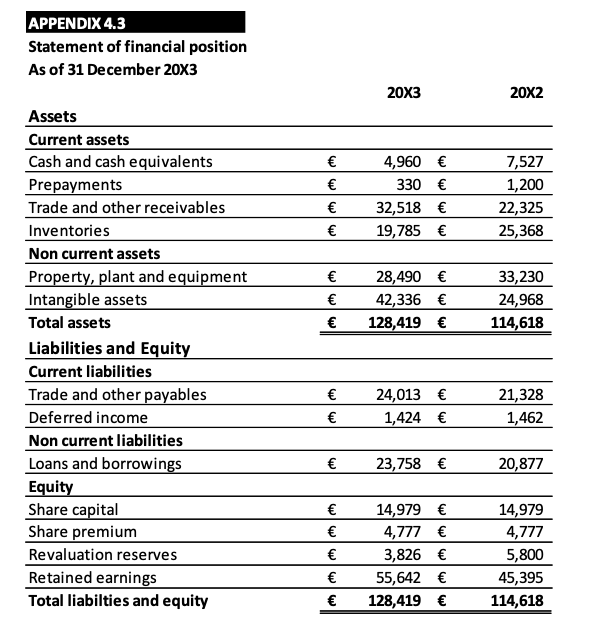

So, what is the problem here? Well, its complicated. Not as complicated as life but still complicated enough to have a serious discourse. It all happened two years ago when the company started to experience the impact of exposure to volatility in the foreign currency translations (see Appendix 1) for its investment operations through their Luxembourg office and then started using the revaluation model for the measurement of intangible assets after initial recognition whilst also revising the recoverable amounts (see appendix 2); and then one of the board members was keen to invest spare cash in Crypto assets (see appendix 2) so the company started trading in Bitcoins to stay ahead of the market.

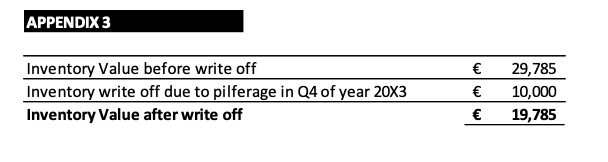

To top it all up, Pierre started receiving calls from his office in Vienna that the inventory records are severely compromised, and inventory had been subject to pilferage due to collusion of the local management. This means that the inventory is overstated in the financial statements and thus needs to be written off (see appendix 3). But for that he needs an approval from his Chief Fraud Officer, Emma, who is heading the investigation into this fraud, and she needs time to come up with her final report. Although Emma did authorize a 75% write off on inventory just two weeks ago from their inventory valuation in the warehouse located in Vienna. This added more complications as the resulting gains (losses) kept on changing the bottom line having an impact on net-earnings and growth prospects reflected in the financial statements (see appendix 4).

All of these events mean that the financial statements will need a lot of adjustments and will likely have revised profit (losses) as its been the case, and this is what prompted strong management reaction from Guillaume.

In essence, the foreign currency translation losses which have sharply increased during the accounting year ended 31 December 20X3 and the impact of impairment in inventory had a diminishing impact on the bottom line. The management is also confused about the revaluation of the intangible assets.

Guillaume has also asked for a risk free, zero cost, hedge against the foreign currency translations gains (losses). We cant be exposed to the foreign currency translations specially when its unrealized., Guillaume told Pierre.

Pierre and Camille have assured Guillaume that they will come up with a solution before the end of the month. Can we use financial instruments to hedge our positions?, Camille asked politely, to which Pierre paused for a while only to say, The point is this: To get others to do what you want them to do, you must see things through their eyes. When you trade minds, the secret of how to influence other people effectively shows up. I am working on it!

Pierre went on to say, When something isn't going right, I fix it. But it's the way I fix it-that's important. Think progress. Believe in progress and push for progress. We will make it. There is always a solution.

What do you think is the best human way to handle this situation and can you even have a Zero Risk, Zero Cost, hedge against volatility in foreign currency translations?

Important Note:

The appendices form part of this case study. The case study should be read in conjunction with the appendices.

Case Questions:

1) Which IFRS deals with the treatment of foreign currency gains (losses) for investments categorized as FVTPL and what is the prescribed accounting treatment in this case as per the IFRS?

2) How concerned are you about the treatment of Crypto-assets in this case and do you think that the volatility in crypto-assets can have an impact on the future earnings upon future remeasurement or recycling through P&L (upon future sale)?

3) Can you even have a Zero Risk, Zero Cost, hedge against volatility in foreign currency translations. If YES, then please give full details and structure of that hedge. Make a proper explanation to illustrate the numbers and the accounting treatment for such a hedge?

4) The remeasurement of intangible assets based on the fair value measurement model has resulted in significant adjustments in the financial statements. Do you think that the entity made the right decision to follow the fair value model as opposed to the cost model. Provide a sufficient basis for your conclusion?

5) The loss on inventory (due to inventory pilferage in the warehouse in Vienna) is going to reduce the profit for this year. Use your create accounting skills to come up with a solution (in compliance of the IFRSs) to avoid the impact of this exorbitant loss in the financial statements for the year ended 31 December 20X3?

6) Last but not the least, what do you think is the best human way to handle this situation? Put yourself in the shoes of Camille and Pierre and make a proper presentation for Guillaume, to come up with a solution*?

* Remember Guillaume doesnt like IFRS, so your explanation should be clear, precise, simple and to-the-point. Normally CEOs dont like long answers. Make a Maximum of Two PPT slides to present to Guillaume. Preferably Just one PPT slide will be better, but it must be clear and should provide the answers that Guillaume is looking for.

Investments operations in Luxembourg Value of investments at the year ended 31 Decemeber 20X3 Categorized as FVTPL Foreign Currency is denominated as "FC" All foreign currency translation rates are direct rates. APPENDIX 2.1 List of intangible Assets Protein Sciences The asset was revalued by Euro 800 at 1 January 202; this was recognised in other comprehensive income, so that there is a revaluation surplus of Euro 800 in the statement of financial position. At 1 Jan 203, the asset is revalued downward by Euro 1,000. Plus, the estimated residual value of this asset is now revised to Euro 1,000 (it was "nil" before the revision). Bioverativ The asset was revalued by Euro 5000 at 1 Jan 20X2; this was recognised in other comprehensive income, so that there is a revaluation surplus of Euro 5,000 in the statement of financial position. At 1 Jan 203, the asset is revalued downward by Euro 2,000. Plus, the estimated residual value of this asset is now revised to Euro 2,000 (it was "nil" before the revision). APPENDDX 2,3 List of intangible Assets Amortization schedule for the year ended 31Dec200B3 \begin{tabular}{llllll} \hline Particulars Estimated & Cost & Additions & Accumulated Amortization \\ & useful & 31 Dec 20x2 & during 200c3 & amortization \& for the year \\ & life (years) & & impaiment \end{tabular} Total \begin{tabular}{llllllll} \hline & 31,349 & & 19,878 & & 6,381 & & 3,336 \\ \hline \end{tabular} For Bioverativ: The downward valuation of Euro 2,000 should first be recognised in other comprehensive income and set against the revaluation surplus of Euro 5,000 . The revaluation surplus should be reduced to Euro 3,000 and no expense or income should be recognised in the statement of profit or loss in 2003. For Investment in Bitcoin: IAS 38 requires a revaluation increase to be recognised in other comprehensive income and accumulated in equity under the heading of revaluation surplus. However, a revaluation increase shall be recognised in profit or loss to the extent that it reverses a revaluation decrease of the same asset that was previously recognised in profit or loss. \begin{tabular}{|c|cccc} & & Dr & \multicolumn{1}{c}{Cr} \\ Investment in Bitcoin & & 826 & & \\ Revaluation surplus & & & 826 \\ \hline \end{tabular} APPENDIX 2.4 Schedule of Intangible assets Reconciliation of carrying amount APPENDIX 3 \begin{tabular}{lcc} \hline Inventory Value before write off & & 29,785 \\ \hline Inventory write off due to pilferage in Q4 of year 20X3 & & 10,000 \\ \hline Inventory Value after write off & & 19,785 \\ \cline { 2 - 4 } \end{tabular} Statement of Comprehensive Income APPENDIX 4.3 Statement of financial position As of 31 December 203

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started